COTI Price Prediction: Will Coti Price Reach New ATH In 2024?

COTI

COTI

Coti, short for ‘Coin of the Internet,’ is a decentralized payment system that uses its own token, COTI. Businesses and even governments can use Coti to create their own cryptocurrencies. It combines the benefits of blockchain technology with traditional payment systems to aim for a leading role in global commerce payments.

The goal of Coti is to create a scalable worldwide payment system, which is something early blockchain technologies like Bitcoin struggle with. Bitcoin, for example, slows down as more people use it, making it less suitable for worldwide transactions. Coti, however, gets faster as more users join, making it a more effective option for international commerce.

Coti offers a payment solution that is quicker, based on trust, and less expensive. Trust is key in Coti’s system, where a unique ‘Trust Chain Algorithm’ helps achieve agreement between buyers and sellers. Coti uses a technology called a directed acyclic graph (DAG) for its data structure, which means all transactions are directly linked rather than grouped in blocks.

This DAG structure allows Coti to handle transactions very quickly — up to 10,000 transactions per second, outperforming even Visa, which processes about 4,000 per second. In the Coti network, each transaction is sent to a cluster and assigned a trust score, reflecting the reliability of the sender’s account.

In this article, we’ll explore Coti price prediction with an in-depth analysis of the current market sentiment and future COTI price forecasts.

Coti: A Quick Introduction

COTI, short for “Currency of The Internet,” was launched in 2017 to transform traditional payment systems. It aimed to reduce transaction costs, speed up processing times, and remove middlemen, enhancing payment transfers in various ways. Initially, COTI started on the Trustchain protocol in 2018 because Ethereum wasn’t scalable enough at the time. Today, it operates as a layer2 network over Ethereum and has become one of the leading layer2 crypto projects known for its payment processing capabilities.

COTI is one of the first enterprise-grade fintech platforms, designed for a diverse range of users including developers, merchants, governments, and individuals, helping them manage decentralized payments effectively.

COTI has earned the nickname “Enterprise L1” due to its innovative technology solutions such as COTI Pay Business, ADA Pay, Djed, and the soon-to-launch Private Payment Network.

Moreover, COTI has rolled out multiple products and features that have bolstered the entire ecosystem. Notable developments include the launch of the VIPER Wallet in 2020 and the COTI Treasury in 2022. The growth was evident as tens of thousands of VIPER wallets were opened and over 500 million $COTI were deposited into the Treasury, marking major milestones in our progress.

Thanks to high network liquidity, widespread media coverage, and regular participation in industry events, our commitment and hard work have received widespread recognition and praise.

Additionally, COTI has cultivated a vibrant and loyal global community, now over 300,000 strong across various platforms.

However, much has changed since these developments.

How Does Coti Work?

What sets COTI apart from other cryptocurrencies is that, technically speaking, it doesn’t use a traditional blockchain or distributed ledger. Instead, it operates on a system known as a directed acyclic graph (DAG) protocol. In this system, transactions move in a specific direction and each one is linked to multiple others, forming a network.

To visualize it, imagine that a blockchain looks like a straight chain of blocks, whereas a DAG resembles a tree with branches spreading out from each other.

COTI utilizes a unique process called Proof-of-Trust. Under this system, every new transaction must verify two previous transactions based on its trust score, which is calculated considering factors like the user’s activity level on the network and their history of successful transactions. This method helps the platform run swiftly, making it more user-friendly and cost-effective.

Coti’s technical documentation or whitepaper explains that the platform has developed various mechanisms to enhance network security by monitoring, detecting, and defending against potential attacks. One such mechanism is the Double Spend Prevention (DSP) Nodes. Additionally, Coti introduces unique protocols designed to manage disputes arising from transaction processes, a capability not commonly available in other cryptocurrencies. The resolution of these disputes is facilitated through an Arbitration Service, which employs game theory principles to ensure equitable resolutions and utilizes voting to decide the rightful party in disputes.

Shahaf Bar-Geffen serves as the founder and CEO of Coti Network, a blockchain-based payment network.

All About COTI V2

COTI V2 introduces several enhancements to its existing ecosystem without starting from scratch:

- Easier Development for Third-Party Developers: COTI V2 offers a secure and private framework for transactions and smart contract interactions (EVM). This improvement reduces barriers for third-party developers, potentially attracting a wider range of talent to the COTI ecosystem, which could lead to more development, a broader ecosystem, and increased usage.

