Bitcoin Dominance Spikes as $100K Looms! Moon or Pullback?

ETF

ETF

MOON

MOON

BTC

BTC

ETF

ETF

ETF

ETF

Bitcoin’s unstoppable rally has the market buzzing. On November 21, BTC shot up to $97,765, an eye-popping 45% gain in just 16 days. It’s now hovering at $97,154, but all eyes are locked on one thing: the $100K milestone. Can it break through, or will resistance hold it back?

Why Bitcoin Is Exploding Right Now

There are many reasons. Since Donald Trump’s re-election, Bitcoin has added over $28,000 to its value, more than tripling from $28,000 a year ago. Its dominance has hit 61.5%—the highest since 2021—lifting the entire crypto market cap to an insane $3.28 trillion. These are massive numbers, right?

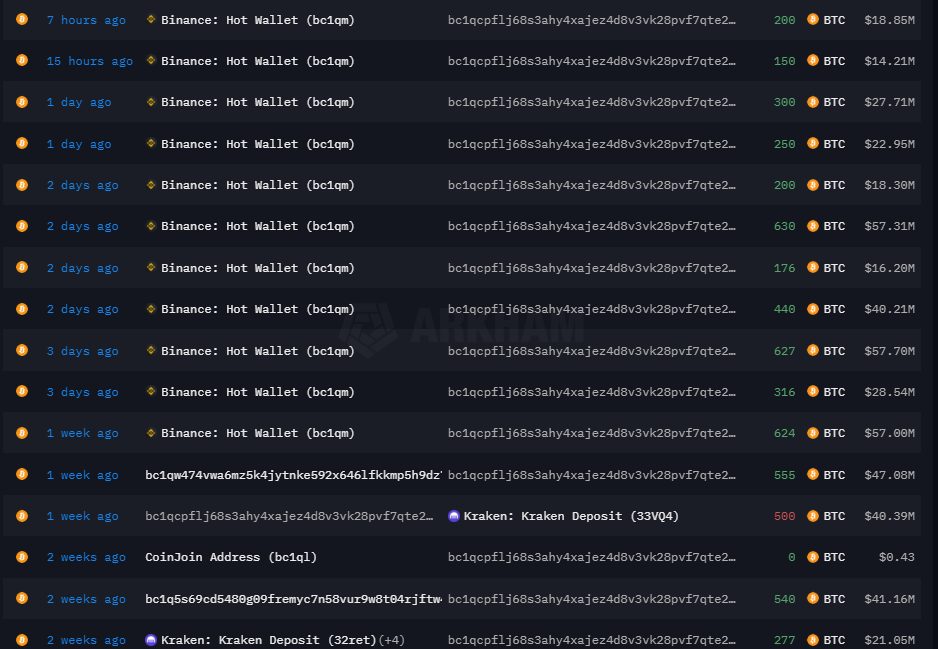

Then there’s the whale activity. Just recently, a big player snagged 3,289 BTC worth $300 million. BlackRock’s Bitcoin ETF isn’t sitting still either—it saw $628 million in inflows on the same day. These moves are a big deal, tightening the already scarce supply of Bitcoin.

The Big $100K Question

Now, here’s where it gets tricky. Bitcoin is just ~2% away from hitting six figures, but resistance is piling up. Sell walls between $98,000 and $100,000 are making it tough to push higher. Plus, overbought signals are flashing red. The RSI, a key momentum indicator, is at 81.01 on the daily chart— Isn't this the level where pullbacks often happen?

Nate Geraci from the ETF Store put it perfectly: “There’s only so much to go around.” The launch of two Spot Bitcoin ETF Options, all these things add support for Bitcoin to rise.

Still, community hopes are high and people are ready to see BTC at $100,000. Charles Edwards from Capriole Fund thinks a $100K breakthrough could trigger what he calls a “teleportation phase.” Prices might shoot up even faster once retail investors jump in, chasing the hype.

What’s Next?

Here’s the bottom line: Bitcoin is at a make-or-break point. If it clears $100K, the sky’s the limit. But don’t forget, whales are lurking, and short-term corrections are possible. For now, keep an eye on $98,000—it’s the battleground for what happens next. One thing’s for sure: the excitement isn’t slowing down anytime soon.