Buy the Dip: AI-Driven Tokens Positioned for the Bull Run

AI

AI

FET

FET

NEAR

NEAR

ICP

ICP

DEFI

DEFI

Buying the dip is one of the best crypto market strategies for making big money. Mastering the art of buying the dip is essential to any crypto investor. It's actually easier than you might think.

AI-powered tokens are emerging as the cornerstone of decentralized innovation.

From decentralized infrastructure to autonomous AI agents, these projects are not only pushing technological boundaries but are also presenting compelling investment opportunities. With a combination of robust fundamentals, innovative mechanisms, and bullish market sentiment, tokens like Internet Computer Protocol (ICP), NEAR Protocol, and Fetch.ai (FET) are proving their worth in the current bull market.

Why do these tokens deserve attention right now? Let's find out.

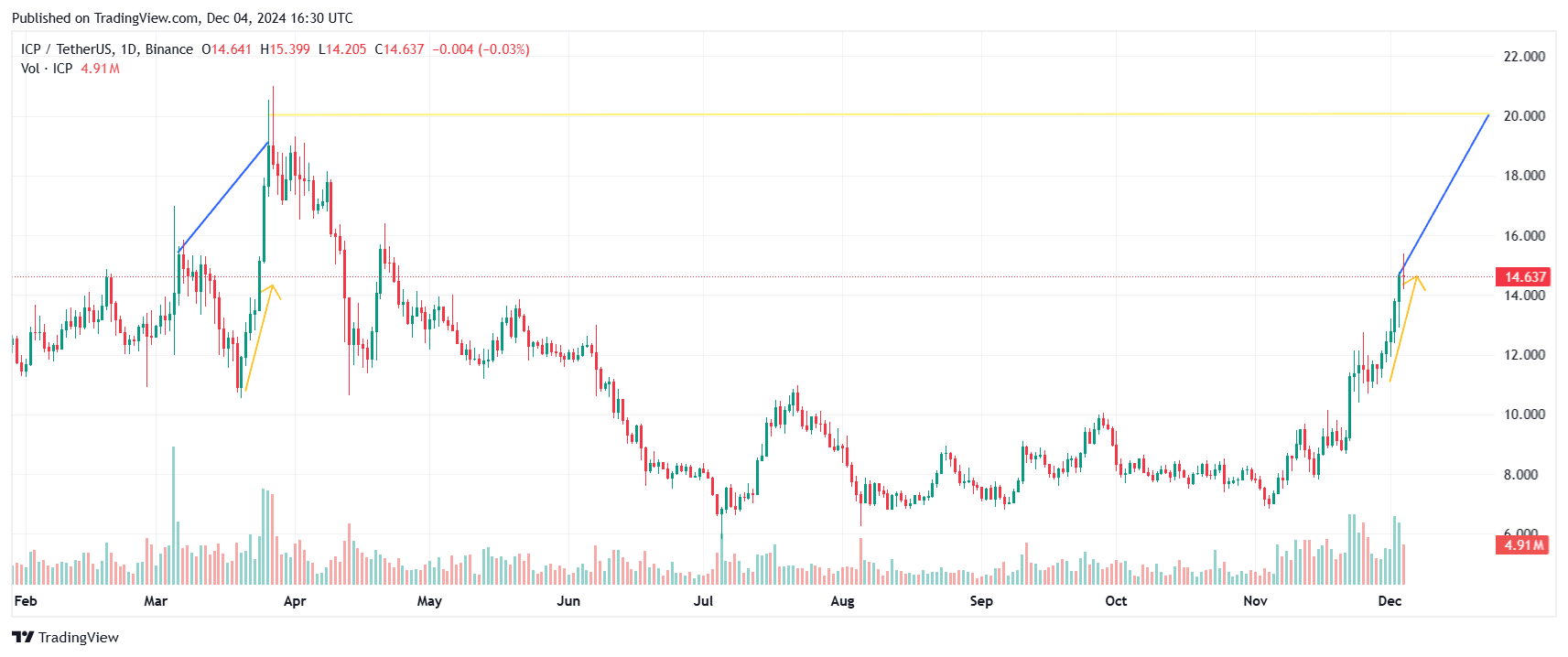

Internet Computer Protocol (ICP)

Current Price: $14.63 Market Cap: $7.3 Billion

About Internet Computer Protocol (ICP)

- Decentralized Infrastructure: ICP enables developers to build and host websites, applications, and services directly on the blockchain, eliminating the need for traditional cloud infrastructure.

