Axelar (AXL) Price Soars 14% After Canary Capital ETF Filing

CNR

CNR

WAXL

WAXL

ETF

ETF

AXL

AXL

ETF

ETF

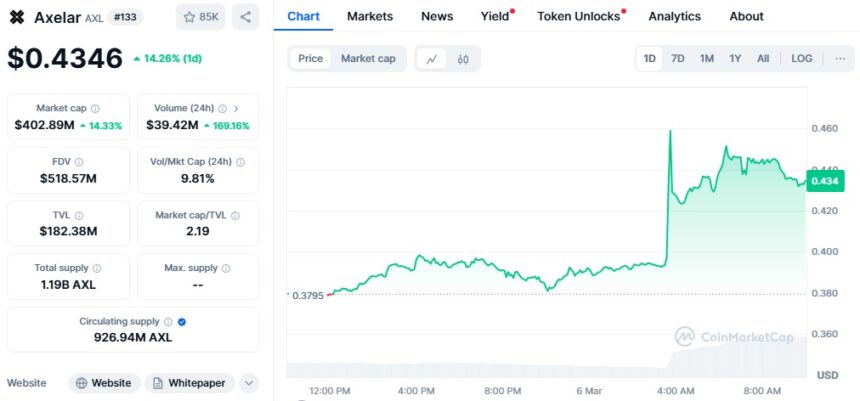

The S-1 registration filing by Canary Capital at the U.S. Securities and Exchange Commission (SEC) for an Axelar (AXL) exchange-traded fund (ETF) caused AXL’s price to increase by more than 14%.

The AXL ETF filing caused Axelar’s AXL token to spike to $0.46 while achieving a 17.95% daily increase. The daily performance of AXL tokens surpassed most other cryptocurrencies during that period.

Axelar functions as a Cosmos-based platform which facilitates cross-network communication between Ethereum and Arbitrum and Optimism blockchain systems. Mobius Development Stack from Axelar delivers protected infrastructure to support cross-chain transaction operations.

The platform achieved more than $1 billion in total value locked (TVL) while receiving support from major companies including Binance and Coinbase and Galaxy. The filing from Canary joins an expanding number of applications for altcoin ETFs.

In parallel with its filing Bitwise submitted an application to create an ETF based on Aptos. After Bitcoin and Ethereum ETFs achieved success and Donald Trump took office as U.S. President the number of ETF applications increased significantly.

The Axelar Foundation created a new Institutional Advisory Board where they selected Brian Brooks who previously served as Coinbase’s Chief Legal Officer. The regulatory expertise of Brooks who previously served as acting comptroller of the currency enables him to contribute to Axelar’s expanding ecosystem.

The rising institutional support and regulatory movement creates positive conditions for Axelar’s ecosystem to expand further.

Also Read: HBAR Price Pumps 10% Amid Grayscale Hedera ETF Filing Buzz