BlackRock’s ETHA Spot Ethereum ETF Surpasses $2 Billion in AUM

ETH

ETH

ETF

ETF

ETF

ETF

BILL

BILL

SPOT

SPOT

BlackRock’s ETHA Spot Ethereum ETF Surpasses $2 Billion in AUM

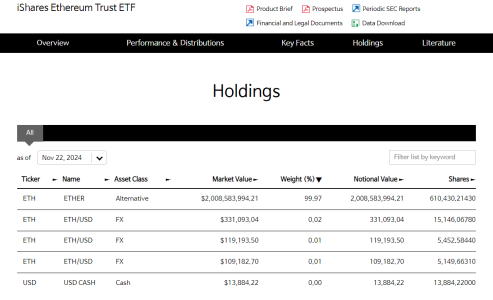

BlackRock’s ETHA spot Ethereum ETF has achieved a significant milestone, surpassing $2 billion in assets under management (AUM). According to data from BlackRock’s official website, ETHA currently manages 610,430.2143 ETH, valued at approximately $2,008,583,994.21. This achievement highlights the increasing institutional demand for Ethereum as a key investment asset, further solidifying the cryptocurrency’s role in global financial markets.

ETHA: A Leading Ethereum Investment Vehicle

1. Milestone Achievement:

- BlackRock’s ETHA has crossed the $2 billion AUM mark, a testament to its growing popularity among institutional and retail investors.

- The ETF’s holdings of 610,430 ETH reflect a robust commitment to the Ethereum ecosystem.

2. BlackRock’s Leadership in Crypto ETFs:

- As one of the world’s largest asset managers, BlackRock’s entry into Ethereum ETFs has driven market confidence and increased accessibility to Ethereum investments.

- ETHA is part of BlackRock’s broader strategy to offer regulated crypto investment products tailored to institutional needs.

Why ETHA Is Attracting Significant Investment

1. Institutional Demand for Ethereum:

- Ethereum’s role in powering DeFi, smart contracts, and NFTs has made it a preferred choice for institutions diversifying into digital assets.

- ETHA provides a regulated and straightforward way to gain exposure to Ethereum without the complexities of direct cryptocurrency ownership.

2. Regulatory Approval Boost:

- The launch and growth of ETHA align with increasing regulatory clarity around spot crypto ETFs in the U.S., building investor trust.

3. Ethereum’s Price Performance:

- Ethereum’s steady growth and adoption have made it an attractive long-term investment, driving inflows into ETHA.

ETHA’s Impact on the Ethereum Market

1. Increased Liquidity:

- The accumulation of 610,430 ETH by ETHA adds significant liquidity to Ethereum markets, stabilizing prices and fostering market growth.

2. Validation of Ethereum’s Value Proposition:

- BlackRock’s success with ETHA validates Ethereum’s role as a cornerstone of the blockchain economy, attracting more institutional players to the space.

3. Competitive Landscape:

- ETHA’s milestone positions it ahead of competing Ethereum ETFs, setting a benchmark for performance and investor trust.

What This Means for Investors

1. Growing Accessibility:

- ETHA’s success demonstrates the viability of spot crypto ETFs as a mainstream investment tool, providing easier access to Ethereum for both institutional and retail investors.

2. Confidence in Ethereum:

- BlackRock’s achievement bolsters confidence in Ethereum’s long-term value and utility, reinforcing its position in diversified portfolios.

3. Opportunities for Growth:

- ETHA’s continued growth may pave the way for additional spot ETFs and crypto-focused financial products, broadening market participation.

The Road Ahead for ETHA and Ethereum

1. Expanding Institutional Adoption:

- As ETHA continues to grow, it sets the stage for further Ethereum adoption by large-scale financial institutions.

2. Influence on Ethereum’s Price:

- The ETF’s rising AUM could positively impact Ethereum’s price trajectory by increasing demand and market interest.

3. Continued Innovation:

- Ethereum’s upcoming advancements, such as scalability improvements and sustainability initiatives, are likely to further attract investment into products like ETHA.

Conclusion

BlackRock’s ETHA spot Ethereum ETF crossing the $2 billion AUM mark is a landmark moment for both the asset manager and the broader cryptocurrency industry. This milestone underscores the growing institutional interest in Ethereum and the increasing demand for regulated investment vehicles that provide exposure to digital assets.

As ETHA continues to thrive, its success not only reflects Ethereum’s strength but also signals the expanding role of cryptocurrencies in traditional financial markets.

To explore more about Ethereum ETFs and their impact, check out our article on top-performing crypto ETFs of 2024