Ethereum Foundation Initiates Major Overhaul to Support DeFi Engagement

ETH

ETH

AAVE

AAVE

MAJOR

MAJOR

DEFI

DEFI

FND

FND

- Ethereum Foundation launches strategic initiative, allocating 50,000 ETH, valued over $163 million, to boost DeFi sector involvement.

- Starting with Aave and Safe, the foundation’s financial commitment demonstrates support for DeFi platform growth and stability.

The Ethereum Foundation has recently unveiled a strategic initiative aimed at rejuvenating its decentralized finance (DeFi) participation.

This move, motivated by extensive feedback from users and developers, represents a significant reorientation in the Foundation’s approach, particularly towards enhancing its contributions to DeFi applications.

The initiative includes the allocation of 50,000 Ethereum (ETH), with a market value exceeding $163 million, to various DeFi platforms, starting with Aave and Safe. This financial deployment is designed to demonstrate the Foundation’s commitment to actively supporting the growth and stability of DeFi services on its network.

Ethereum Foundation Treasury Update

The Ethereum Foundation (@ethereumfndn) has set up a new @safe 3-of-5 multisig wallet.

The wallet address is 0x9fC3dc011b461664c835F2527fffb1169b3C213e

An op has been initiated to send 50,000 ETH there, but be patient; due to signing delays,… pic.twitter.com/sIkAlH8ROf

— hww.eth (@icebearhww) January 20, 2025

The plan was kicked off with a test transaction on Aave and will expand to include further investments in platforms like Safe that have proven their reliability and user-friendly features.

The shift in strategy follows periods of criticism aimed at the Foundation’s management and financial strategies, particularly concerning the regular sales of ETH. The Foundation has defended these sales, capped at $100 million annually, as essential for supporting its numerous projects.

Despite this, some developers have felt overlooked, pointing out a lack of direct engagement from the Foundation.

This is incredible from EF. This is the beginning of a new era for EF, powering and participating in DeFi on Ethereum.

After building 8 years on Ethereum, this feels really good. Thank you for using Aave. https://t.co/a3n0H6rTly

— Stani.eth (@StaniKulechov) January 20, 2025

Responding to the announcement, Stani Kulechov, founder of Aave, praised the Foundation’s renewed commitment, stating:

“This is incredible from EF. This marks a new phase for EF, actively powering and participating in DeFi on Ethereum.”

Continuing with the reports in ETHNews. His comments reflect a positive reception to the Foundation’s strategy to directly contribute to and enhance DeFi applications.

No one from the Ethereum foundation has ever reached out to me or anyone on the @AbstractChain team.

I'm not expecting any special treatment or a ton of help, but it'd be nice to talk to someone from the EF every once in a while so we can figure out how to best help each other…

— cygaar (@0xCygaar) January 20, 2025

Additionally, the Foundation’s restructuring extends beyond financial maneuvers. According to Ethereum co-founder Vitalik Buterin, there are ongoing changes to the leadership framework, aiming to streamline operations and sharpen the strategic direction of the organization.

We are indeed currently in the process of large changes to EF leadership structure, which has been ongoing for close to a year. Some of this has already been executed on and made public, and some is still in progress.

What we're trying to achieve is primarily the following…

— vitalik.eth (@VitalikButerin) January 18, 2025

Buterin has expressed that these changes are part of a broader effort to address past shortcomings and position the Ethereum network for a future of growth and more robust development activity.

This restructured approach by the Ethereum Foundation could greatly influence the Ethereum network’s standing in the cryptocurrency market.

As Ethereum’s value hovers around $3.2K, the broader implications of these strategic investments and organizational changes are closely watched by investors and developers, who are keen to see how these efforts will translate into real-world enhancements and market performance.

