Bitcoin on the Verge of Surpassing Google by Market Cap

TOP

TOP

BTC

BTC

XVG

XVG

INFINITE

INFINITE

CAP

CAP

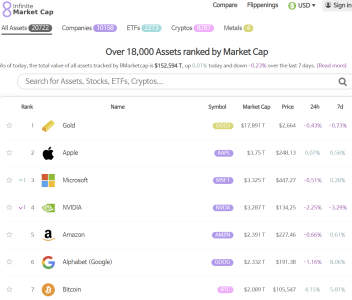

Bitcoin (BTC) is poised to surpass Google as the sixth-largest global asset by market capitalization, requiring just a 14% price increase to reach $117,755 per BTC. As of December 16, 2024, Bitcoin’s market cap stands at $2.087 trillion, trailing Google’s $2.332 trillion, according to data from Infinite Market Cap (8MarketCap).

This milestone highlights Bitcoin’s rapid ascent in the global financial hierarchy, fueled by increasing institutional adoption and growing mainstream recognition.

Current Market Cap Comparison

| Asset | Market Cap | Gap |

|---|---|---|

| $2.332 trillion | $245 billion | |

| Bitcoin | $2.087 trillion | – |

For Bitcoin to overtake Google, its price must rise by 14%, pushing its market cap past $2.33 trillion.

What’s Driving Bitcoin’s Market Cap Growth?

Several key factors have propelled Bitcoin’s rapid market cap expansion:

1. Institutional Adoption

- Institutional inflows into Bitcoin have reached historic levels, with spot Bitcoin ETFs in the U.S. attracting billions in investments.

- Hedge funds, family offices, and corporations are increasingly allocating a portion of their portfolios to Bitcoin as a hedge against inflation.

2. Growing Retail Participation

- Bitcoin’s rising profile as “digital gold” has attracted a wave of retail investors.

- Platforms like PayPal and Cash App have made crypto more accessible to the average consumer.

3. Regulatory Optimism

- Pro-crypto policies, particularly under the administration of President-elect Donald Trump, have bolstered market confidence.

- The potential for clearer and more favorable crypto regulations could further enhance adoption.

Significance of Surpassing Google

If Bitcoin overtakes Google’s market cap, it would solidify its position as a dominant global financial asset.

Key Implications

- Recognition as a Mainstream Asset: Bitcoin would join the ranks of the world’s largest companies, further validating its status as a store of value.

- Increased Adoption: Institutional and retail investors would likely accelerate their adoption of Bitcoin as it gains more credibility.

- Milestone for Digital Assets: This achievement would represent a significant step forward for the broader cryptocurrency ecosystem.

Bitcoin’s Journey to the Top 6

Bitcoin’s market cap growth over the years has been nothing short of remarkable. It has consistently climbed the ranks of global assets, outpacing major corporations and traditional commodities:

| Year | Market Cap Milestone | Global Rank |

|---|---|---|

| 2021 | Surpassed $1 trillion | Entered Top 10 |

| 2024 | $2 trillion milestone achieved | 7th place |

Challenges Ahead

While Bitcoin is on the cusp of overtaking Google, several factors could influence its trajectory:

1. Market Volatility

- Bitcoin’s price remains highly volatile, with swings influenced by macroeconomic trends, regulatory developments, and market sentiment.

2. Regulatory Risks

- Potential regulatory crackdowns in key markets could pose obstacles to Bitcoin’s growth.

3. Competition from Altcoins

- Rising interest in alternative cryptocurrencies could divert attention and investment away from Bitcoin.

What’s Next for Bitcoin?

To maintain its momentum and secure its place among the world’s top assets, Bitcoin must:

- Sustain Institutional Inflows: Continued adoption by large investors is crucial for long-term growth.

- Strengthen Regulatory Frameworks: Clear and supportive regulations will enhance trust and adoption.

- Expand Use Cases: Innovations like the Lightning Network and Bitcoin-based DeFi could further solidify its utility.

Conclusion

Bitcoin’s potential to surpass Google as the sixth-largest global asset by market cap underscores its growing influence in the financial world. With just a 14% price increase required, Bitcoin’s ascent could mark a transformative moment for digital assets, propelling them further into the mainstream.

As market conditions and adoption trends continue to evolve, Bitcoin’s journey to $117,755 will be closely watched by investors and institutions alike.

To stay informed about the latest developments in Bitcoin and cryptocurrency markets, explore our article on latest news, where we cover the most significant milestones shaping the industry.