3 Best Cryptocurrencies on Base Chain Set to Explode – $AERO, $BRETT, $WELL

ARB

ARB

SOL

SOL

AERO

AERO

TBA

TBA

BRETT

BRETT

As Solana and Arbitrum experience significant surges, Base Chain might emerge as the next powerhouse, with Bitcoin holding its euphoric price level.

The rise of Base Chain is further fueled by the influx of new users, as it is closely tied to Coinbase, one of the most user-friendly and widely adopted exchanges. The capital flowing into Coinbase is likely to spill over into projects launching on Base, providing opportunities for significant gains.

As the market remains greedy and Bitcoin holds strong near its all-time highs, Base Chain’s Total Value Locked (TVL) is rising rapidly, reflecting the increasing volume and transaction fees.

The presence of new on-chain users and fresh liquidity has the potential to spark further growth. While the market has yet to fully reach “FOMO” levels, the loosening of regulations in certain areas presents a positive outlook for the future.

Aerodome Finance (AERO)

Aerodrome Finance is a key project on Base Chain, offering a next-generation automated market maker (AMM) designed to serve as a central hub for liquidity. It combines advanced features like a robust liquidity incentive engine, vote-locked governance, and a user-friendly interface.

Building on the innovations of Velodrome V2, Aerodrome Finance provides a sophisticated platform for trading and liquidity management within the Base ecosystem.

The project has seen steady growth in market capitalization, and despite earlier token dilution that impacted its price, it remains a promising investment. $AERO is accessible across major platforms, including Coinbase, and is positioned as a flagship token on Base Chain.

With a current market cap nearing $900 million and strong 24-hour trading volumes, it is anticipated to achieve significant milestones, potentially reclaiming its previous highs within the next 3-6 months.

As a financial instrument in the crypto space, Aerodrome Finance stands out by creating tangible value for users. Its integration with Base Chain, backed by Coinbase, ensures ample liquidity and a growing ecosystem.

Brett (Based) (BRETT)

Brett (Based), the first meme coin launched on the Base Chain, has gained significant attention as a cultural phenomenon and a key player in the emerging ecosystem.

Referred to as “Pepe’s best friend,” Brett (Based) stands out with substantial market activity, boasting massive liquidity and thousands of active holders. Despite experiencing a slight correction from its all-time high of $1.9 billion, $BRETT has stabilized to $1.6 billion mark and is showing signs of resurgence.

Currently, $BRETT is priced at $0.162, reflecting a 48% gain over the past week. The coin’s positioning as a pioneering meme token on Base Chain, coupled with its widespread availability on major exchanges, makes it an attractive option for investors exploring Base Chain assets.

$BRETT’s strong community backing and its integration within a growing network of decentralized applications (dApps) further bolster its long-term appeal.

Moonwell (WELL)

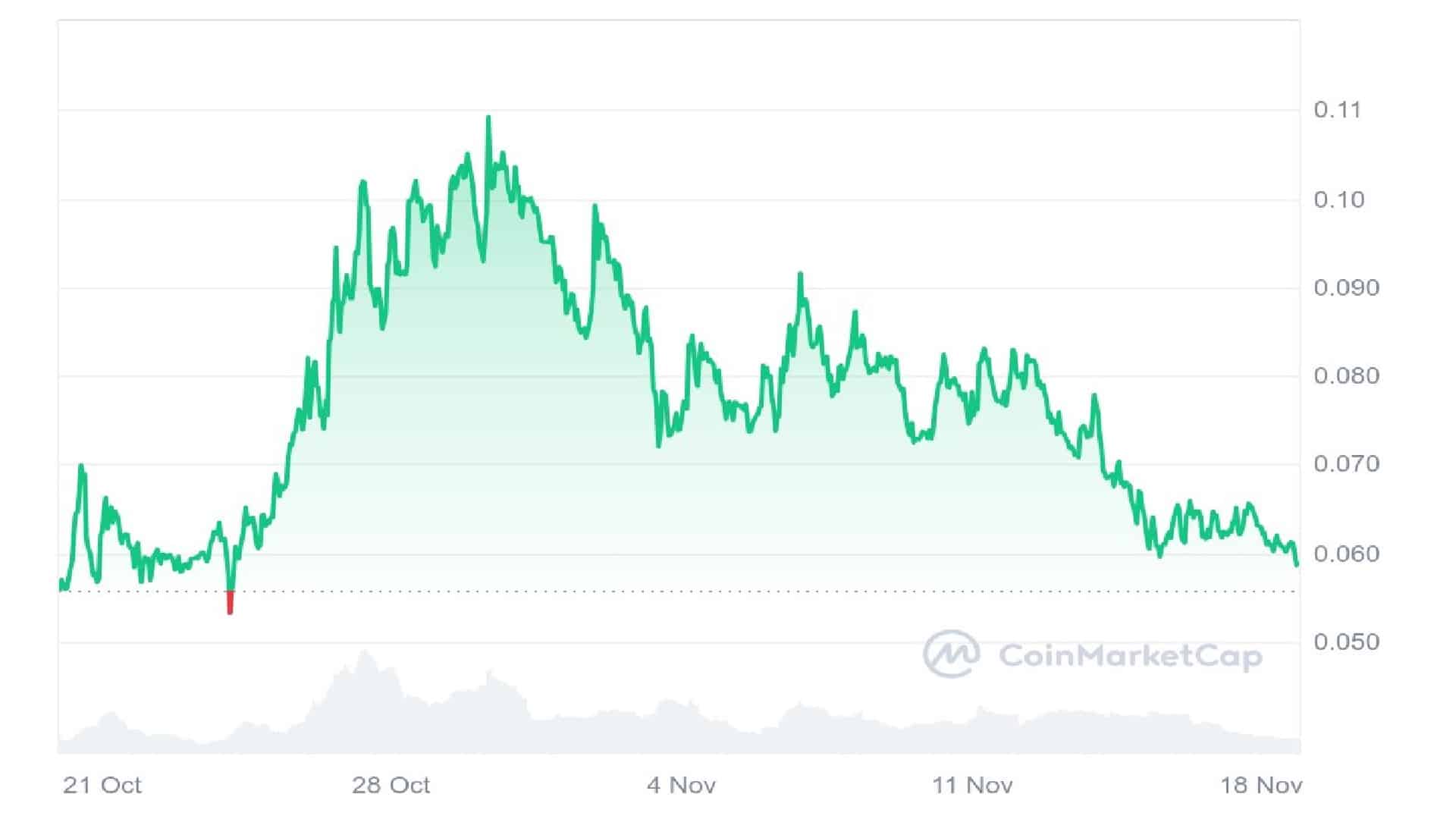

Moonwell has shown remarkable performance recently, particularly over the past year. Its market cap, currently self-reported at $176 million, has grown significantly from earlier lows. $WELL recently reached an all-time high of $0.113, though it has since retraced by 47%.

If the token can establish a support level and consolidate, it has the potential for further growth. As a lending and borrowing platform, Moonwell offers a user-friendly experience similar to platforms like Aave.

It allows users to lend or borrow digital assets with features such as flexible repayment schedules and no monthly fees. Additionally, Moonwell operates across multiple chains, including the Base chain, making it interoperable and widely accessible.

The platform supports assets like USDC and offers substantial staking rewards, highlighting its appeal as a financial tool for the future.

Lending and borrowing dApps like Moonwell are increasingly recognized as critical components of the evolving financial ecosystem, providing essential utility for a growing user base.