Crypto: Loans Reach Historical Highs

AAVE

AAVE

TBD

TBD

DEFI

DEFI

USDE

USDE

NOTE

NOTE

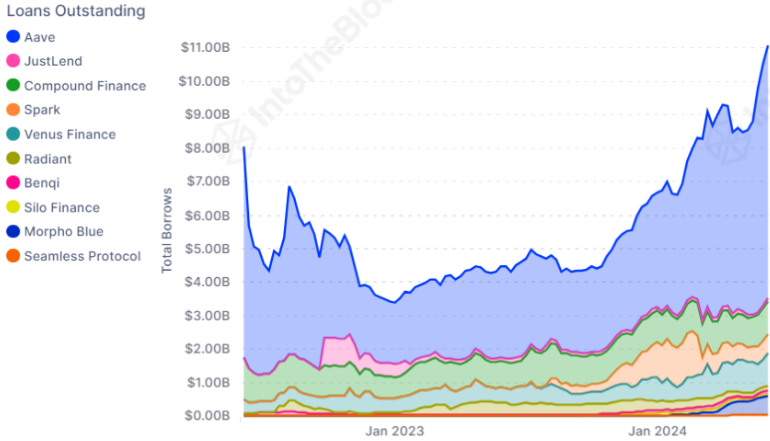

The decentralized finance (DeFi) ecosystem is experiencing an unprecedented growth period, marked by record lending levels and an incessant quest for yield. The Aave V3 protocol is nearing $6 billion in loans, signaling the maturity of DeFi strategies.

A Rapid Growth in the Sector

In the vast DeFi universe, innovation reigns and the numbers speak for themselves. According to the “On-chain Insights” newsletter from IntoTheBlock, on-chain borrowings have reached an excess of $11 billion, a peak not seen in two years.

This dizzying rise is propelled by major players like Ether.fi and Ethena, reports CoinBriefing. Ether.fi’s eETH crypto and Ethena’s USDe crypto dominate with respective amounts of $6.4 billion and $3.2 billion.

Note that eETH, a key component of the EigenLayer ecosystem, now reaches 1.7 million tokens, while Ethena’s USDe crypto ranks among the top four stablecoins. This trend reflects a relentless search for yields and an increased sophistication in investment strategies within DeFi.

Crypto: Aave V3 Leads the List

The Aave V3 protocol is undoubtedly the flagship of this expansion. Nearing $6 billion in borrowed funds, it exemplifies the sector’s rising momentum.

This success is partly explained by the massive use of weETH as collateral for borrowing ETH crypto. Since its introduction in April, weETH has surged to exceed $1 billion in collateral. Additionally, high-risk loans peak at $1 billion, reflecting an increasing exposure of users to market volatility.

This trend not only highlights the current market’s depth, but also an increased understanding of leverage and reward dynamics. Sophisticated strategies, such as the use of liquid tokens for staking and restaking, demonstrate a growing maturity and ambition among DeFi players.

The vibrant DeFi ecosystem is redefining modern finance paradigms with historical records and a relentless quest for yield.