Ai16z drops 21% as Smart Money Starts Selling Off

AI

AI

SOL

SOL

ORCA

ORCA

DROPS

DROPS

VIEW

VIEW

Ai16z, an AI meme coin on the Solana blockchain, faced a major price drop, entering what seems like a local bear market. After rising by over 20,500% since November, the token had a market capitalization peak of $2.3 billion earlier this week.

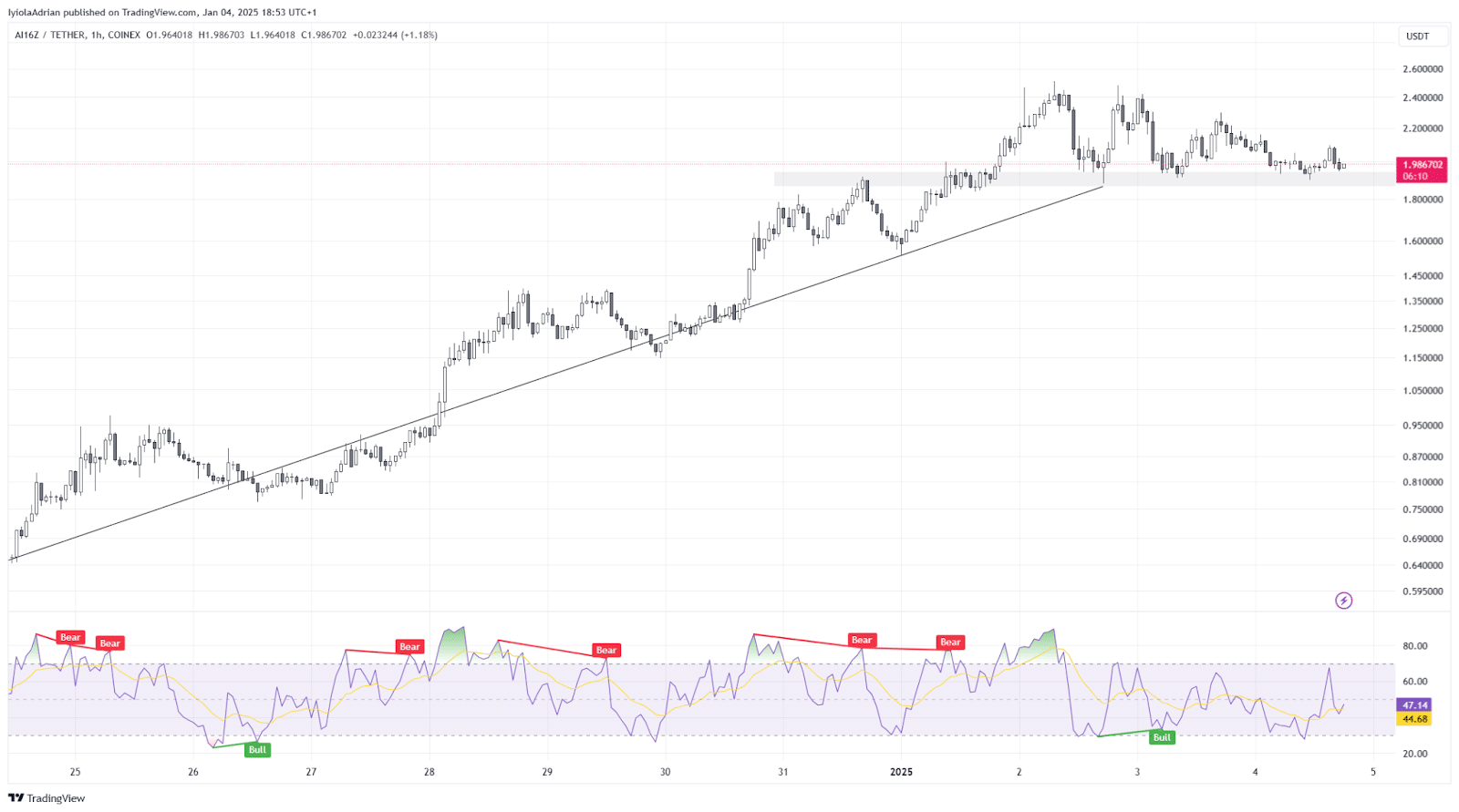

But by January 4, its price fell to $2, down more than 21% from its high of $2.50 this month. This correction was expected due to a decrease in buying pressure and high RSI, suggesting memecoin has been overbought by traders and hence pric ebay taje a u turn.

