4 reasons behind Aave’s rally to 40-month highs

AAVE

AAVE

BULLISH

BULLISH

LT

LT

FOUR

FOUR

BAL

BAL

Aave recorded significant gains, emerging as the top gainer among the leading 100 crypto assets, amid the market-wide bullish momentum.

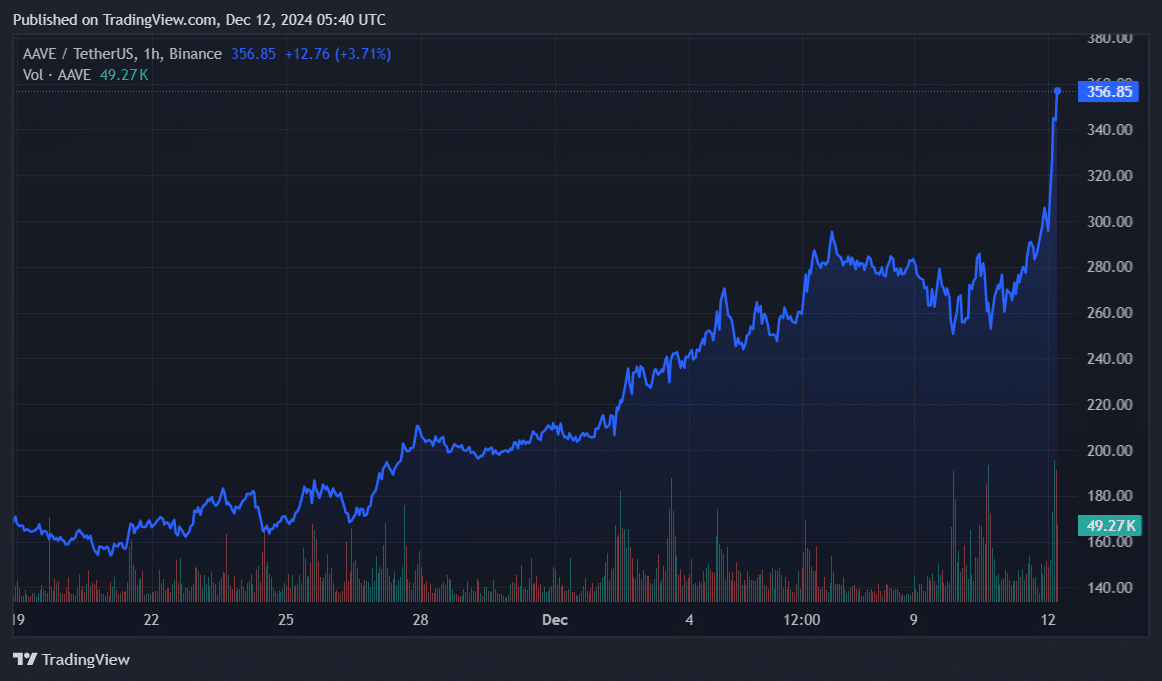

Aave (AAVE) surged 34% in the past 24 hours and is trading at $355 at the time of writing. The native token of the leading lending protocol saw its market cap rise to $5.3 billion, making it the 31st-largest cryptocurrency.

This is the first time since late August 2021 that Aave has broken the $350 mark.

4 main reasons behind Aave’s rally

First, the broader crypto market, including Bitcoin (BTC), started rising right after Wednesday’s U.S. Consumer Price Index report.

The U.S. inflation rate in November came at the expected 2.7% year-over-year, 0.1% up from October’s 2.6%, according to data from Investing.com.

You might also like: Bitcoin price to hit $275,000, top crypto expert predicts

Subsequently, Bitcoin crossed the $100,000 mark again as the global crypto market capitalization increased by 4%, reaching $3.82 trillion, per data from CoinGecko.

Second, a set of new developments brought bullish sentiment to the second-largest decentralized finance protocol — Aave’s DeFi total value locked is hovering at $22 billion.

