Exploring Stablecoins, The Pillars of the Crypto Ecosystem

STABLE

STABLE

SOURCE

SOURCE

BUSD

BUSD

USDC

USDC

CAP

CAP

Have you ever felt overwhelmed by the volatile world of cryptocurrency? This is where stablecoins step in as a solution, offering stability amidst extreme price fluctuations. But what exactly are stablecoins? Let’s dive in and find out!

What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value. Unlike Bitcoin or Ethereum, whose prices can fluctuate drastically within a short time, stablecoins are backed by specific assets, such as fiat currencies (USD, EUR), gold, or even algorithms.

Why Are Stablecoins Important?

Imagine you’re an international trader or investor. Bitcoin’s price could surge by 20% in a day but could just as easily drop by the same amount. With stablecoins, risks like these are minimized because their value tends to remain steady. This makes stablecoins widely used for:

- Cross-border payments: Reducing costs and transaction times.

- Hedging: Protecting assets against market volatility.

- DeFi and lending: Providing more stable collateral for various activities in the decentralized finance ecosystem.

Stablecoins, Bridging Two Worlds

Stablecoins are not just tools for simplifying the transition between fiat currency and crypto but are also catalysts for the adoption of blockchain technology. By combining the stability of fiat currencies with crypto innovation, stablecoins serve as a driving force for the new digital economy.

Stablecoins Come in Many Types! It’s Not Just About USDT or USDC

Stablecoins come in various forms, each with unique mechanisms to maintain stability. From fiat-backed to algorithmic models, these coins are crucial to bridging the gap between traditional finance and the crypto ecosystem. Let’s explore the main types of stablecoins and uncover their secrets to stability, along with an overview of their current market dominance.

1. Fiat-Backed Stablecoins: Stability Anchored in Real Assets

Fiat-backed stablecoins are the most common and widely used. Their value is pegged to traditional currencies like the US Dollar, Euro, or Yen, with reserves held in trusted financial institutions.

- Popular Examples: USDT, USDC, BUSD

- Backing Mechanism: Cash reserves, short-term treasuries

- Stability Secret: Each coin is backed 1:1 with fiat, ensuring minimal price fluctuations.

2. Crypto-Backed Stablecoins: Decentralized Stability

These stablecoins use cryptocurrencies like Ethereum or Bitcoin as collateral. To counter crypto’s inherent volatility, they are often over-collateralized. For instance, MakerDAO’s DAI requires $1.50 worth of ETH for every $1 issued.

- Popular Example: DAI

- Backing Mechanism: Over-collateralized ETH, BTC

- Stability Secret: Smart contracts adjust collateral ratios automatically to manage market swings.

3. Algorithmic Stablecoins: Innovation Meets Risk

Unlike fiat or crypto-backed stablecoins, algorithmic stablecoins rely on algorithms and smart contracts to maintain price stability. They often use a dual-token model or adjust supply dynamically.

- Popular Example: Frax (partially algorithmic)

- Backing Mechanism: Algorithm + hybrid reserves

- Stability Secret: Supply and demand are balanced through programmatic interventions.

Visualizing the Stablecoin Market

Here’s a snapshot of the stablecoin market, showcasing their dominance and diversity:

| Stablecoin Type | Examples | Market Cap (2024) | Backing Mechanism |

|---|---|---|---|

| Fiat-Backed | USDT, USDC, BUSD | $132B (USDT), $38B (USDC) | Cash, Treasuries |

| Crypto-Backed | DAI | $5B | ETH, BTC |

| Algorithmic | Frax | $1.3B | Algorithm + Reserves |

What’s Next for Stablecoins?

As the market matures, hybrid models like Frax, which combine multiple mechanisms, are becoming increasingly popular. However, traditional fiat-backed stablecoins remain dominant due to their perceived safety and reliability.