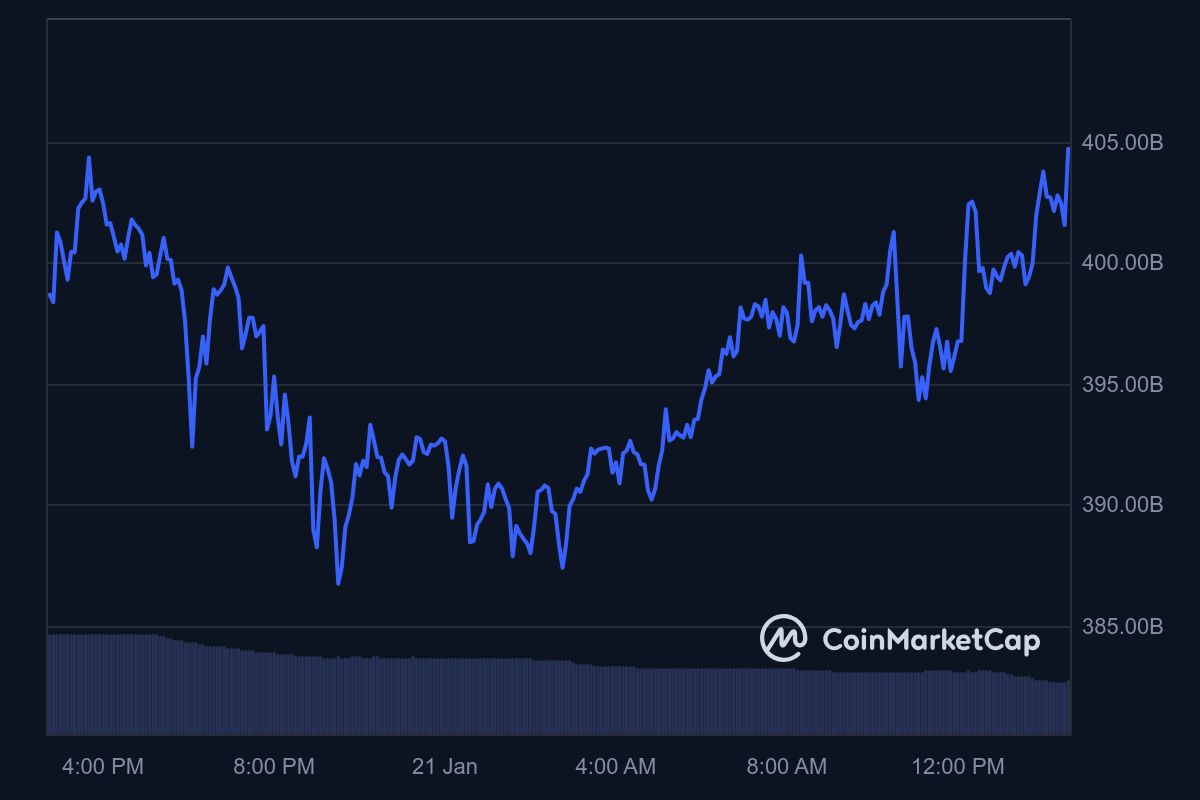

Ethereum (ETH) is currently priced at $3,285.95 USD, showing a 1.85% increase in the last 24 hours. Its market capitalization stands at $400.4 billion USD, making it the second-largest cryptocurrency by market cap.

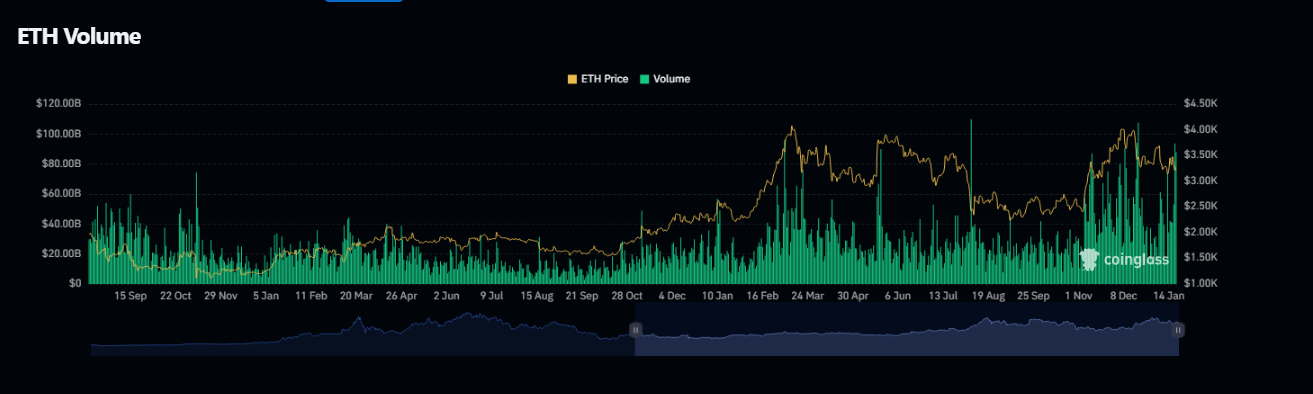

Ethereum’s trading volume in the past 24 hours has reached an impressive $39.64 billion USD, indicating significant market activity and liquidity. The circulating supply remains at 120.5 million ETH, highlighting its importance within the broader cryptocurrency ecosystem.

From a technical perspective, Ethereum is trading near a critical support level of $3,200, which has provided stability in recent sessions.

On the upside, resistance levels are noted at $3,350 and $3,400, which could act as barriers for further bullish momentum.

The recent increase in trading volume, up by 35.72%, suggests a surge in investor interest, possibly driven by positive market sentiment or developments in the Ethereum ecosystem.

The post Ethereum Foundation Initiates Major Overhaul to Support DeFi Engagement appeared first on ETHNews.