Altcoin Season Index Dips to 45, Signaling Continued Market Dominance by Bitcoin

FLOW

FLOW

BTC

BTC

WHEN

WHEN

MATIC

MATIC

GAINS

GAINS

Altcoin Season Index Falls to 45: What It Means for Crypto Traders

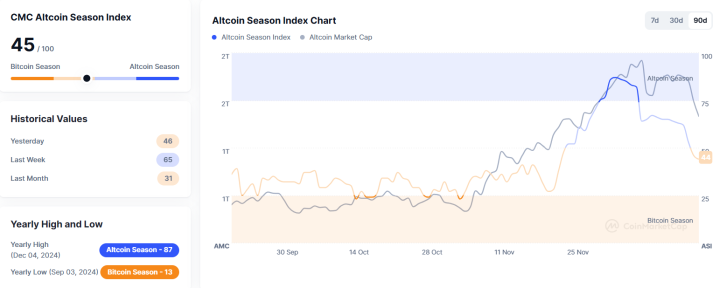

The Altcoin Season Index, a key indicator for gauging market dynamics between Bitcoin and altcoins, has dropped one point to 45 as of December 20, 2024, according to data from CoinMarketCap (CMC).

This reading suggests the market remains in Altcoin Season, albeit with reduced momentum compared to previous weeks. The index, which measures the performance of the top 100 altcoins against Bitcoin over the past 90 days, provides valuable insights for traders and investors seeking to understand market trends.

What is the Altcoin Season Index?

The Altcoin Season Index is a widely-used metric that evaluates whether altcoins are outperforming Bitcoin. The index is calculated using the following criteria:

- Altcoin Season: At least 75% of the top 100 altcoins must have outperformed Bitcoin in the last 90 days.

- Bitcoin Season: Occurs when 25% or fewer altcoins outperform Bitcoin in the same period.

- The index ranges from 1 to 100, with daily updates reflecting shifts in market sentiment.

The current reading of 45 places the market in a transitional phase, where Bitcoin’s dominance remains strong but some altcoins continue to capture attention.

Interpreting the Current Index Score of 45

A score of 45 indicates a mixed market environment:

- Bitcoin’s Stronghold: Bitcoin continues to demonstrate its dominance, particularly after surpassing the $100,000 mark. This milestone has redirected capital and attention toward the leading cryptocurrency.

- Altcoin Opportunities: Despite Bitcoin’s strength, a number of altcoins have shown resilience and potential, particularly those in the DeFi, NFT, and Layer-2 scaling sectors.

The market’s current state reflects a tug-of-war between Bitcoin enthusiasts and altcoin advocates, with neither side gaining full control.

Factors Driving the Altcoin Season Index

1. Bitcoin’s Recent Rally

Bitcoin’s recent surge past $100,000 has solidified its position as the market leader, drawing investment from retail and institutional players alike. This has led to a relative underperformance of many altcoins, pulling the index score lower.

2. Selective Altcoin Performance

Certain altcoins, particularly those tied to innovative technologies or real-world use cases, have managed to outperform Bitcoin. Examples include:

- Ethereum (ETH): Continues to benefit from strong activity in decentralized finance (DeFi).

- Solana (SOL): Gains traction due to its high-speed blockchain and ecosystem growth.

- Polygon (MATIC): Strengthens its position with Layer-2 scaling solutions.

3. Market Sentiment and Capital Flow

The crypto market’s sentiment often oscillates between Bitcoin and altcoins. As Bitcoin achieves significant milestones, like reaching new all-time highs, market participants tend to reallocate capital to the leading cryptocurrency, slowing altcoin growth.

Historical Trends and Insights

The Altcoin Season Index has historically provided early warnings of market transitions:

- When the index exceeds 75: Altcoin Season is in full swing, often coinciding with Bitcoin price stagnation.

- When the index drops below 25: Bitcoin Season dominates, usually following major Bitcoin rallies.

In 2021, the index hit a peak of 95, signaling an explosive Altcoin Season driven by DeFi and NFT booms. Conversely, it dropped to 10 during Bitcoin’s strong rally in early 2023.

What Does This Mean for Traders?

For Bitcoin Traders:

- The current environment favors Bitcoin, with capital inflows supporting its price. Traders might consider holding or adding to Bitcoin positions, particularly as it consolidates above $100,000.

For Altcoin Traders:

- While the market isn’t in full Altcoin Season, select altcoins continue to perform well. Traders should focus on fundamentally strong projects with active development and adoption.

For Long-Term Investors:

- A balanced portfolio with exposure to both Bitcoin and top-performing altcoins can help mitigate risks and capitalize on opportunities during market shifts.

FAQs

What is the Altcoin Season Index?

The Altcoin Season Index measures the performance of the top 100 altcoins relative to Bitcoin over the past 90 days. A score above 75 indicates Altcoin Season, while a score below 25 indicates Bitcoin Season.

Why did the index drop to 45?

The index fell due to Bitcoin’s strong price rally, which has outperformed many altcoins. However, some altcoins continue to show resilience, keeping the index in a transitional phase.

Is this a good time to invest in altcoins?

Yes, but with caution. Focus on altcoins with strong fundamentals and active ecosystems, as they are more likely to outperform in the current environment.

What factors influence the index?

The index considers the price performance of altcoins compared to Bitcoin, excluding stablecoins and wrapped tokens. Market trends, sentiment, and capital flows also play a significant role.

How often is the index updated?

The Altcoin Season Index is updated daily, providing real-time insights into market sentiment and performance.

Conclusion

The Altcoin Season Index’s dip to 45 highlights the ongoing battle for dominance between Bitcoin and altcoins. While Bitcoin continues to attract the lion’s share of market attention, select altcoins are proving their worth in a competitive landscape.

For traders and investors, the key lies in staying informed and identifying opportunities in both Bitcoin and promising altcoins. As the crypto market evolves, the Altcoin Season Index will remain an essential tool for navigating its complexities.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.