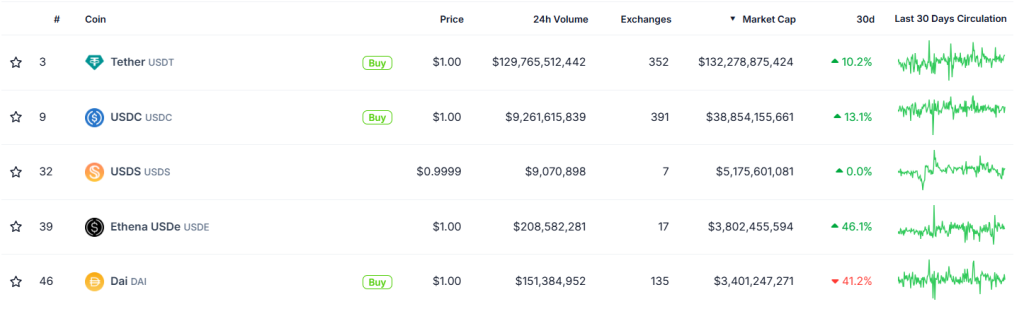

Top 5 Stablecoins by Market Cap in 2024

Based on data from CoinGecko, stablecoins are taking center stage in the crypto ecosystem. These digital assets have revolutionized how we transact and store value, offering stability in a world often characterized by volatility.

In November 2024, CoinGecko’s rankings highlight the top stablecoins that dominate the market, showcasing their vital role in the ever-growing blockchain econom Let’s dive into the top five stablecoins by market capitalization!

With the dominance of stablecoins clear, two names consistently stand out as the giants of the market: USDT (Tether) and USDC (USD Coin).

In the next segment, we’ll explore what makes USDT and USDC the go-to choices for traders, investors, and institutions alike. From their mechanisms to their global impact, get ready to uncover the driving forces behind these leading stablecoins!

Dive Deeper to USDT, The King of Stablecoins

When it comes to stablecoins, USDT (Tether) wears the crown. Known for its stability and liquidity, USDT has become the go-to asset for traders, businesses, and institutions alike. But what makes it stand out so prominently? Let’s break it down.

USDT’s Dominance in the Market

USDT is not just a stablecoin; it’s the backbone of the crypto market, boasting a staggering market cap of $132 billion (2024). This makes it not only the largest stablecoin but also one of the most traded cryptocurrencies in the world.

Key Reasons Behind USDT’s Popularity

1. Liquidity Like No Other

USDT is one of the most actively traded tokens globally, with high trading volumes across exchanges.

2. Multi-Chain Integration

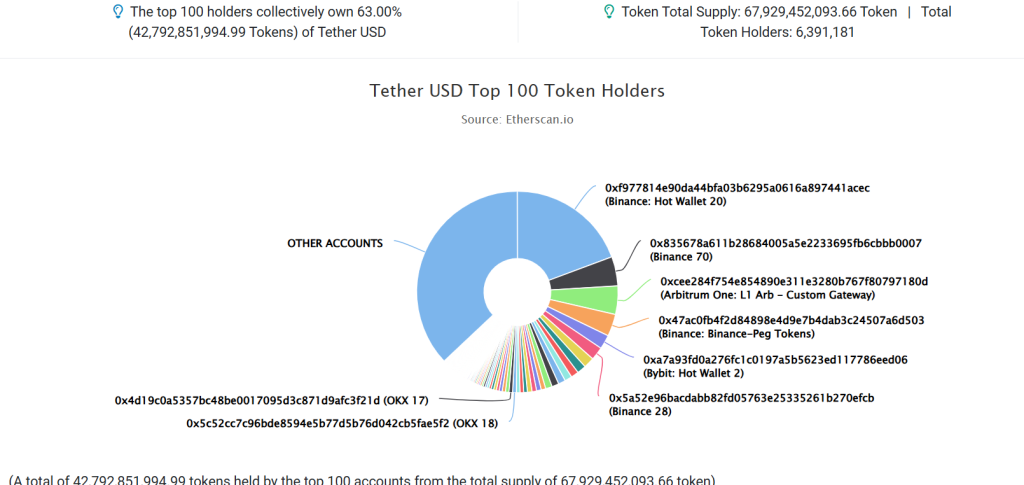

Data from Etherscan shows that 63% of USDT tokens are held by the top 100 addresses, with centralized exchanges like Binance, OKX, and Bybit playing key roles in managing liquidity.

