Bitwise Files For 10 Crypto Index ETFs, Gets Investment From Ripple for XRP ETF

BTC

BTC

XRP

XRP

ETH

ETH

BCH

BCH

LINK

LINK

ADA

ADA

AVA

AVA

SOL

SOL

NEAR

NEAR

DOT

DOT

UNI

UNI

Bitwise has filed an application with the U.S. Securities and Exchange Commission (SEC) to create an exchange-traded fund (ETF) based on its 10 Crypto Index Fund.

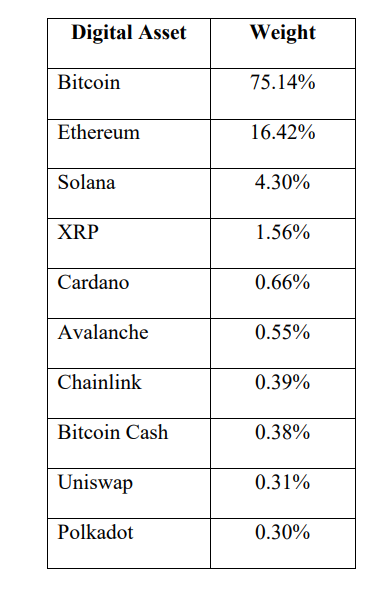

Bitcoin, Ethereum, Solana, XRP, Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap are all represented in the fund, making it the most diversified and extensive crypto ETF in the US.

All Assets Under the BitWise Crypto Index ETF. Source: SEC

All Assets Under the BitWise Crypto Index ETF. Source: SEC

The index's value is tied to the performance of the ten largest cryptocurrencies by market capitalization and has been maintained by Bitwise since 2018.

Meanwhile, Ripple has backed Bitwise's Physical XRP ETP (GXRP), previously called the European XRP ETP, which provides European investors with direct exposure to XRP.

"With the U.S. regulatory environment for crypto finally becoming more clear, this trend is poised to accelerate, further driving demand for crypto ETPs, such as the Bitwise Physical XRP ETP," Ripple CEO Brad Garlinghouse said in a press release.

"As one of the most valuable, liquid, and utility-driven digital assets, XRP is at the forefront of this momentum, standing out as a cornerstone for those seeking access to assets that are resilient and have real-world utility."

Originally launched in 2022, the ETP operates under a BaFin-approved prospectus, Germany’s financial regulatory framework.

Bitwise also recently joined the Solana ETF race by submitting its regulatory filings for the product, following in the footsteps of VanEck and 21Shares, which filed theirs in June.

Cboe BZX Exchange has now submitted four 19b-4 filings, which are formal submissions that propose rule changes to the SEC by self-regulatory organizations such as stock exchanges.

The company has already made a mark in the ETF space with its Bitcoin ETF (BITB), as one of the first ten applicants to seek SEC approval for a cryptocurrency-based ETF.

Earlier this week, WisdomTree registered an XRP ETF in Delaware, reflecting the increasing appetite for digital asset investment vehicles. The move suggests the company is preparing to file an S-1 registration with the US Securities and Exchange Commission (SEC) to launch an XRP-focused ETF.

WisdomTree follows the likes of Bitwise and Canary Capital, which have also sought SEC approval for spot XRP ETFs.

Additionally, 21Shares has announced the launch of new exchange-traded products (ETPs) for four digital asset tokens.

Oracle provider Pyth, decentralized graphics processing protocol Render, RWA platform Ondo Finance, and layer-1 blockchain Near Protocol will each have their own ETPs through 21Shares known as:

- 21Shares NEAR Protocol Staking ETP

- 21Shares Ondon ETP

- 21Shares Pyth Network ETP

- 21Shares Render ETP

Join Blockhead today for FREE and stay in the loop on digital assets!