- Unique Proof-of-Useful-Work Model: The network operates on a sovereign setup of "node machines," ensuring security, efficiency, and scalability without reliance on centralized hosting services.

- Chain Key Cryptography: Enables seamless interaction between subnet blockchains, making ICP capable of limitless scaling. It also allows integration with other blockchains like Bitcoin for direct transactions without insecure bridges.

- Governance by NNS DAO: The Network Nervous System (NNS) governs the blockchain, enabling decentralized decision-making and incentivizing staking with voting rewards.

- Deflationary Mechanics: ICP tokens are converted into cycles to power computations, effectively reducing the token supply over time.

- Developer-Friendly Ecosystem: Supports programming in Rust and Motoko, with features like HTTP outcalls and scalable smart contracts for advanced use cases like DeFi and decentralized applications.

Why Now?

Internet Computer Protocol (ICP) has recently broken out of a critical resistance at $9.22, signaling a bullish reversal in its price trajectory. This breakout, coupled with a weekly gain of 23%, reflects strong market sentiment amidst Bitcoin’s massive surge to $99,502. The current price of $14.63 positions ICP within a key resistance zone of $14–$15, where a decisive breakout could open the path toward $20, a level seen in its past bull cycles. Historical patterns from earlier this year, during Bitcoin's rally, show a similar upward momentum for ICP, suggesting that it could follow a comparable trajectory. With an RSI of 66.28, the token still has room for growth before entering overbought territory, making this a prime opportunity to buy into its momentum. Additionally, the recent increase in trading volume reinforces investor confidence, indicating sustained interest that could propel the price even higher.