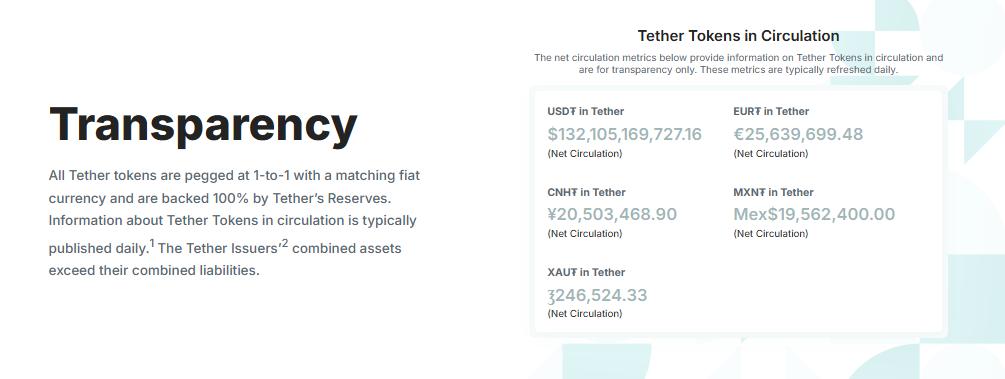

3. Transparency and Trust

Tether is committed to full transparency, each USDT is pegged 1:1 with real-world assets, primarily cash and short-term investments, ensuring its value stability.

Use Cases USDT

- For Individuals

- Offers a stable store of value, especially during volatile market periods.

- Ideal for traders looking to hedge against market swings or engage in arbitrage.

- For Businesses

- Used in cross-border payments, reducing fees and transaction times compared to traditional banking systems.

- An efficient way for merchants to accept crypto payments without dealing with volatility.

- For DeFi and Exchanges

- The backbone of many DeFi protocols, serving as a collateral asset or a stable trading pair.

- Facilitates liquidity for exchanges and traders, with unmatched availability.

USDT’s Unique Value Proposition

- Seamless Integration

- Unparalleled Liquidity

- Global Accessibility

- 100% Backed by Reserves

- Regulatory Compliance

- Commitment to Transparency

- Round-the-Clock Support

What Lies Ahead for USDT?

USDT isn’t just a tool for traders; it’s a key player in the financial evolution. Its growth trajectory suggests that it will continue to dominate the stablecoin space, introducing innovations while maintaining its reputation as a reliable and trusted asset.

Stay Tuned! Next, we’ll dive into USDC, the contender that’s making waves in the stablecoin ecosystem. What makes it different from USDT? Let’s explore!