- New Use Cases and dApps Development: The new version facilitates the development of advanced dApps that require high privacy, trust, and secure data computation. This capability is ideal for sectors like finance, healthcare, and logistics, where data confidentiality is crucial. Innovations such as secure data marketplaces and confidential supply chain tracking systems are possible, expanding the ecosystem and increasing demand.

- Reduced Costs for Users: The implementation of a lower computational complexity garbling protocol as a privacy engine on an L2 reduces transaction costs. This change makes the COTI network more cost-effective and accessible, encouraging more frequent usage and increasing demand.

- Increased Brand Awareness: Utilizing garbling protocol technology in an Ethereum-based L2 solution positions COTI V2 as a leader in blockchain privacy solutions. This strategic move enhances brand visibility and attracts users who prioritize privacy, given the current climate of frequent data breaches.

- Enhanced Network Impact: As an EVM-compatible network, COTI V2 draws users and developers from the Ethereum ecosystem. This influx enhances the network’s dynamics through increased transaction volumes and a variety of decentralized applications, fostering a thriving, self-sustaining community.

COTI V2 rolls out a new economic framework that differs from its original network, leveraging unique features and Ethereum Virtual Machine compatibility to ease integration for developers and apps. This version adopts an open, permissionless model that attracts a diverse group of developers, facilitated by familiar coding practices thanks to EVM compatibility.

The shift includes revamping the original tokenomics designed for a basic payments network to suit this expansive, open Layer 2 network. This adjustment aims to grow the ecosystem, attract more users, and enhance security. Over the past year, COTI has studied other blockchain networks to inform its updated economic strategies, ensuring a smooth transition to a more complex, privacy-focused network while maintaining the COTI token’s value.

Coti Historical Price Sentiment

Let’s review the price history of COTI. While it’s important to remember that past performance is not necessarily indicative of future results, understanding the token’s historical price movements can provide valuable context for making or evaluating COTI/USD price predictions.

2019–2020: COTI was launched in mid-2019, initially priced below $0.10. It quickly dropped to an all-time low of $0.006226 by November 9, 2019, followed by a modest recovery throughout 2020.

2021: The market turned bullish, propelling COTI’s price to $0.50 in March. Despite a slow summer, the introduction of COTI’s debit cards in October pushed the price to a peak of $0.6826 on October 31, ending the year just below $0.40.

2022: The price suffered from market downturns, ending the year slightly above $0.05.

2023: The year started promisingly, with COTI breaking the $0.10 mark in late January. However, it experienced a decline over the subsequent months, dropping to $0.0526 by June 9. It recovered somewhat in the latter half of the year, closing at $0.0719.

2024: COTI’s price continued to climb early in the year, reaching $0.1352 on June 3. It has since declined, currently trading at around $0.108.

Coti Price Prediction: Technical Analysis

Coti price surpassed the $0.11 resistance, indicating the beginning of a new upward movement. Currently, the price is on a strong upward trend, aiming for further upward surges in the coing hours. However, sellers are defending the $0.12 level strongly. As of writing, COTI price trades at $0.112, surging over 1.5% in the last 24 hours.

Should buyers keep the price above $0.11, the COTI/USDT pair is poised to progress toward $0.13, though the bears may strongly contest this level.

Conversely, if the price declines from its current position and falls below $0.1, it would imply that the market has not sustained the breakout. The pair could then decrease to $0.09 and possibly further to the 50-day SMA at $0.075. A rebound from the 20-day EMA could see the bulls attempt to elevate the pair above $0.13 once more, aiming to continue the upward trend.

Coti Price Prediction By Blockchain Reporter

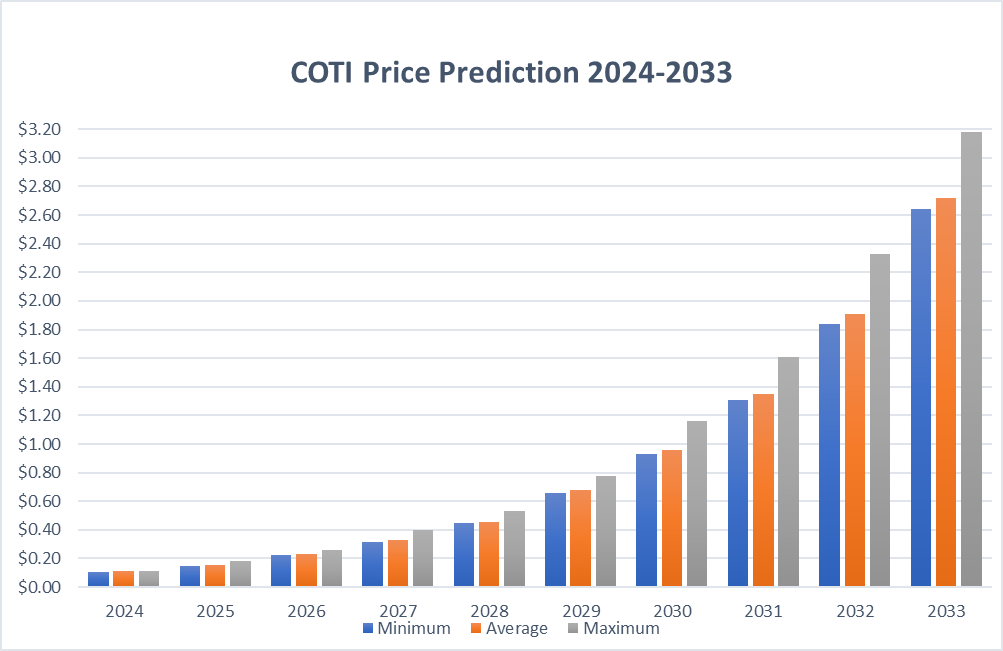

COTI Price Prediction 2024

COTI’s innovative technology and expanding ecosystem have positioned it as a notable player in the blockchain space, attracting optimistic growth predictions.

Anndy Lian, an expert in intergovernmental blockchain initiatives, highlighted the project’s focus on enhancing privacy. “Their announcement at the end of 2023 about ‘increased privacy on the chain’ caught my attention. They plan to launch Ethereum Layer 2 — COTI V2 — in 2024,” Lian said. He explained that COTI V2 could support new applications like private transaction histories on decentralized exchanges or privacy-focused decentralized applications that enable businesses to confirm product authenticity and traceability without exposing sensitive details.

Lian also noted the potential impact of broader market trends on COTI’s performance. “Given the recent surge in Bitcoin’s price and the halving event in April, coupled with Ethereum’s upcoming Dencun upgrade, COTI could see more significant price movements,” he added.

Tony Severino, a Chartered Market Technician (CMT) candidate, technical analyst, and author of the CoinChartist VIP newsletter, shared developments about the foundation’s strategic investments. “The COTI Foundation recently announced a $100 million growth fund aimed at fostering development in areas like DeFi, GameFi, AI, and beyond,” Severino reported.

The forecast for COTI in 2024 anticipates a minimum price of $0.1052 and a maximum price of $0.1129, with an average trading price of $0.1100.

COTI Price Prediction 2025

Recently, the COTI Foundation outlined the specific uses and priorities for its $100 million development fund, which will be distributed in COTI tokens.

This fund is designed to back projects across multiple sectors such as decentralized finance (DeFi), data management, artificial intelligence (AI), GameFi, among others. Developers interested in these opportunities can apply through a structured selection process.

In 2025, COTI’s price is expected to bottom out at $0.1494 and could reach up to $0.1822, with an average price around $0.1538.

COTI Price Prediction 2026

For 2026, the predictions suggest COTI will range from a low of $0.2239 to a high of $0.2617, averaging $0.2300 throughout the year.

COTI Price Prediction 2027

COTI’s price in 2027 is predicted to be at least $0.3163, potentially climbing to $0.3964, with an average of $0.3278 across the year.

COTI Price Prediction 2028

Predictions for 2028 forecast COTI’s price to start at a minimum of $0.4450, reaching a maximum of $0.5351, and maintaining an average price of $0.4581.

COTI Price Prediction 2029

In 2029, COTI is expected to achieve a minimum price of $0.6558, a maximum price of $0.7769, with an average trading price of $0.6787.

COTI Price Prediction 2030

The forecast for 2030 predicts that COTI will have a minimum value of $0.9305, a maximum value of $1.16, and an average price of $0.9577.

COTI Price Prediction 2031

For 2031, COTI is expected to reach a minimum price of $1.31, a maximum of $1.61, with the average trading price around $1.35.

COTI Price Prediction 2032

The price of COTI in 2032 is forecasted to range between $1.84 as a minimum and $2.33 as a maximum, with an average price of $1.91.

COTI Price Prediction 2033

In 2033, COTI is predicted to achieve a minimum price of $2.64, a maximum of $3.18, with an average expected price of $2.72.

