Crypto Industry Faces New Turmoil With Jobless Claims Data

COQ

COQ

READ

READ

- The U.S. jobless claims fell to 228,000, affecting financial markets.

- Lower than expected claims could stabilize market outlook.

- Crypto market may react to broader economic shifts.

The U.S. reported 228,000 initial jobless claims for the week ending May 3. This was slightly below the expected 230,000. The previous value was 241,000.

The U.S. Labor Department announced that the number of initial jobless claims decreased to 228,000 for the week ending May 3. This dip is lower than the anticipated 230,000, suggesting a potential improvement in the labor market. The previous week's figure stood at 241,000.

Crypto Trading Volume Reacts to Economic Indicators

Observers note that this decline may suggest improved market sentiment and potentially enhance investment in cryptocurrencies. The cryptospace, traditionally sensitive to macroeconomic indicators, could see shifts in volatility driven by changing investor confidence.

Market analysts also highlight increased trading volume in certain crypto assets following the news. A senior economist at Pantera Capital pointed out, "A stronger labor market may lead to increased consumer spending, indirectly benefiting sectors like crypto."

The Coincu research team emphasizes that continued improvements in labor market conditions could foster greater confidence among investors. Historical trends indicate that a robust economic backdrop might support cryptocurrency adoption, though regulatory scrutiny remains a factor. Economic analysts view these developments as pivotal in shaping future investment strategies.

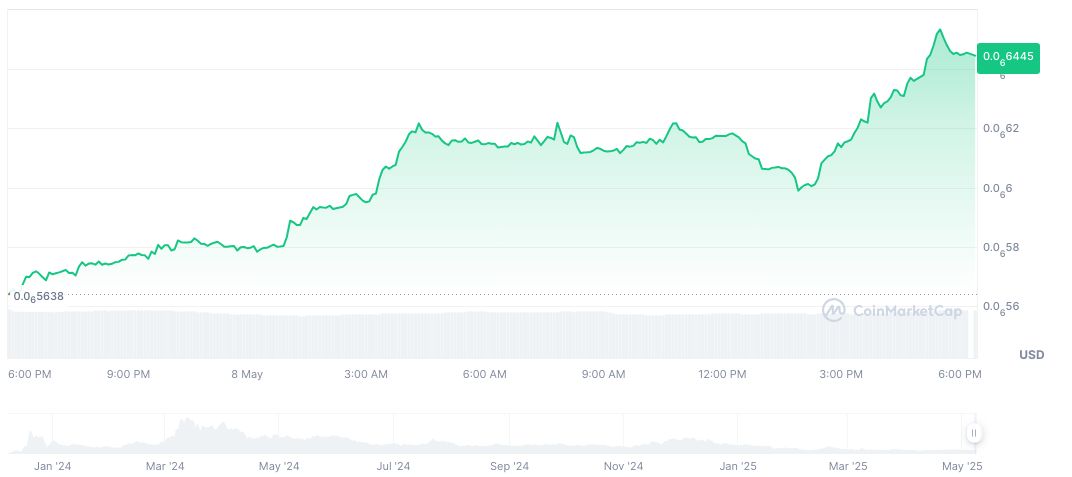

Coq Inu Market Data

Did you know? The fluctuation in jobless claims can lead to volatile spikes in cryptocurrency trading volumes, as historically observed during the economic recovery stages post-pandemic.

Coq Inu, represented by the symbol COQ, is currently priced at $0.00. According to CoinMarketCap, it holds a market cap of $44.78 million and its 24-hour trading volume is $3.16 million, a slight 0.80% decrease. In the past day, Coq Inu's price has risen by 13.68% and by 47.49% in 30 days.

Analysts are closely watching these trends as they could indicate a shift in how macroeconomic factors influence the cryptocurrency market.

Read original article on coincu.com