Coinbase Faces Significant Stock Decline Amid Challenging Market Conditions

COIN

COIN

BTC

BTC

APRIL

APRIL

READ

READ

- Coinbase stock drops 33% Q1 2025, broader market downturn, geopolitical factors.

- Crypto markets face struggles amid U.S. trade tension fears.

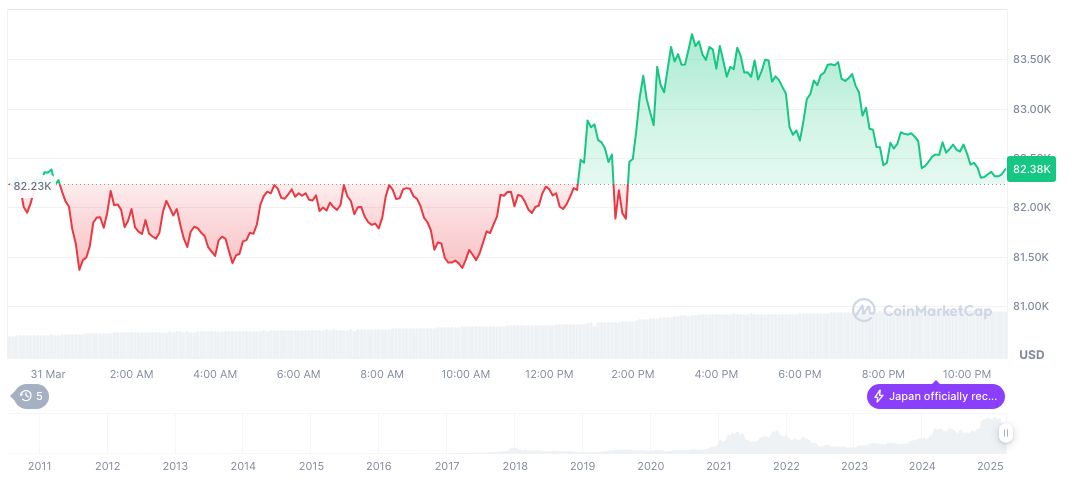

- Bitcoin price drops over 10% amid global uncertainties.

Coinbase's stock plummeted 33% in Q1 2025, reflecting its worst quarterly drop since the FTX collapse in 2022. This decline adds to the broader crypto industry challenges amid recent geopolitical uncertainties.

The decline in Coinbase's stock, alongside significant drops in crypto markets, underscores market concerns amid U.S. trade policy anxieties and geopolitical tensions.

Coinbase Stock Down 33% in Q1 2025 Amid Uncertainties

Coinbase experienced a 33% fall in stock price during Q1 2025. This marks the most severe quarterly performance since the 2022 FTX incident. The downturn coincides with challenges faced by the entire crypto industry and broader financial markets. As part of this negative trend, market analysts highlight the persistent impact of geopolitical issues.

The Coinbase stock decline has led to increased caution among investors. The company's anticipated profit of around $1.87 billion for the quarter stands in stark contrast to the stock's downward trend. Despite maintaining significant transaction and subscription revenues, the market reaction reveals skepticism tied to macroeconomic factors and the broader uncertainty affecting traditional and crypto markets.

Market participants, including industry leaders and financial analysts, have responded to these developments with concern. Owen Lau from Oppenheimer remarked that macroeconomic elements, not fundamentals, drive such downturns. The backdrop of U.S. President Trump's trade policy plays a significant role in shaping investor sentiment, with potential shifts anticipated in the coming days.

"Many people in the community understand that this is not driven by fundamental reasons. This is mainly driven by the macro reasons because of the tariffs, potential trade war, people worried about a recession coming in." - Owen Lau, Analyst at Oppenheimer

Bitcoin’s Volatility Shakes Market Confidence

Did you know? The recent challenges faced by Coinbase resemble the aftermath of the FTX collapse in late 2022, where similar percentage declines in stock prices were observed amidst market corrections.

Bitcoin (BTC), presently valued at $84,768.07, holds a prominent market cap of $1.68 trillion. It dominates with 61.57% amidst a trading volume decline of 11.57% over the past 24 hours. Recent data shows Bitcoin down by 10% this quarter, indicating significant price volatility.

Insights gathered from the Coincu research team suggest the broader economic environment will continue to impact cryptocurrency valuations. With geopolitical uncertainties and trade tensions likely to persist, the focus remains on finding new market catalysts.

Analysts urge cautious optimism, highlighting the dynamic nature of crypto markets amid evolving geopolitical landscapes.

Read original article on coincu.com