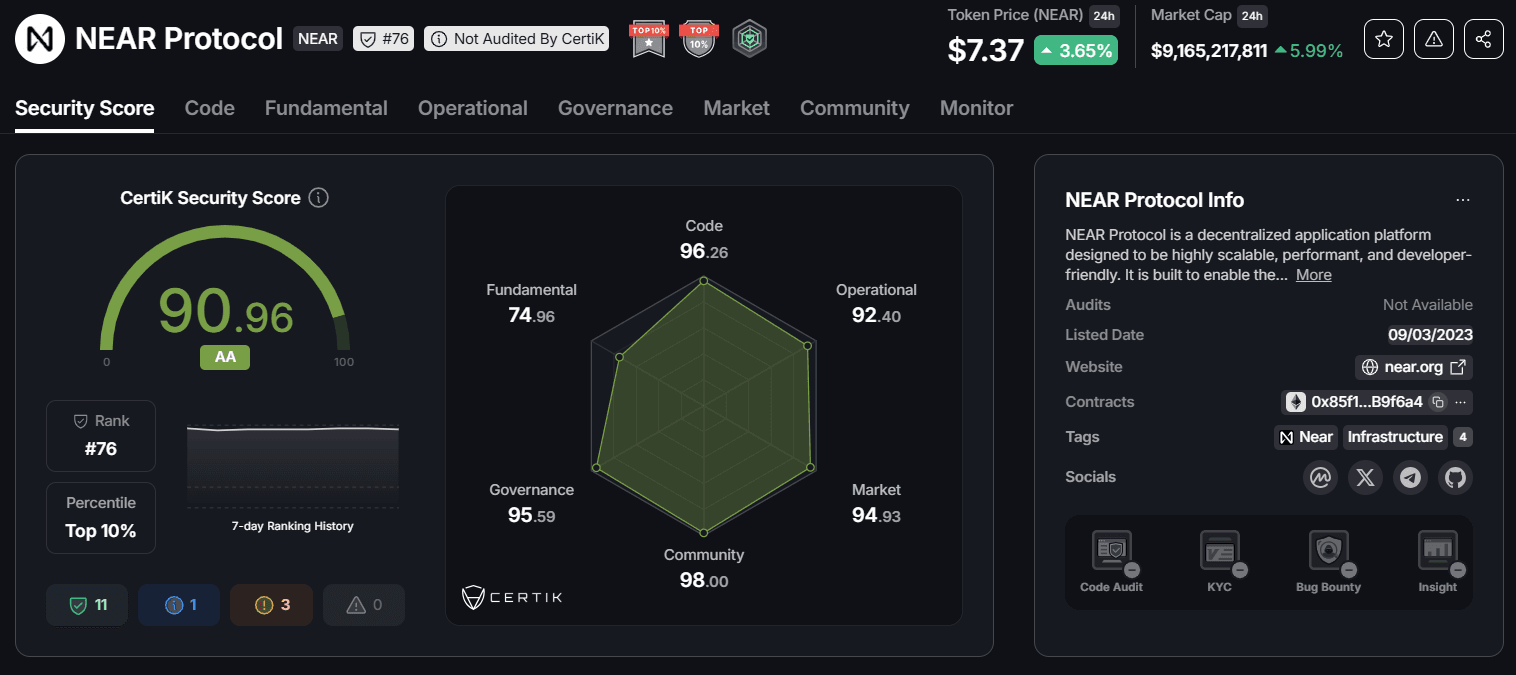

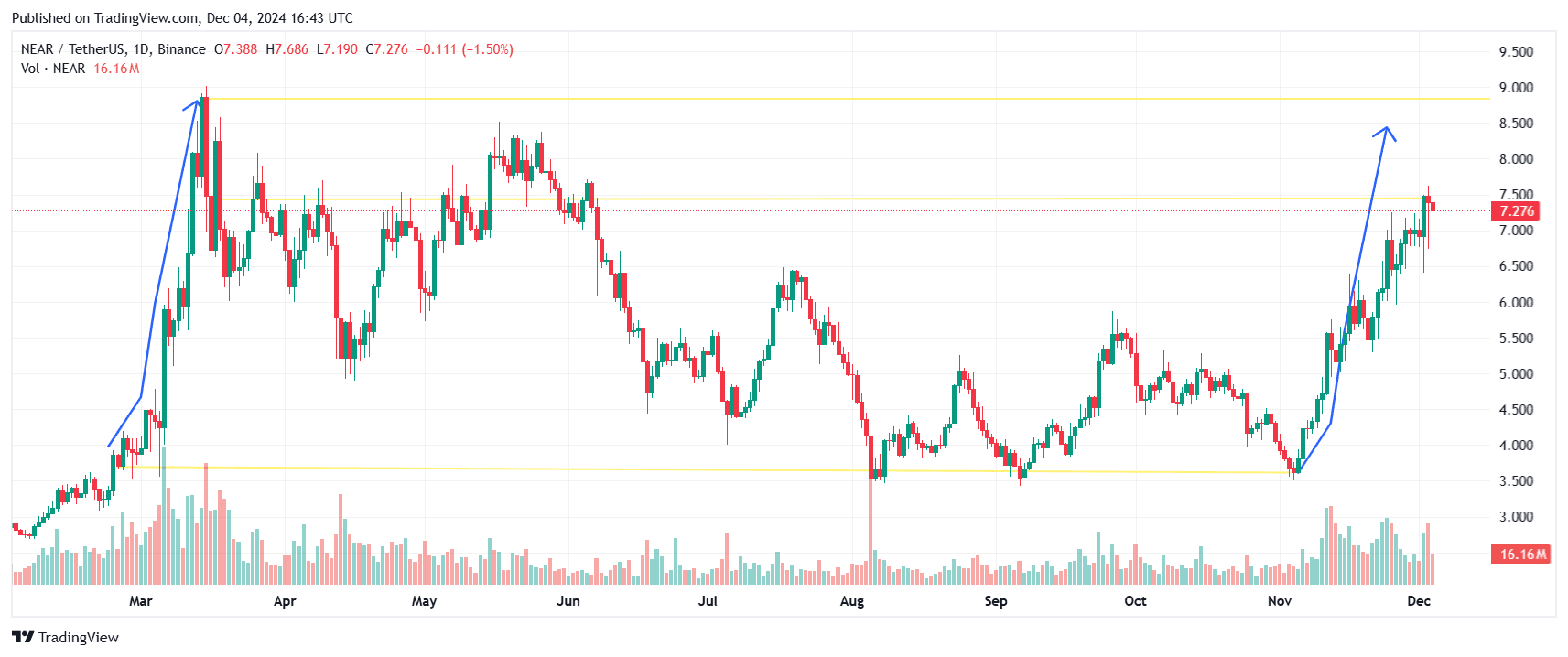

NEAR Protocol (NEAR)

Current Price: $7.31 Market Cap: $8.90B

About NEAR Protocol

- Highly Scalable Blockchain: NEAR leverages its Nightshade sharding technology to achieve up to 100,000 TPS with minimal transaction fees, making it a highly efficient network.

- User-Friendly Design: It introduces human-readable addresses and modular tools for developers, enhancing ease of use for both users and builders.

- Consensus Mechanism: Employs Doomslug, a unique Proof-of-Stake variation, ensuring near-instant finality and strong network security.

- Ecosystem Strength: Supported by an $800M Ecosystem Fund, NEAR focuses on DeFi, NFTs, and DAOs, with active institutional backing from Deutsche Telekom.

- High Security: NEAR boasts a Certik Security Score of 90.96, ranking in the top 10% of audited blockchain projects, demonstrating its robust operational and code security.

Why Now?

NEAR's price chart demonstrates a strong bullish trend, supported by key technical indicators. In the last few months, NEAR successfully breached a crucial resistance level of $6.20, flipping it into a support zone. This is further reinforced by Deutsche Telekom's validator partnership, which has fueled market confidence.

On the technical front, the Bollinger Bands on NEAR's daily chart indicate rising volatility, with the price consolidating near the middle band, signaling a potential upward breakout. The Relative Strength Index (RSI) stands at 62.76, just below the overbought zone, suggesting room for further growth.

If NEAR maintains momentum, the next significant resistance levels to watch are $8.50 and $10. On-chain metrics, such as a Total Value Locked (TVL) of $243.36 million, further affirm its strong fundamentals. Analysts predict a rally to $15-$20 in the medium term, contingent on market conditions.