Balancer announced to upgrade its decentralized exchange and automated portfolio management protocol to v3 in partnership with Aave, crypto.news reported on Wednesday. The lending protocol will optimize Balancer v3’s liquidity pools, allowing users to maximize yield.

Moreover, Aave is set to launch on Linea, a zk-rollup network supported by Consensys, after getting the green light from its community. This will allow Aave to scale up and increase its transaction throughput with lower fees.

Third, President-elect Donald Trump’s DeFi project, World Liberty Financial, accumulated $1 million worth of AAVE tokens at an average price of $297.8 earlier today.

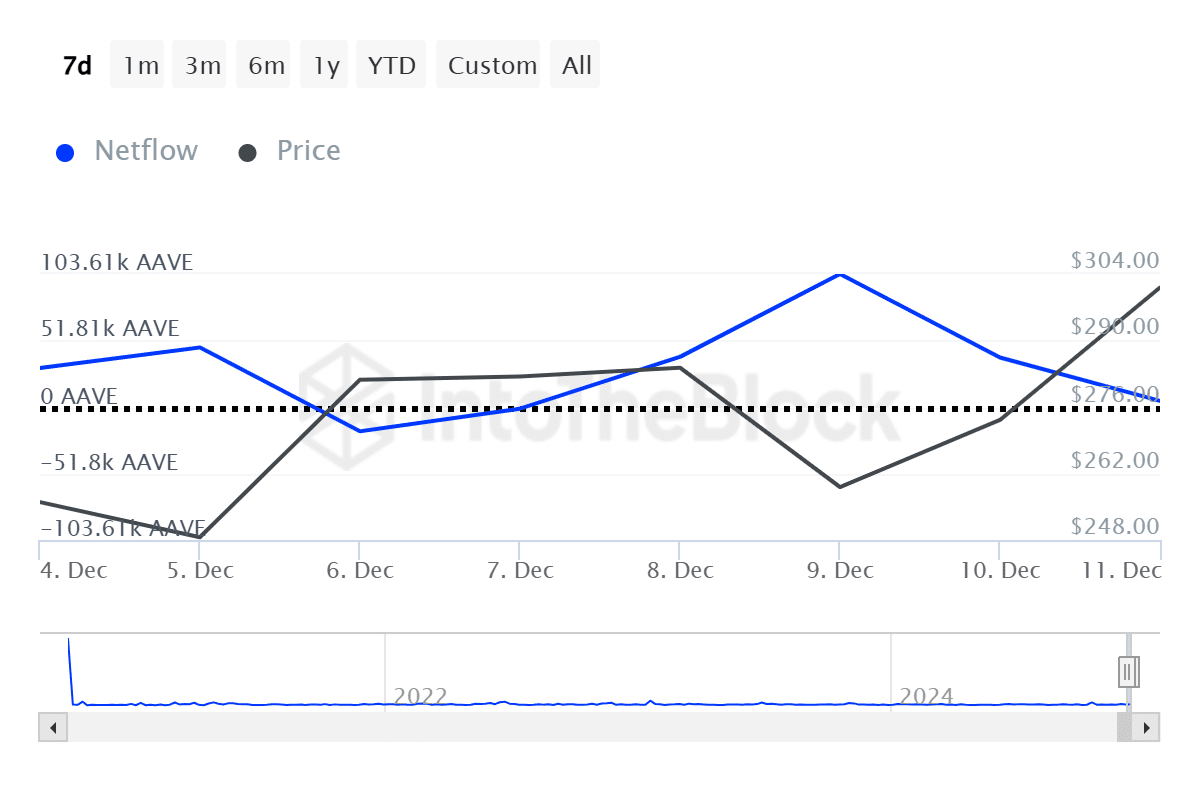

Last but not least, Aave’s whale accumulation strengthened as the price fell below the $260 mark on Monday. According to data from IntoTheBlock, the asset’s large holder net inflow reached 103,610 AAVE on Dec. 9.

Sudden spikes in whale inflows usually trigger the fear of missing out among retail investors, potentially pushing the prices higher.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.