3 Best Altcoins to Watch This Week: BERA, IP, and DEXE

BERA

BERA

STORY

STORY

READ

READ

IP

IP

DEXE

DEXE

| Key Points: - Berachain (BERA) leads with 492% gains but faces downside risk. - Story Protocol (IP) surges 30%, breaking out of a bearish pattern. - DeXe (DEXE) hits a 4-year high, trading at $17.28 amid strong activity. |

Despite Bitcoin's 15% decline over the past 90 days, these best altcoins, Berachain (BERA), Story Protocol (IP), and DeXe (DEXE), have appeared as top performers, posting strong triple-digit gains amid shifting market conditions.

Berachain (BERA) leads with an impressive 492% gain, but negative funding rates signal potential downside risks, with key support at $5.825.

Meanwhile, Story Protocol (IP) surged 30% in a single day, breaking out of a descending channel, while DeXe (DEXE) hit a 4-year high, trading at $17.28 amid strong market activity.

Best Altcoins: BERA Up 492%, IP Surges, DEXE Hits 4-Year High

1. Berachain (BERA)

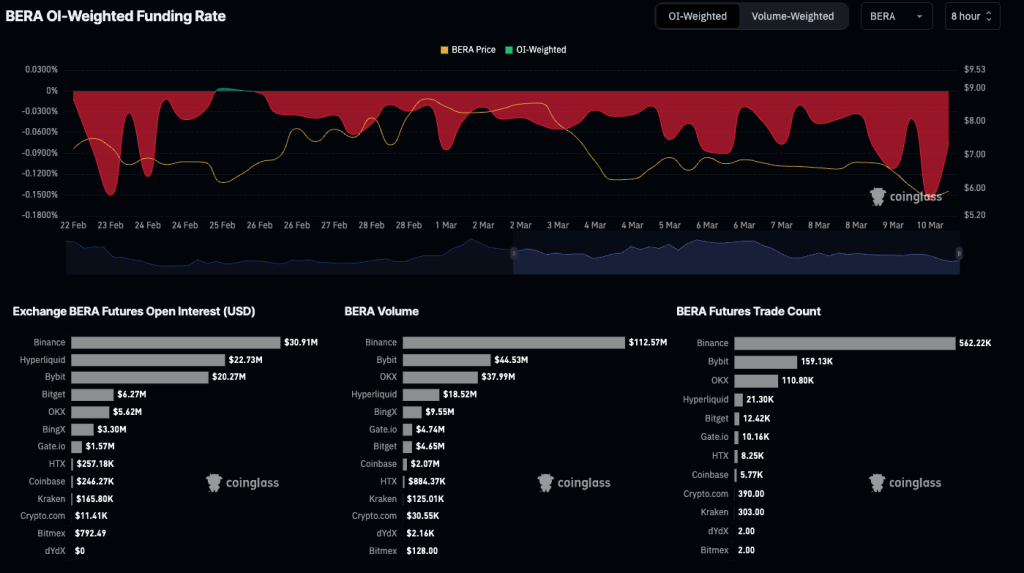

Berachain (BERA) has posted the highest gain among major tokens, surging 492% in the past three months. However, growing short interest and negative funding rates indicate potential downside risk.

Since launching on February 6, BERA’s funding rate has remained negative, signalling that many traders are betting on a price decline. Currently, the token is trading at $5.838, holding just above key support at $5.825. A break below this level could push BERA toward $5.35, with further downside risk to its all-time low of $4.74.

The BERA futures market shows strong trading activity, with Binance leading in volume at $112.57M and Bybit at $44.53M. Open interest remains highest on Binance ($30.91M), suggesting traders are actively speculating on BERA’s next move.

On the upside, if buying momentum strengthens, the token could attempt to reclaim resistance at $7.36.

2. Story Protocol (IP)

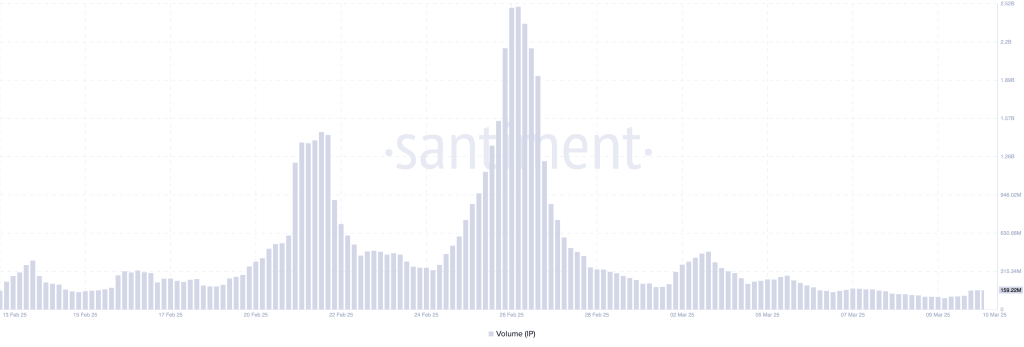

Story Protocol (IP) has recorded a 30% price increase in the past 24 hours, breaking out of a descending parallel channel—a technical reversal signal often associated with trend shifts.

The breakout was accompanied by a 159.22M surge in trading volume, significantly lower than previous peak levels but still indicating strong buying interest. Currently, IP is trading at $5.045, with key resistance at $5.09 and support at $5.018.

If IP fails to hold its current breakout, key support lies at $4.36, with further downside potential toward $4.00.

3. DeXe (DEXE)

DeXe (DEXE), the governance token for DeXe DAO, has reached its highest price since December 2021, trading at $17.284 after a 0.46% daily decrease.

The DEXE Total Liquidations Chart shows significant market activity, with total liquidations reaching $7.74K for long positions and $350.07 for short positions on March 10, 2025.

Binance saw the highest liquidations, with $350.07 in short positions and $6.96K in long positions, while Bybit and Gate.io recorded smaller amounts. In terms of DEXE trading volume, Binance leads with $12.93 million, while Bybit holds $2.11 million. Other exchanges such as Gate.io ($549.18K), Bitget ($469.36K), and Kraken ($20.92K) contribute smaller shares of the market.

Bybit follows with $5.02M in open interest and 32.05K trades, while Bitget, Gate.io, and Kraken have significantly lower market shares. With most activity concentrated on Binance, it remains the primary exchange for DEXE futures liquidity and price movements.

Altcoin Season Index Drops to 16, Signaling BTC Market Dominance

The CMC Altcoin Season Index currently stands at 16/100, confirming that the market remains in Bitcoin Season, where Bitcoin has outperformed most altcoins over the past 90 days.

The historical values show that yesterday's index was 17, last week's was 16, and last month’s was 34, indicating a continued dominance of BTC over altcoins.

Did You Know

The yearly high for the Altcoin Season Index was 87 on December 4, 2024, while the yearly low was 13 on September 3, 2024. The Altcoin Season Index Chart also highlights a declining trend, reinforcing Bitcoin’s strength in the market.

Despite Bitcoin’s dominance, some altcoins have significantly outperformed it over the past 90 days. The top-performing coin is BERA, with an impressive 491.80% gain, followed by DEXE (+79.42%), IP (+76.04%), BGB (+72.80%), TRUMP (+71.11%), GT (+65.29%), and OM (+55.61%). Other notable gainers include XMR (+18.37%), PAXG (+9.63%), XAUT (+9.00%), HYPE (+5.05%), and LEO (+4.22%).

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |