Altcoin Season Index Holds Steady at 52: What It Means for Investors

Altcoin Season Index Holds Steady at 52: What It Means for Investors

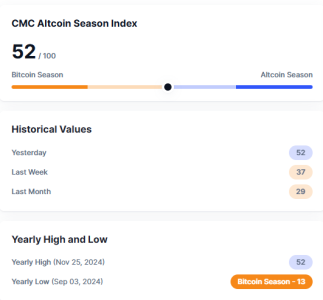

The Altcoin Season Index, a widely followed indicator in the cryptocurrency market, held steady at 52 on November 26, 2024, according to data from CoinMarketCap (CMC). This unchanged score suggests the market is currently in a phase of equilibrium, where altcoins and Bitcoin are competing closely for dominance. The index’s stability offers valuable insights for traders and investors navigating the volatile crypto landscape.

What Is the Altcoin Season Index?

The Altcoin Season Index tracks the performance of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) over the past 90 days, comparing them against Bitcoin.

Key Metrics:

- Altcoin Season: Occurs when at least 75% of the top 100 altcoins outperform Bitcoin.

- Bitcoin Season: Defined when 25% or fewer altcoins outperform Bitcoin.

- Index Range: Scores from 1 to 100, updated daily.

With the index at 52, the market sits in a neutral zone, suggesting neither Bitcoin nor altcoins have clear dominance.

Altcoin Season vs. Bitcoin Season

Altcoin Season:

- Indicates strong performance from altcoins compared to Bitcoin.

- Typically occurs during market phases driven by innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), or specific altcoin narratives.

Bitcoin Season:

- Bitcoin outperforms the majority of altcoins.

- Often coincides with macroeconomic uncertainty or a risk-averse sentiment in the market, as Bitcoin is seen as the “safe haven” of crypto.

What the Current Index Level Tells Us

At 52, the index suggests the market is in a balanced state:

- Altcoins and Bitcoin are performing similarly, without significant divergence.

- Investors are cautiously exploring altcoins while maintaining exposure to Bitcoin.

This equilibrium reflects a market phase where traders are awaiting clear signals for a shift toward either Altcoin Season or Bitcoin Season.

How the Altcoin Season Index Is Calculated

The index uses the past 90-day performance of the top 100 cryptocurrencies:

- Outperformance Threshold: A coin must perform better than Bitcoin to count toward Altcoin Season.

- Exclusions: Stablecoins and wrapped tokens are excluded to ensure the metric focuses on active, speculative assets.

This calculation provides a snapshot of the market’s momentum and sentiment, helping investors identify opportunities in different crypto categories.

What Could Trigger a Shift in the Index?

1. Altcoin Season Indicators:

- Breakthroughs in DeFi, NFTs, or blockchain scalability projects.

- High-profile token launches or upgrades (e.g., Ethereum layer-2 solutions).

- Declining Bitcoin dominance, as measured by its share of the overall crypto market cap.

2. Bitcoin Season Indicators:

- Increased macroeconomic uncertainty driving investors to Bitcoin as a safe asset.

- Regulatory developments impacting altcoins disproportionately.

- Rising institutional interest in Bitcoin, shifting market focus away from altcoins.

Investor Takeaways

1. Portfolio Diversification:

With the index at a neutral 52, investors should consider diversifying between Bitcoin and high-performing altcoins to capture potential gains.

2. Watch for Trends:

Stay updated on market news and developments in sectors like DeFi, NFTs, and Bitcoin ETFs, as these could signal a shift in the index.

3. Risk Management:

Maintain a balanced strategy, as the current market equilibrium suggests that volatility could favor either altcoins or Bitcoin.

Conclusion

The Altcoin Season Index holding steady at 52 indicates a balanced market, reflecting cautious optimism among crypto investors. While altcoins and Bitcoin are performing similarly, future market developments could tilt the scale toward a definitive Altcoin Season or Bitcoin Season.

For investors, this phase offers an opportunity to assess their portfolios, stay informed about market trends, and prepare for potential shifts in the crypto landscape.

To learn more about how to navigate Altcoin and Bitcoin seasons, check out our article on crypto market cycles