ECB Projects Digital Euro to Replace Banknotes by 2025

BASED

BASED

BANK

BANK

IMX

IMX

EURS

EURS

READ

READ

- ECB anticipates digital euro will replace some euro banknotes and influence deposits.

- Christine Lagarde pushes for October 2025 digital euro readiness.

- ECB moves to counter non-euro stablecoins and enhance monetary sovereignty.

The European Central Bank (ECB) is advancing plans to introduce a digital euro by 2025, aiming to replace some circulating banknotes in the eurozone.

ECB's digital euro could influence €256 billion of banknotes, affecting the euro's asset structure and countering digital currencies.

ECB Prepares for Digital Euro Launch by 2025

The European Central Bank is diligently studying the potential of a digital euro to transform currency use in Europe. President Christine Lagarde is pushing for readiness by October 2025 and emphasizes the digital euro's role in limiting stablecoins and other "bankless solutions."

ECB initiatives aim to maintain eurozone monetary autonomy, facing the rise of non-euro stablecoins. The ECB estimates that for every €10 of digital euro issued, €5 in banknotes could be replaced, influencing the traditional financial structures.

"The digital euro will be ready for October 2025." - Christine Lagarde

Market participants and analysts are closely observing the ECB's digital euro initiative. Executive Board member Chiara Pronzini underscores the currency's potential to curb "bankless" solutions, essential for monetary control. Active city investments aim to counter the rise of stablecoins pegged to USD, with ECB pushing for urgent legislative progress to address these challenges.

Potential Impact on Eurozone Banknotes and Deposits

Did you know? In previous CBDC implementations, like China's digital yuan, limited physical cash has been reduced. Yet, the ECB's digital euro predictions could influence up to €256 billion in banknotes, contrasting with the current euro circulation of over €15.6 trillion.

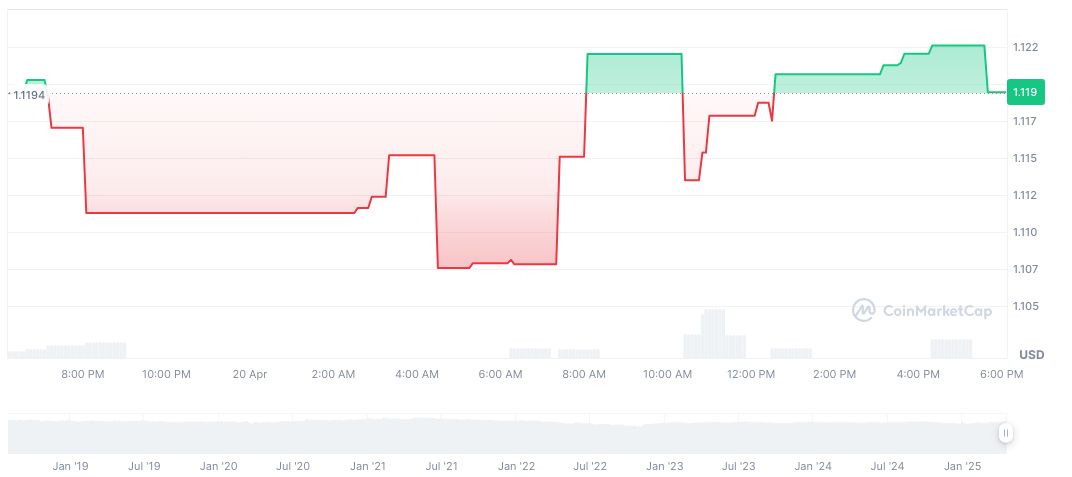

Based on data from CoinMarketCap, STASIS EURO (EURS) is priced at $1.12 with a market cap of $138.95 million. The currency saw a 90-day price increase of 6.87%, and its 24-hour trading volume stood at $0 with a recent change of 0.62%.

The Coincu research team suggests the digital euro could bolster EU monetary sovereignty against foreign digital currencies. Although potential tech challenges exist, regulatory advancements are underway. Financial impacts and public acceptance are integral to determining the digital euro's future influence on euro-based financial instruments, including stablecoins.

Read original article on coincu.com