Bitcoin Spot ETF Outflows Reach $277M Amid Market Activity

ETF

ETF

BTC

BTC

READ

READ

ETF

ETF

SPOT

SPOT

Key Points:

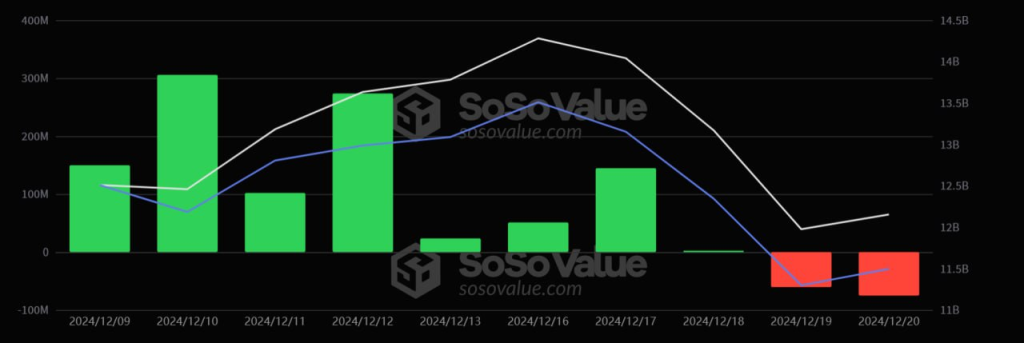

- Bitcoin Spot ETF outflows totalled $277M, with $109.725B in net assets.

- Ethereum Spot ETF saw $75.11M outflows, with net assets valued at $12.15B.

Bitcoin Spot ETF outflows hit $277M, Grayscale GBTC saw $57.36M in outflows, and Ethereum Spot ETF recorded $75.11M, with $12.15B in net assets on December 20.

Bitcoin Spot ETF Outflows and Their Impact on the Market

Reflecting changing investor mood, Bitcoin Spot ETF observed notable outflows of $277 million on December 20. Withdrawals of $57.36 million for Grayscale GBTC also point to market instability. With a remarkable $109.725B net asset value, Bitcoin Spot ETF shows strong but dynamic positioning.

This emphasizes more general patterns in bitcoin investments since outflows could indicate temporary changes in market policies. Particularly considering their involvement in institutional-level crypto exposure, investors carefully watch these ETFs, according to Sosovalue.

Read more: Bitcoin Spot ETF Inflows Reach $275 Million on December 18

Ethereum Spot ETF Trends Highlighted by December Activity

On December 20, Ethereum Spot ETF noted a $75.11M outflow; historically, cumulative net inflows for Ethereum had reached $2.328B. Reflecting investor confidence, its net asset value is $12.15B.

Notwithstanding these losses, Ethereum's development path and large inflows point to its ongoing attractiveness to investors. For both institutional and individual players, these ETFs remain essential in increasing access to Ethereum investing.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |