Compound adds Ethena and Mantle Tokens to its platform

COMP

COMP

USDE

USDE

MNT

MNT

ENA

ENA

XRP

XRP

Compound Finance has added two new assets to its lending and borrowing platform: Ethena’s stablecoin “USDe”, and Mantle’s liquid staking token “mETH”.

The decision came after a vote by Compound’s token holders on January 8. This approval means both tokens can now be used as collateral on the platform.

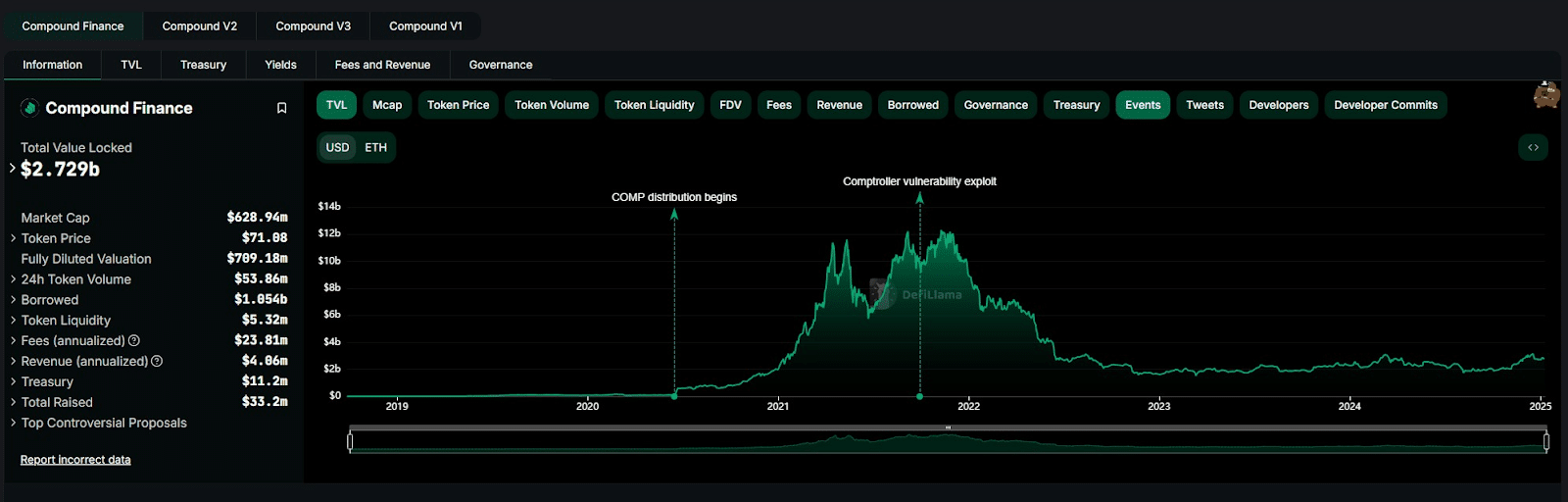

Compound Finance is a reputable DeFi platform with over $2.7 billion locked in value according to DefiLlama. As of January 9, discussions were underway to add cmETH, another Mantle token, onto the Compound Finance platform, showing a similar upward trend in LST usage in DeFi.

The integration of USDe and mETH shows the rise of liquid staking tokens and the role they play in enhancing liquidity and yields within decentralized finance.

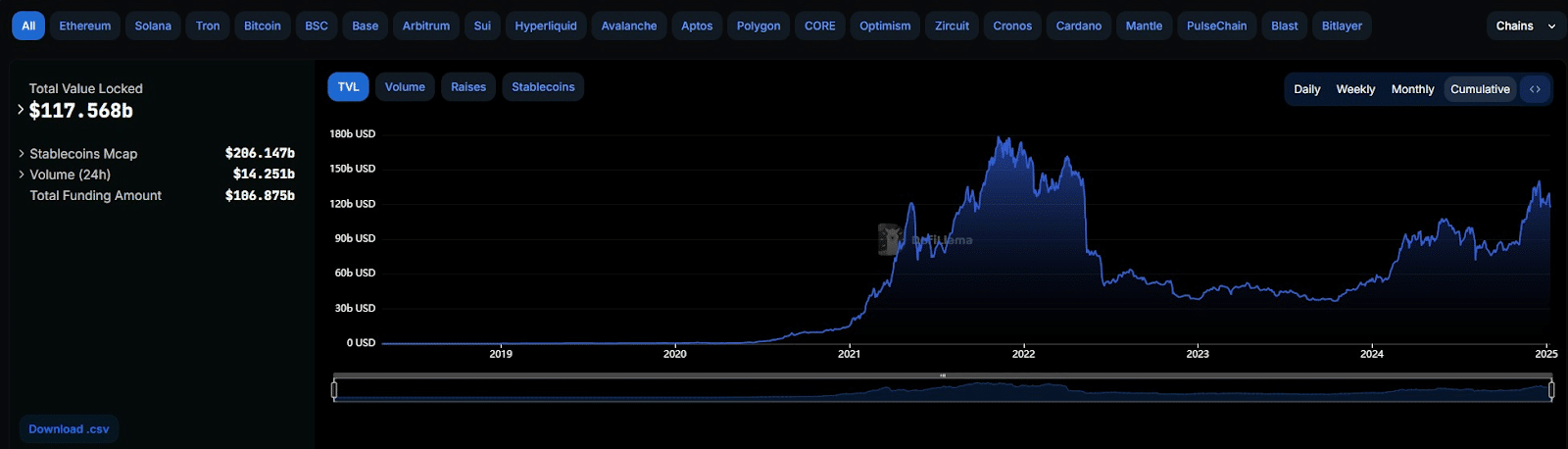

This was mostly due to the use of LSTs and liquid restaking methods that have driven the growth of DeFi. As of January 9, the total DeFi TVL stands at over $117 billion, up around 150% since the beginning of the year. That is still less than the 2021 peak of $170 billion, but the growth is still significant.

LSTs like mETH and cmETH are the reasons for his growth, as they offer additional rewards through restaking — Restaking makes staked tokens available to be used in other protocols at the same time for more yields.

Stablecoins have been on the rise, too. Ethena’s stablecoin, USDe, launched in February 2024, is rapidly gaining in popularity and has surpassed Dai in market value, now sitting as the third-largest stablecoin after Tether’s USDT and USD Coin (USDC). In particular, USDe has been popular because of its high returns.

Since its launch, holders of staked USDe (sUSDe) have seen annual percentage yields (APY) averaging 17.5%. At present, sUSDe offers a yield of approximately 11.25% annually.