COTI Price Targets: By Experts

According to Coincodex’s current Coti price prediction, the value of Coti is expected to increase by 32.49%, reaching $0.143478 by December 11, 2024. Technical indicators suggest a bullish sentiment, with the Fear & Greed Index indicating 69 (Greed). Over the past 30 days, Coti has experienced 14/30 (47%) green days and 6.71% price volatility. Based on these forecasts, it is considered a good time to invest in Coti. For the year 2024, Coti (COTI) is projected to trade within a range of $0.102709 to $0.233141, with an average price of $0.150945. This positioning could yield a potential return on investment of 114.93% from current levels.

According to Digital Coin Price, market analysts anticipate that by 2026, COTI will open the year at $0.32 and average around $0.39, marking a significant increase from the previous year. This represents substantial growth for COTI.

By 2032, it is estimated that COTI’s price could reach a minimum of $1.49, with an average trading value of $1.56 throughout the year, peaking at the same level. Experts project that the maximum trading price may stabilize around $1.56.

Is Coti a Good Investment? When to Buy?

COTI stands out among Ethereum-based Layer 2 projects for several reasons. It can handle all types of payments, from online and offline transactions to payments made with cryptocurrencies, stablecoins, credit cards, and blockchain-native currencies.

The blockchain industry’s pressing need for scalability is addressed by COTI through its Proof-of-Trust (PoT) mechanism. Combined with its multiDAG layer, this approach distinguishes COTI from other blockchain projects by enabling faster, secure payments while also prioritizing privacy and offering a globally inclusive platform that enhances access to digital payments.

Looking ahead to 2024, COTI plans to implement Garbled Circuits, an advanced form of cryptographic technology that plays a crucial role in protecting sensitive transaction data. Beyond its existing functionalities, COTI aims to develop its infrastructure to be more efficient, scalable, and faster than current ZK rollup solutions on Ethereum.

It is advised to invest in COTI at a price of $0.09 for a profitable return in the long term. However, it is advised to do proper research and conduct investment opinion before investing in the volatile crypto market.

Conclusion

To address the evolving cryptocurrency demands of 2024 and beyond, COTI is set to transform into a leading Web3 infrastructure that will efficiently manage sensitive data on Ethereum. It combines the best aspects of COTI’s business model — including global listings, a robust community, and innovative products — with the scalability of an L2 solution like Arbitrum, and the security and liquidity of Ethereum, all enhanced with unique privacy features.

COTI holders will benefit from an EVM-compatible ecosystem that taps into Ethereum’s extensive liquidity pool, opening up a plethora of new opportunities in DeFi, gaming, hardware wallets, and more. As an L2 solution, COTI will offer significantly lower gas fees while maintaining the security benefits of the Ethereum primary layer.

For developers, COTI V2 offers a permissionless environment and the use of Solidity, making it both accessible and familiar for software creation. This encourages a thriving community where dApps proliferate, boosting network activity, increasing fee generation, and driving higher demand for the token. Moreover, COTI holders will be at the forefront of experiencing groundbreaking privacy, identity, and compliance tools introduced with COTI V2.

Frequently Asked Questions (FAQ):

What is COTI?

COTI, short for “Currency of the Internet,” is a decentralized payment network that aims to create scalable, efficient payment solutions for global commerce using its native token, COTI.

How does COTI differ from traditional blockchain systems?

Unlike traditional blockchains, COTI uses a Directed Acyclic Graph (DAG) structure, allowing faster transaction speeds as more users join, making it highly scalable and efficient.

What is COTI’s Proof-of-Trust mechanism?

COTI’s Proof-of-Trust combines Trust Scores with a DAG infrastructure, creating a unique consensus model that enhances network security, scalability, and efficiency.

What are the notable products of COTI?

COTI offers solutions like COTI Pay Business, ADA Pay, the COTI Treasury, and the upcoming Private Payment Network, aiming to improve decentralized payments for various sectors.

What is COTI V2, and what does it offer?

COTI V2 is an upgrade that introduces EVM compatibility, attracting developers and enabling advanced dApps, particularly for privacy-sensitive sectors like finance and healthcare.

Is COTI a good investment?

COTI’s unique technology and expanding ecosystem make it promising for long-term growth, with analysts forecasting strong potential, particularly as COTI V2 rolls out.

What is the 2024 price prediction for COTI?

In 2024, COTI is expected to trade between $0.1052 and $0.1129, with average projections at $0.11, driven by the COTI V2 launch and increasing market adoption.

What’s the best time to buy COTI?

For long-term potential, analysts suggest accumulating COTI around the $0.09 mark while considering broader market conditions.