[Bitop Review] Ethereum's Burn Rate Plummets: Is the Network Losing Its Deflationary Edge?

ETH

ETH

ETC

ETC

SOL

SOL

When Ethereum implemented the London upgrade in August 2021, the introduction of EIP-1559 simplified the transaction fee structure while mandating that all ETH used to pay base fees be burned. This mechanism was designed to reduce inflationary pressure and, during periods of peak network activity, potentially transform Ethereum into a deflationary asset.

Single-Day ETH Burn Rate Hits Historic Low

However, according to data from The Block, Ethereum’s network burned just 53.07 ETH last Saturday—equivalent to approximately $106,000 at current prices—marking a record low.

Based on Ultrasound.money data, if the burn rate from the past seven days is annualized, Ethereum’s supply growth rate is projected to reach 0.76%.

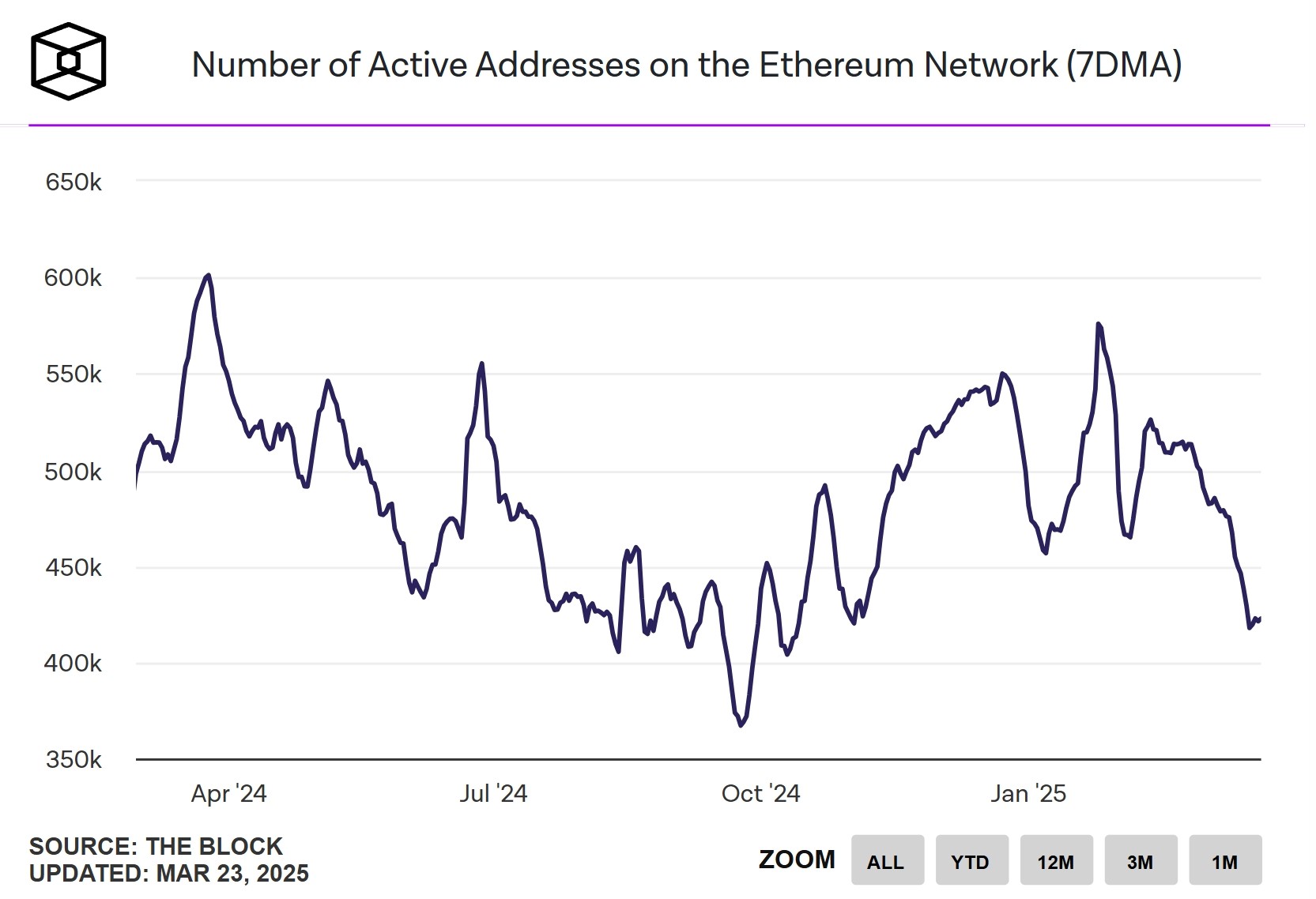

This exceptionally low burn rate aligns with a broader decline in other Ethereum activity metrics. Per The Block, the seven-day moving average of active addresses recently fell to its lowest level since October 2024. The creation of new addresses, transaction counts, and daily trading volume have also trended downward over the past few weeks.

Ethereum Foundation Considers a Shift in Strategy

Amid Ethereum’s stagnation, Standard Chartered Bank recently slashed its 2025 price forecast for Ethereum from $10,000 to $4,000. The downgrade reflects the rapid growth in both the number and scale of Ethereum’s Layer 2 solutions.

In its report, Standard Chartered noted that Ethereum is at a crossroads. While it continues to dominate several blockchain metrics, that dominance is steadily eroding. Ethereum’s much-touted Layer 2 networks, originally intended to enhance scalability, have instead contributed to a $50 billion reduction in Ethereum’s market cap, driven largely by Coinbase’s Layer 2 network, Base.

To reverse this trend, Standard Chartered suggests that the Ethereum Foundation may need to pivot its business strategy—such as imposing taxes on Layer 2 solutions. Additionally, if the tokenized market sees significant growth, Ethereum could leverage its security to capture roughly 80% of that market, potentially providing some support for the network.

As Ethereum grapples with a crisis of confidence, Haseeb Qureshi, managing partner at Dragonfly, recently revealed that the Ethereum Foundation is actively responding to community feedback and contemplating a shift in its operational focus. The leadership is seriously considering lessons from other successful models—particularly Solana’s Superteam approach—moving away from pure research toward fostering project development and investment activities.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.