Crypto Crash Alert: Bitcoin Slips Below $96K, Altcoins Tumble

CRASH

CRASH

GREED

GREED

SOURCE

SOURCE

BTC

BTC

FARTCOIN

FARTCOIN

The crypto market took a sudden hit as El Salvador struck a $1.4 billion deal with the IMF. The country agreed to bring some adjustments to its Bitcoin Policy, and this news shook the market. This created waves of bearish momentum causing all major cryptos to plummet while memecoins maintained their course.

Bitcoin Dips, Altcoins Follow

Bitcoin (BTC) dropped by 3.32%, currently trading at $97,697. Over the last 24 hours, it fluctuated between $95,537 and $102,747. Its market cap now stands at $2.05 trillion, with trading volume slightly lower at $39.57 billion. What’s behind the decline? A massive $682.04 million flowed out of spot BTC ETFs. Big names like Fidelity and Grayscale weren’t spared, reporting hefty outflows as well.

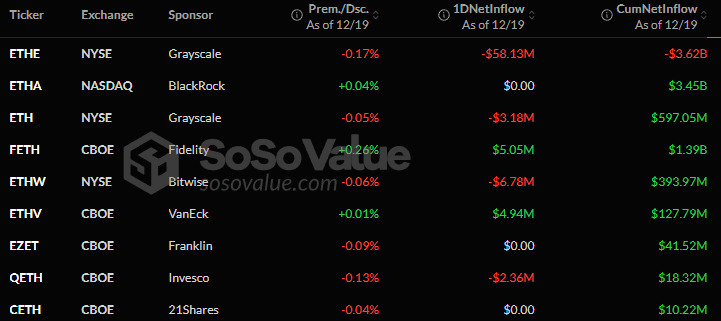

Ethereum (ETH) took an even bigger hit, falling 6.52% to $3,420. Grayscale’s ETH ETFs saw outflows of $58.13 million, though there was a tiny silver lining—Fidelity and a few others reported small inflows. Even so, the overall vibe is negative. Total spot ETH ETF outflows hit $70.45 million, adding to the pressure.

Solana (SOL) didn’t escape the slump either, dropping 6.09% to $196.56. Trading volume for Solana rose slightly, but it wasn’t enough to offset the losses. Analysts believe this bearish trend could continue for now, especially for major altcoins.

Meme Coins Steal the Spotlight

Amid all this chaos, meme coins are thriving. Solana’s Fartcoin is up a jaw-dropping 608%, reaching a market cap of $1.18 billion since December 5. It’s a bit wild, but it shows that even in a tough market, some investors still chase risky, high-reward opportunities.

XRP, on the other hand, has been a bit of a rollercoaster. After crashing 13% following the RLUSD stablecoin launch, it managed a small recovery, up 1.51%. It’s not much, but it hints at growing confidence among its supporters.

What to Expect

The market looks uncertain, to say the least. Bitcoin and Ethereum could see more sell-offs as traders cash in on any opportunity amid the current volatility. But there’s some hope—the SEC’s approval of new ETFs might boost crypto’s integration into mainstream finance, giving the market some long-term stability.

For now, the Fear and Greed Index sits at 62. That means people are less greedy but not exactly panicking either. If you’re watching the market, hang tight. Things could still get unpredictable.