Ethena price slips after BitMex founder Arthur Hayes moves tokens

LT

LT

ARTHUR

ARTHUR

USDE

USDE

READ

READ

ENA

ENA

Ethena erased some of the gains made on Friday, Dec. 12, after on-chain data showed that Arthur Hayes was selling.

Ethena (ENA) token retreated to $1.10, down from an intraday high of $1.2240. It has dropped by over 16% from its highest level this month.

Data by Nansen shows that Hayes, the co-founder and former CEO of BitMEX, moved 7 million tokens worth $8.47 million to Binance. Moving a cryptocurrency from a self-custody wallet is usually a sign that a crypto investor is selling.

According to Arkham, Hayes now owns 7.19 million ENA tokens worth over $8.5 million. His other portfolio assets include Ethereum (ETH), Wilder World, Pendle (PENDLE), and Ethena Staked USDe.

Hayes’ selling came a few days after Donald Trump’s World Liberty Finance acquired 741,687 ENA tokens valued at $823,000. Ethena has now proposed a deeper collaboration with WLFI, a move that could see sUSDe integrated in the upcoming DeFi platform.

The total value locked in Ethena’s ecosystem in the form of USDe stablecoin jumped to over $6 billion for the first time. This growth has made it the third-biggest stablecoin in the crypto industry after Tether and USD Coin.

You might also like: Altcoin season update: A look at what’s next for Cardano and Solana

USDe’s growth is mostly because of its strong yield. According to its website, USDe’s stablecoin yields at 12%, much higher than what US government bonds and most dividend ETFs are offering.

Meanwhile, Polymarket users believe that the USDe stablecoin will not lose its $1 peg this year. According to the site, odds of the coin falling below 90 cents. The odds of it losing its peg were almost 20% in May as analysts compared it with Terra.

Ethena also recently launched USDtb, a new stablecoin backed by asset manager BlackRock, which boasts over $11.5 trillion in assets.

Technicals suggest more Ethena price gains

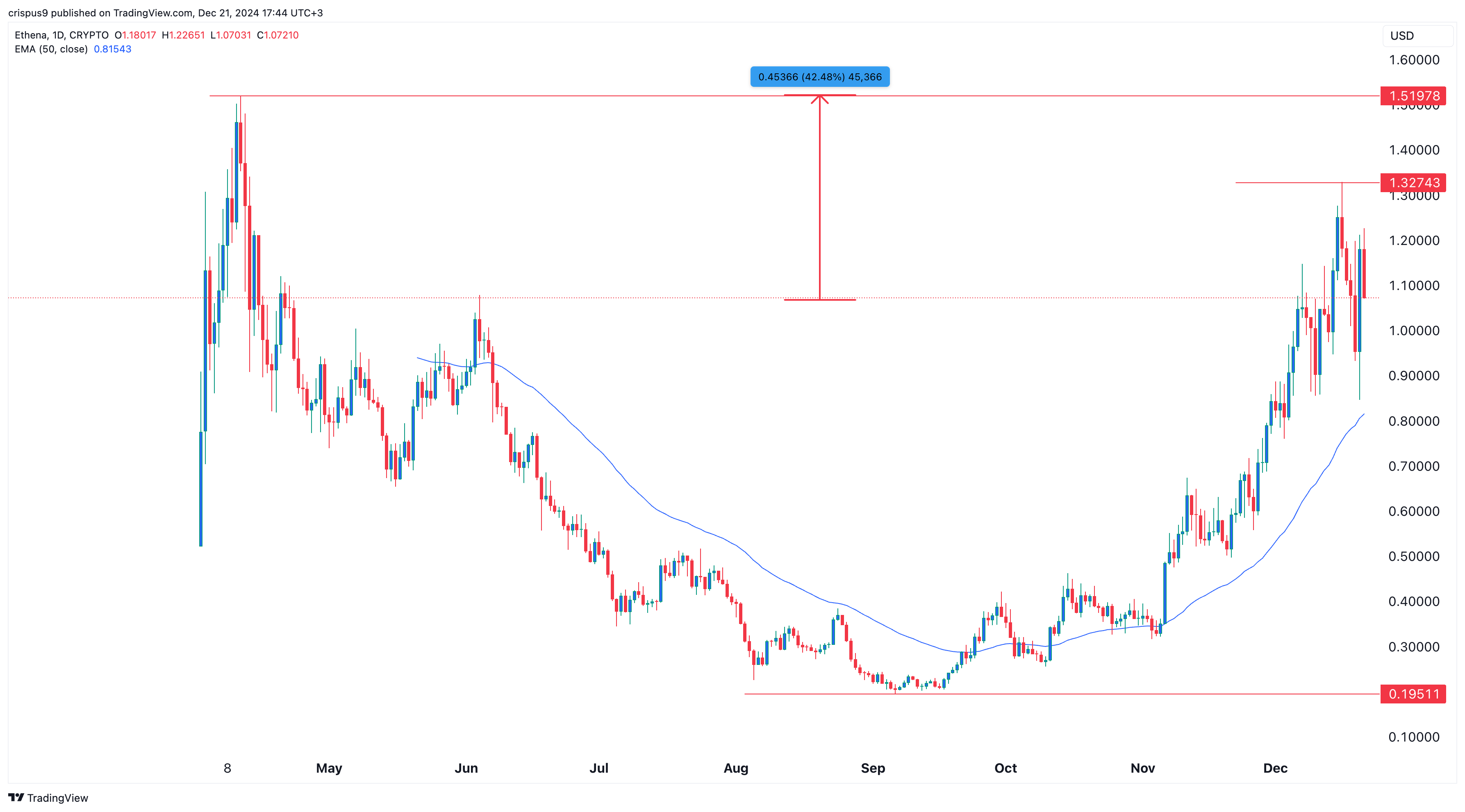

The daily chart shows that the ENA price bottomed at $0.1951 in September and has jumped by 445% to the current $1.0825. The coin has moved above the 50-day moving average and the psychological level at $1.00.

There are signs that it is forming a cup and handle pattern whose top is at $1.5197. Therefore, a move above this month’s high of $1.3275 will increase the odds of the coin rising to $1.5197, which is about 42% above the current level.

Read more: Michael Saylor: Bitcoin as a national asset for US Treasury could generate $81 trillion