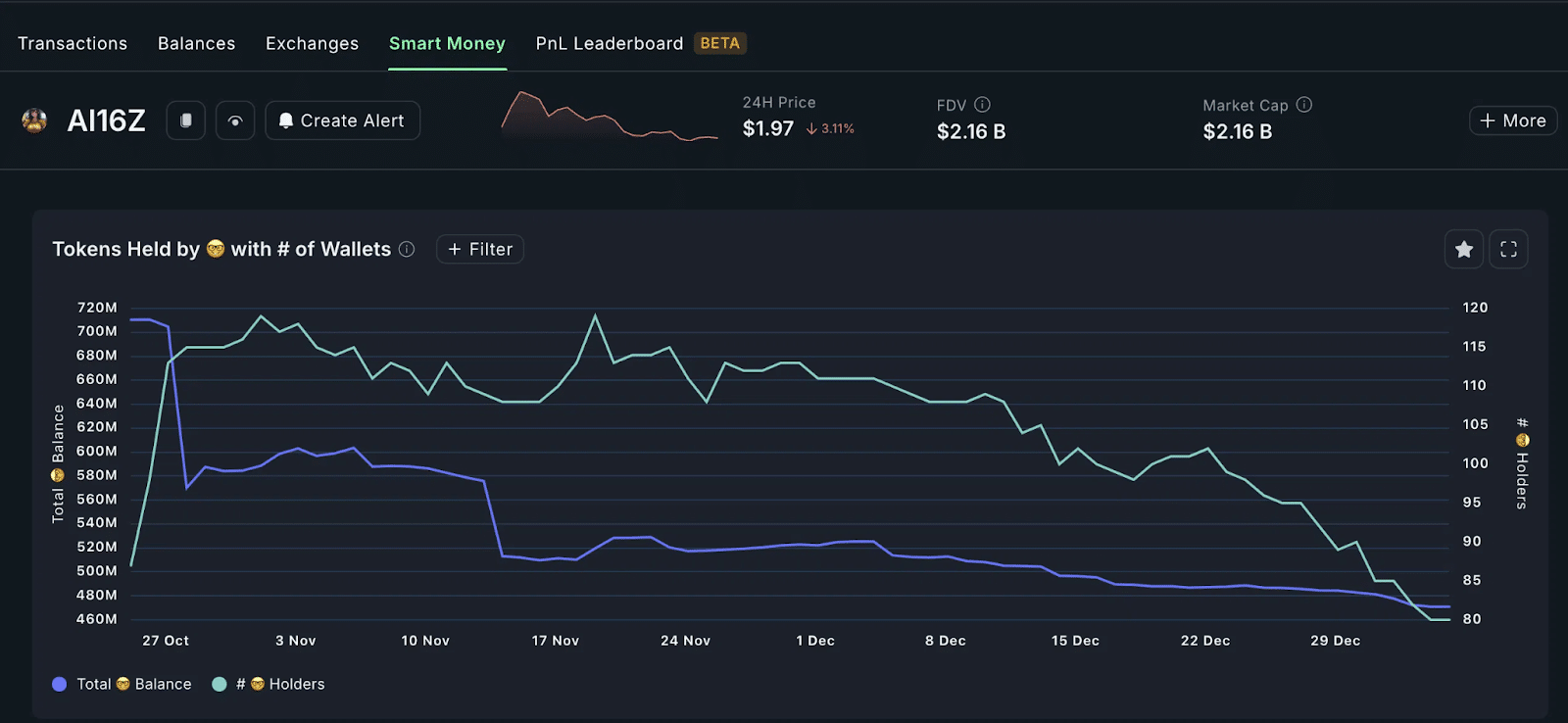

This sharp decline is mainly due to profit-taking by investors, especially those referred to as “smart money.” According to Nansen data, the number of smart money holders dropped from 118 in November to just 80 on January 4.

At the same time, their combined holdings have dropped from more than 700 million tokens to under 500 million. Smart money investors tend to sell their holdings before the market enters a downward phase, so this trend isn’t unexpected.

Additionally, the number of Ai16z tokens on exchanges has surged recently. Last week, there were 12.32 million tokens on exchanges, but that number jumped to over 43.65 million on January 4. Popular platforms like Gate, Raydium, MEXC, and Orca have seen the largest increases. This indicates that more tokens are being sold rather than bought, as holders cash out.

In terms of individual investors, the most profitable Ai16z trader has made $148 million in profits. While this trader has sold $4.6 million worth of tokens, they still hold 96% of their investment. Other profitable traders, who made $63 million, $57 million, and $44 million respectively, have kept their positions. However, many other profit-makers have decided to sell a portion of their holdings.

This price retreat can also be linked to the Wyckoff Method, a popular market theory. The theory breaks market cycles into four stages: accumulation, markup, distribution, and markdown. Ai16z began its journey in the accumulation phase in November, followed by a markup phase in December.

Now, it seems to be in the distribution phase, which is when more tokens are sold than bought. If this continues, the token could fall further, with some speculating a drop to $1, which would be a 50% decrease from its current value.