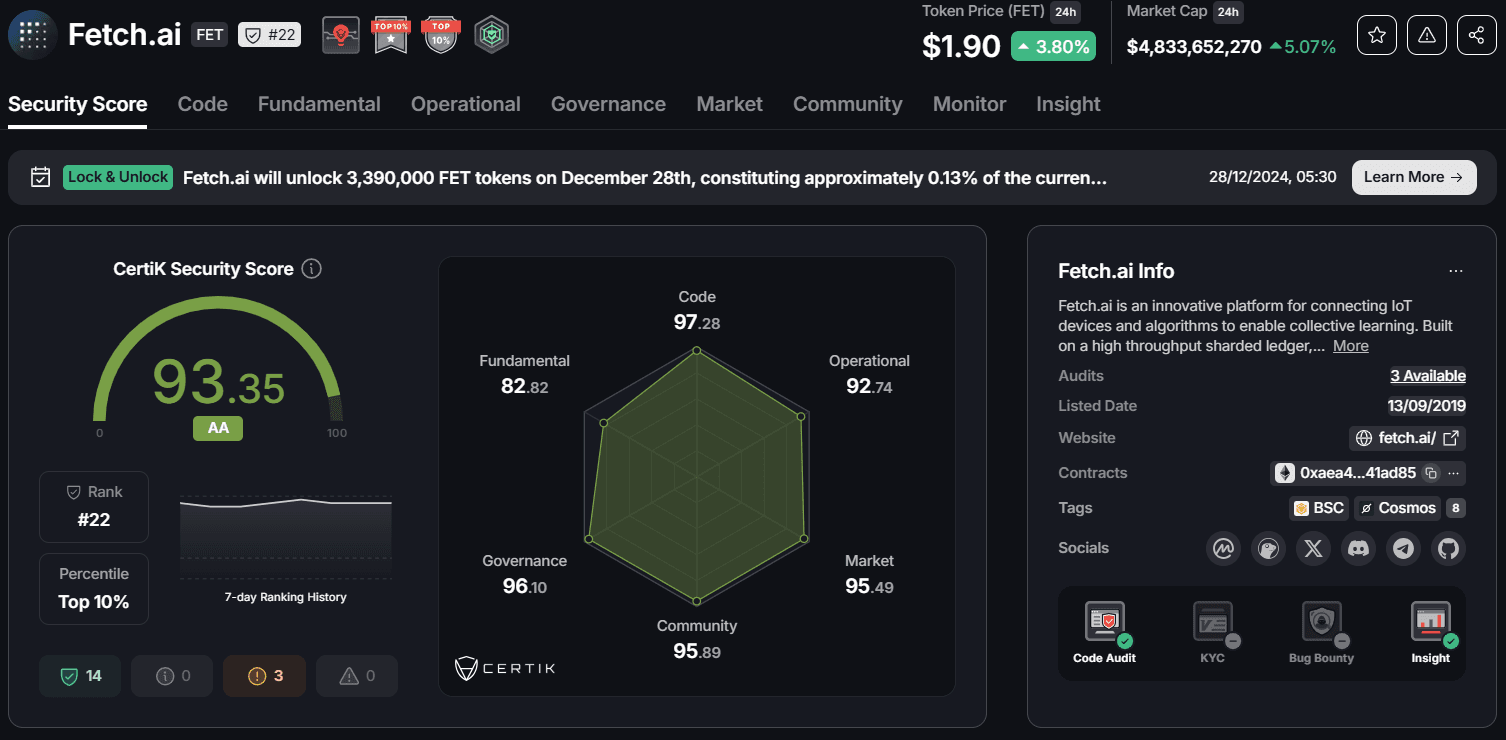

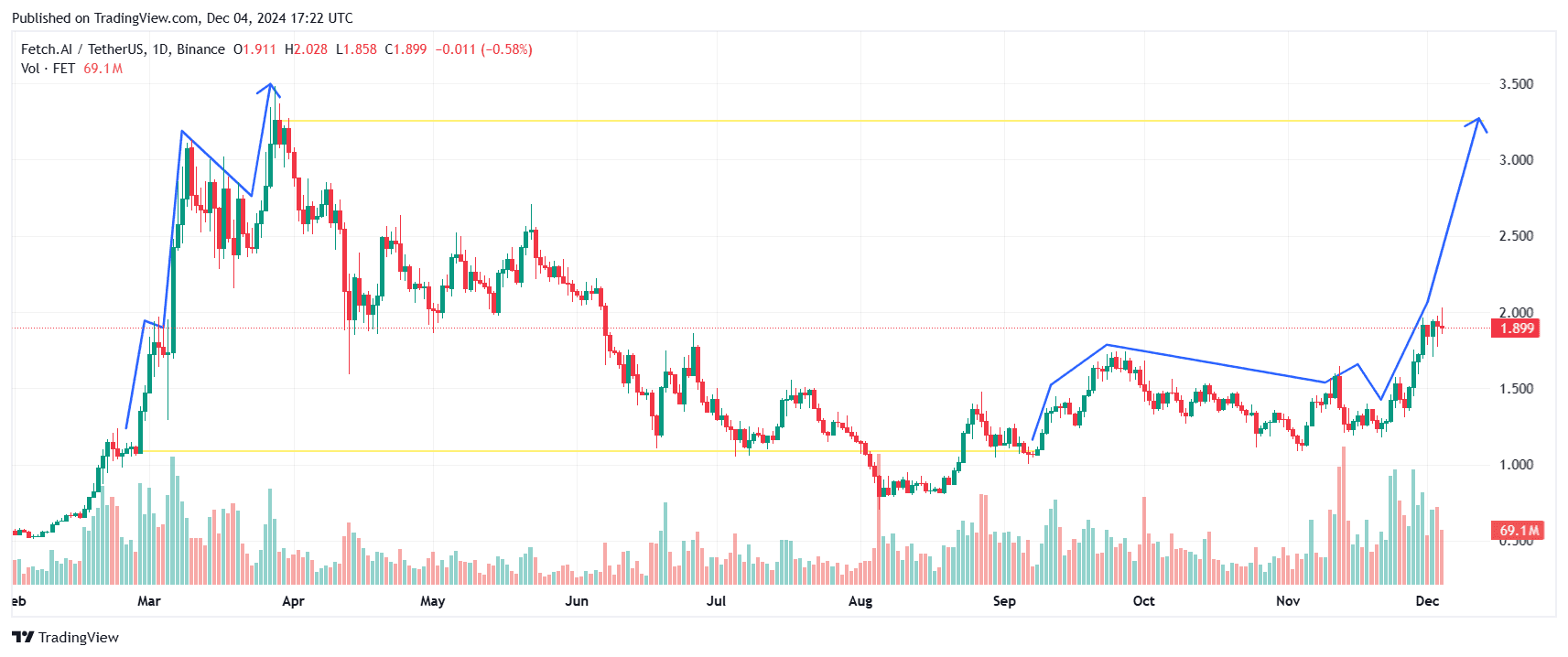

Artificial Superintelligence Alliance (FET)

Current Price: $1.90 Market Cap: $4.63B

About FET

- Decentralized AI Infrastructure: Fetch.ai is a decentralized machine-learning network designed to optimize complex systems using autonomous AI agents.

- Core Use Cases: Applications include transportation networks, DeFi optimization, smart energy grids, and personalized AI services.

- Innovative Mechanisms: Features like the Digital Twin Framework and Open Economic Framework enable seamless integration of AI-driven solutions into real-world systems.

- Blockchain Security: Powered by multi-party cryptography and game theory, the Fetch.ai blockchain ensures secure, decentralized operations.

- CertiK Score: With a strong CertiK security rating of 93.35, Fetch.ai ranks among the most secure blockchain networks.

Why Now?

Fetch.ai recently broke out of a descending channel, a technical move often signaling the start of a bullish trend. The token is currently testing critical resistance at $1.67, with a potential target of $2.56 if momentum persists. The upcoming Earn-and-Burn mechanism, set to eliminate up to 100 million tokens from circulation, adds deflationary pressure that could further boost prices. On-chain data supports this optimism, with increased large transactions and growing open interest. Historical patterns from March 2024 show a similar breakout, leading to an ATH of $3.10. If market conditions remain favorable, FET could replicate or exceed past performance in this bull cycle.

Closing Thoughts

Blockchain projects that use AI are changing the future of decentralized apps and data-driven solutions. Each token is making its own way in this quickly growing field, whether it's Internet Computer's ground-breaking infrastructure, NEAR Protocol's easy scalability, or Fetch.ai's self-driving AI systems.

These tokens have strong fundamentals and bullish technical setups, which means they are good investments for people who want to ride the next wave of blockchain innovation.