Bitcoin Faces Correction as Short-Term Investors Take Profits, Long-Term Potential Intact

CryptoQuant Analyst: Bitcoin Faces Correction as Short-Term Investors Take Profits, Long-Term Potential Intact

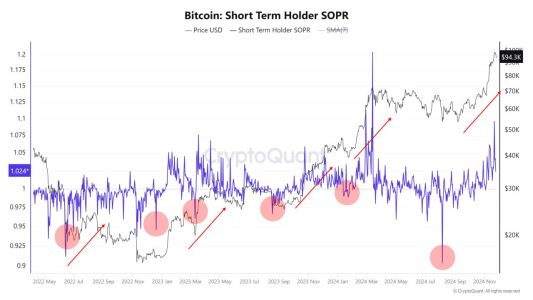

Bitcoin’s recent retreat from its $100,000 resistance level to $92,500 has raised questions about its short-term trajectory. According to MAC_D, a contributor at CryptoQuant, this downturn represents a routine market correction triggered by profit-taking from short-term investors. Despite the dip, on-chain data suggests that Bitcoin’s long-term potential remains strong, making this correction a potential buying opportunity for strategic investors.

Profit-Taking and Market Adjustment

1. Short-Term Investor Activity:

Bitcoin’s recent price action reflects selling pressure from short-term investors cashing in on profits:

- Profit-Taking: Investors who bought at lower levels are locking in gains, causing temporary downward pressure.

- Peaking Metrics: Indicators such as open interest and the estimated leverage ratio reached yearly highs, signaling heightened market activity.

2. Price Drop to $92,500:

This adjustment brought Bitcoin down to $93,620 as of the latest update, marking a 4.35% decline over the past 24 hours, according to CoinMarketCap.

Historical Context: Corrections Often Precede Rebounds

Historical trends highlighted by MAC_D show a recurring pattern:

1. Short-Term Selling at a Loss:

When short-term investors sell Bitcoin during price drops, the cryptocurrency often rebounds as the selling pressure eases.

2. Buying Opportunities:

- Extended corrections provide an entry point for long-term investors.

- Past data indicates that significant dips during such phases often precede strong upward movements.

MAC_D’s Insight:

“A more significant or extended correction could present a buying opportunity, as such dips frequently occur when short-term investors sell at a loss.”

On-Chain Metrics Supporting Long-Term Growth

Despite the current correction, on-chain data points to Bitcoin’s underlying strength:

1. Low Exchange Reserves:

- Bitcoin held on exchanges remains near multi-year lows, indicating reduced selling pressure.

2. Long-Term Holders:

- Accumulation by long-term holders suggests confidence in Bitcoin’s upward trajectory.

3. Network Activity:

- Rising wallet activity and consistent transaction volumes signal healthy network engagement.

Market Sentiment and Future Scenarios

1. Short-Term Outlook:

- Bitcoin may consolidate further, trading in the $90,000 to $95,000 range as the market digests recent gains.

2. Long-Term Potential:

- On-chain metrics and historical patterns suggest Bitcoin could reclaim and potentially surpass the $100,000 level in the coming months.

3. Key Levels to Watch:

- Support: $90,000 serves as a crucial support level.

- Resistance: A breakout above $100,000 would signal renewed bullish momentum.

Investor Takeaways

1. Patience in Volatility:

- Short-term fluctuations are part of Bitcoin’s typical market cycles. Investors should avoid panic selling during corrections.

2. Strategic Buying:

- Corrections like these often offer buying opportunities, especially for long-term investors.

3. Monitoring On-Chain Data:

- Stay informed about metrics like exchange reserves, long-term holder activity, and leverage ratios to anticipate market movements.

Conclusion

Bitcoin’s recent drop from $100,000 to $93,620 underscores the influence of short-term profit-taking on price movements. However, historical trends and robust on-chain data suggest that Bitcoin’s long-term growth trajectory remains intact. For investors, this correction may present an opportunity to enter the market before the next significant rally.

To explore more about Bitcoin’s market cycles and on-chain analysis, check out our article on navigating Bitcoin corrections.