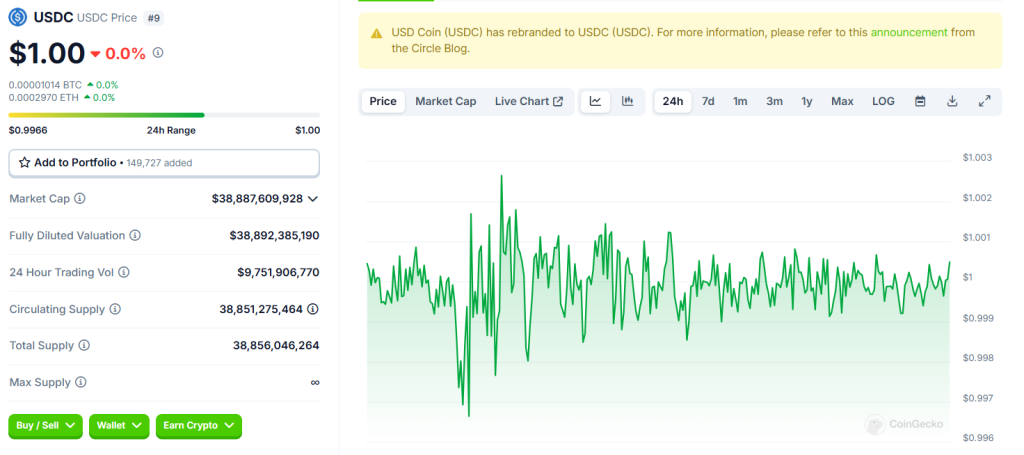

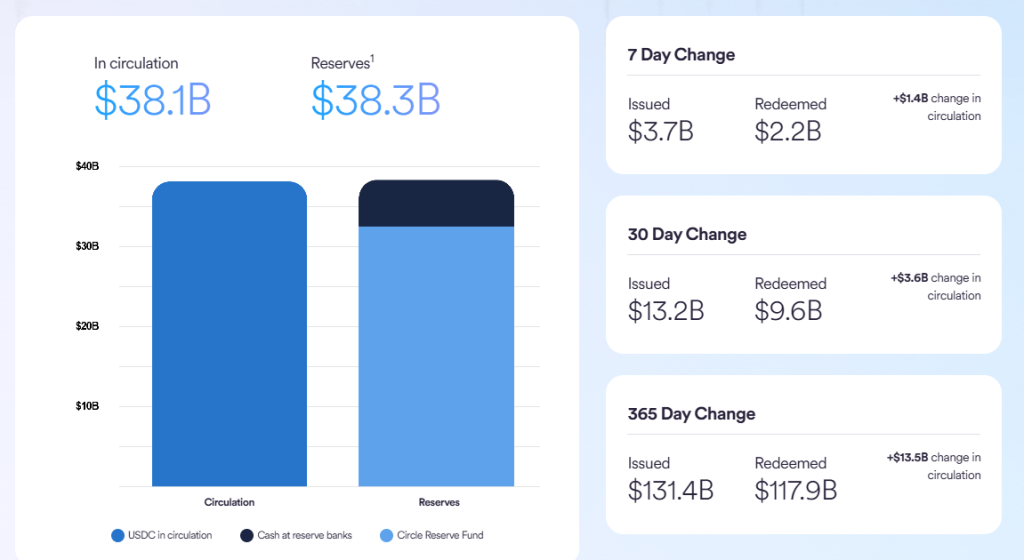

USDC, The Digital Dollar Revolutionizing Crypto Transactions

If Tether (USDT) is the king of stablecoins, USD Coin (USDC) is its closest competitor, setting a gold standard for transparency and regulation. With a circulation of $38.86 billion as of November 2024, USDC has positioned itself as the most trusted regulated stablecoin globally.

Related The stablecoin showdown

The Foundations of USDC

Launched in 2018 by Circle in collaboration with Coinbase, USDC is backed 1:1 by US dollars held in reserves. These reserves, comprised of cash and short-term U.S.

- Market Growth: Since its inception, USDC has achieved a remarkable $18.16 trillion all-time trading volume, reflecting its rapid adoption across the crypto ecosystem.

- Liquidity at Its Best: Boasting a $42.18 billion 24-hour trading volume, USDC simplifies trading for institutions and retail investors, ensuring smooth transactions at any scale.

