BlackRock Strategist Predicts Long-Term Growth via AI Despite Market Woes

AI

AI

AGIX

AGIX

APRIL

APRIL

READ

READ

BLACKROCK

BLACKROCK

- BlackRock's strategist foresees short-term market pressure but long-term AI-driven growth.

- AI advancements and a strong economy boost U.S. stock market allure.

- Market reactions highlight optimism for AI-related growth opportunities.

The report suggests a potential upward trajectory for sectors aligned with AI technologies. Despite current market challenges, analysts emphasize that ongoing technological advancements may boost long-term growth significantly. "The U.S. stock market may face shorter-term pressure but remains attractive for long-term investments, primarily due to technological advancements in artificial intelligence (AI), robust corporate earnings, and a resilient U.S. economy," said a strategist from BlackRock Investment Institute.

Community reactions reflect optimism about AI's role, echoing past sentiments towards transformative sectors amid previous economic pressures. BlackRock's reassurance indicates institutional confidence, possibly rejuvenating market interest, especially in AI-linked stocks and sectors.

BlackRock's April 2025 AI and Market Growth Predictions

A report from BlackRock, unveiled on April 15, 2025, highlights AI advancements and robust corporate earnings as potential buffers against short-term U.S. stock market pressures. The strategist emphasizes the resilience of the U.S. economy and future stock growth.

The Coincu research team anticipates AI's applications in crypto sectors such as decentralized finance (DeFi) could be substantial. AI and blockchain intersections may transform the digital landscape, although regulatory focus might intensify as these technologies mature.

AI Growth and its Effects on Cryptocurrency Markets

Did you know? In 2009, post the financial crisis, emerging technologies like AI were seen as pivotal in economic recovery, paralleling today's optimism amid economic challenges.

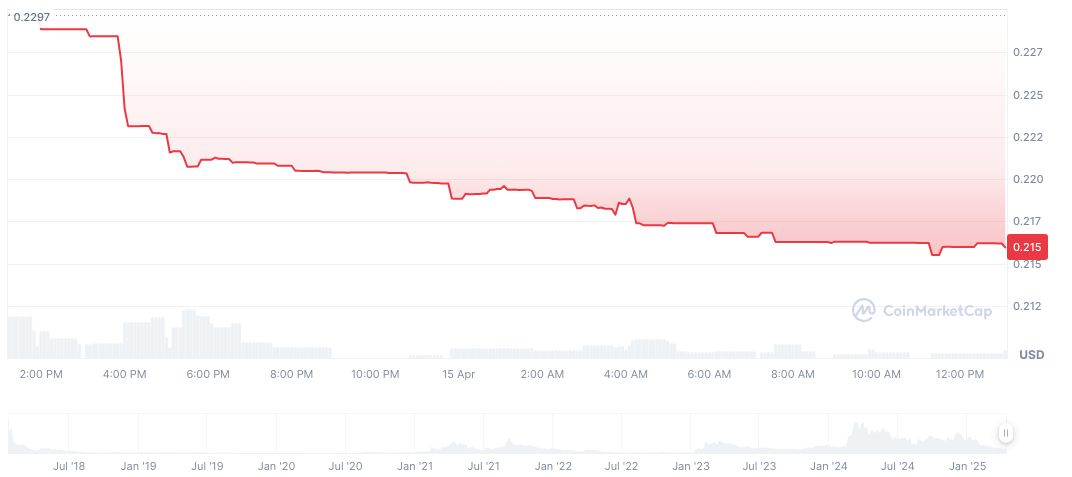

SingularityNET (AGIX), priced at $0.22, shows fluctuating trends with a 24% rise over 7 days despite a 5.65% dip in the last 24 hours, according to CoinMarketCap. The token's fully diluted market cap stands at $431.94 million, with trading volume decreasing 74% to $10,500, noted at 13:08 UTC on April 15, 2025.

The report suggests a potential upward trajectory for sectors aligned with AI technologies. Despite current market challenges, analysts emphasize that ongoing technological advancements may boost long-term growth significantly.

Read original article on coincu.com