Bitcoin Trading Volume Continues at Record High Despite Ongoing Dip: Is a BTC Price Reversal Imminent?

BULLISH

BULLISH

TOKEN

TOKEN

BTC

BTC

X

X

RVL

RVL

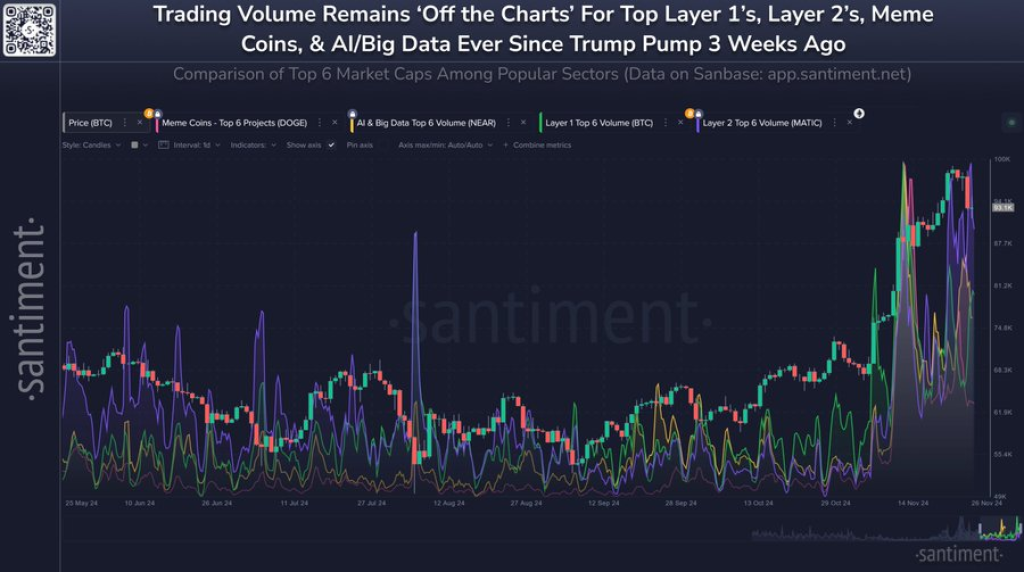

Trading volume in Bitcoin has surged to levels last seen in May 2021, with volumes reaching 154.92 billion BTC on November 12th. Santiment data shows a 32% increase in overall trading volume over the past week, even as BTC price remain under pressure.

Key observations:

- Trading volume peaks mirror May 2021 levels

- 32% weekly volume increase despite price decline

- Significant altcoin exchange activity suggests profit rotation

- Traders redistributing BTC profits into speculative assets

The surge in trading activity during a price dip often precedes significant market movements. While high volumes typically signal strong market participation, the concurrent shift toward altcoins indicates traders are diversifying their positions rather than exiting the market entirely.

Bitcoin Hold Above $91,000: Is BTC Price Reversing?

The price of Bitcoin closed above the key support level at $91,000 yesterday. As the price started dipping, many analysts began to set their key price levels where it could hit some support and see a bullish reversal.

Read Also: ONDO Reflecting Exact Metrics that Spiked Solana 70x as Binance Could List the Token

There seemed to be a more general consensus that the $90,000 to $92,000 level was a key zone for the price of BTC to reverse.

With a successful close above that zone on the daily chart, the stage might be set for a reversal. If the price continues to hold above this level, we could see BTC prices start to rise again towards $100,000.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

The post Bitcoin Trading Volume Continues at Record High Despite Ongoing Dip: Is a BTC Price Reversal Imminent? appeared first on CaptainAltcoin.