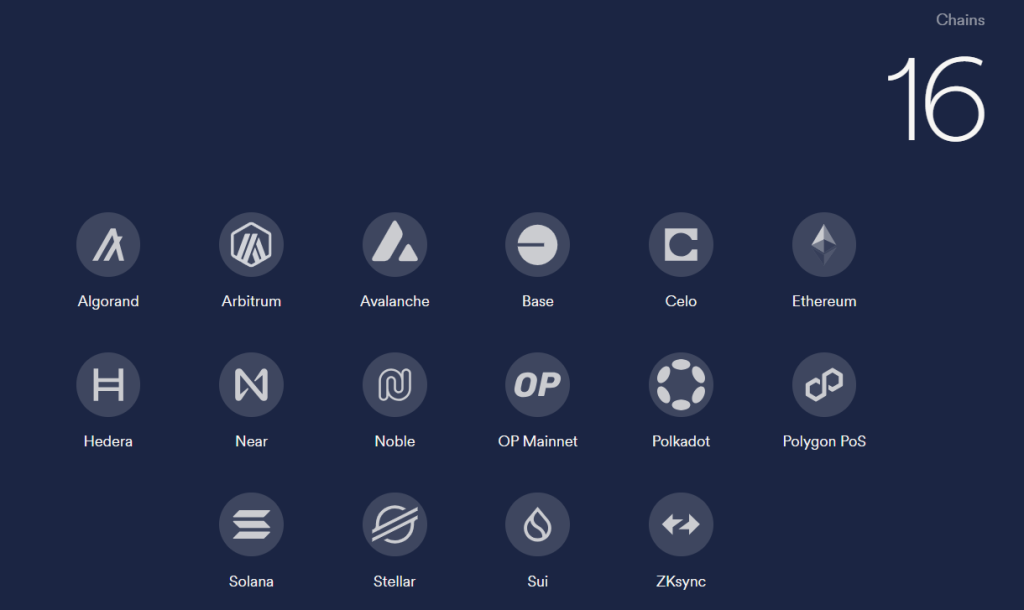

USDC’s Multi-Chain Advantage

One of USDC’s standout features is its deployment across 16 major blockchains, including Ethereum, Solana, Polygon, Avalanche, and more.

Expanding Global Reach

USDC’s availability in 100+ countries cements its role as a stablecoin for global use. Whether for international payments, cross-border trading, or decentralized finance (DeFi) applications, and ETC.

Why Choose USDC?

USDC’s transparent audits, regulatory focus, and liquidity make it a cornerstone of the crypto economy. Whether you’re trading, participating in DeFi, or managing international transactions. As we continue to explore the world of stablecoins, the next segment dives into the much-anticipated showdown: USDT vs. USDC a battle for stablecoins supremacy.

USDT vs USDC in the Stablecoin World

While both are designed to provide price stability and ease of transactions, they cater to different needs and priorities. Let’s break it down in the table below to help you decide!

| Feature | USDT (Tether) | USDC (USD Coin) |

|---|---|---|

| Market Capitalization | $132 billion | $38.86 billion |

| Transparency | Reserves include cash, equivalents, and other assets. Limited audit transparency. | Fully audited monthly, backed 1:1 by cash and U.S. Treasury bonds. |

| Blockchain Support | Supports multiple blockchains, including Ethereum, Solana, Tron, and Binance Smart Chain. | Supports 16 blockchains, including Ethereum, Solana, Polygon, and Avalanche. |

| Use Case | Preferred for high-volume trading and liquidity. | Favored by institutions and DeFi users for compliance |

The battle between USDT and USDC reflects a broader choice: flexibility and dominance vs. compliance and trust. Stablecoins like USDT and USDC are not just pivotal in trading or DeFi but are also revolutionizing cross-border payments. This evolution is exemplified by platforms like PEXX, which seamlessly bridge the gap between crypto and traditional finance.

PEXX, Revolutionizing Stablecoin Payments in Indonesia

As stablecoins like USDT and USDC continue to revolutionize the financial ecosystem, platforms like PEXX stand at the forefront of this transformation. Designed to bridge the gap between cryptocurrencies and traditional banking, PEXX offers seamless cross-border payment solutions, including direct transfers to banks in Indonesia.

Why PEXX Stands Out?

PEXX’s innovative platform provides several key advantages that make it a game-changer in global money transfers:

- Speed: Transactions are completed in under 5 minutes, ensuring efficiency.

- Affordability: Transparent Google Finance rates with zero hidden fees.

- Global Access: Supports transfers to 50+ countries in 16 currencies.

- User-Friendly Interface: Designed for all users, from crypto experts to beginners.

- Enhanced Security: Partners with Fireblocks to provide top-tier asset security.

Tailored for Indonesian Users

In Indonesia, PEXX supports transfers to major banks like BCA, BNI, BRI, Mandiri, and Permata, with transaction limits of up to USD 1 million per transfer. For other banks, users can transfer up to IDR 100 million per transaction, making PEXX ideal for both personal and business needs.

With such tailored support, PEXX opens up a world of possibilities for Indonesians to leverage stablecoins in a practical, secure, and efficient manner. Whether you’re an entrepreneur managing international payments or an individual seeking a reliable remittance option, PEXX offers a solution that simplifies global money movement.

You can start your journey with PEXX here and enjoy fast, secure, and affordable cross-border transfers!

You can also read this DOGE Gains Coinbase CEO’s Backing as a Path to U.S. Economic Freedom

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]