Expert Describes “Worse-Case Scenario” for Bitcoin (BTC) as Price Struggles to Break Past $100k

BTC

BTC

X

X

X

X

REKT

REKT

RKT

RKT

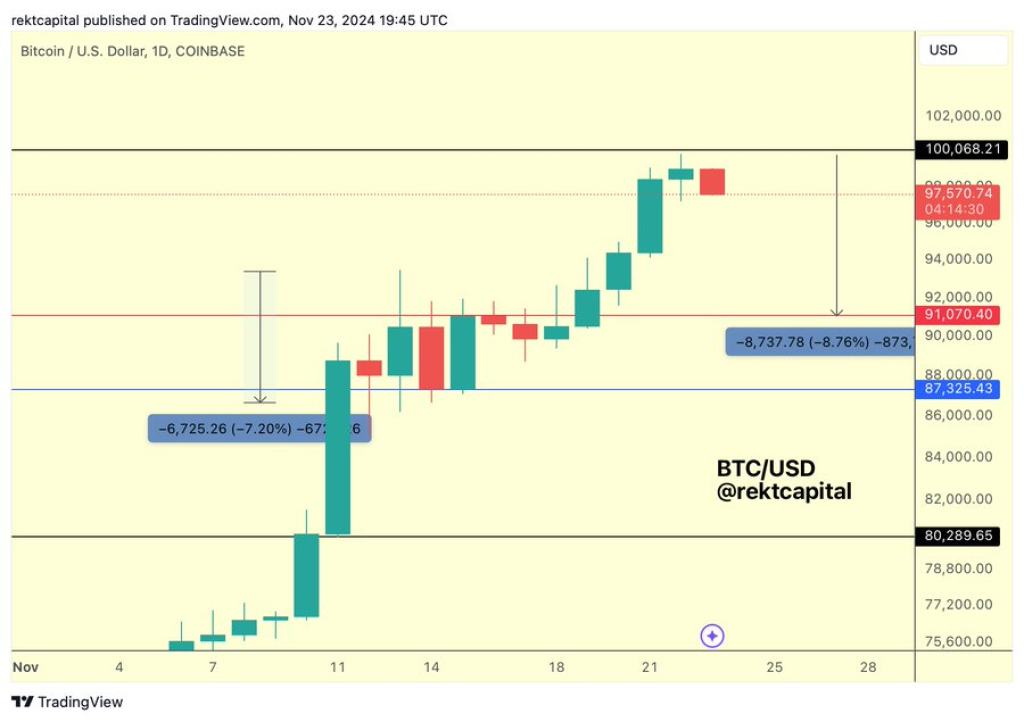

The price of BTC has remained close to the highly anticipated $100,000 mark for the last five days. it has consistently traded between $96,000 and $99,000. There seems to be a strong resistance to growth at the peak of the $99,000 mark.

Rekt Capital made a post to address the market’s doubts and struggles. His post, which was made on X on Sunday, also stated what he termed the worse-case scenario for the Bitcoin price.

Rekt Capital explained that Bitcoin is understandably encountering resistance at the major psychological milestone of $100,000. He posed the question of whether a dip is necessary, considering BTC price only broke out from a sideways range five days prior.

While this is debatable, he suggested that the worst-case scenario could see Bitcoin dip as much as 8.5% down to around $91,000, which would serve as a retest of prior resistance.

For context, he noted that Bitcoin previously experienced a 7% dip about ten days ago. Rekt Capital acknowledged that while Bitcoin could experience a shallower dip, it is essential to remember that dips are a natural part of the market cycle and often precede further upward movement.

Read Also: Federal Reserve Expands Hedera (HBAR) and XRP Integration for RLUSD Payments

Increase In BTC Buying Pressure

Amid all this, the price of BTC has started to see an increase, with a 3% rise in the last 36 hours. Also, yesterday’s candlestick has a long rejection wick that suggests the bulls might be ready for an upward move. Such a wick is typical at price bottoms.

Adding to the bullish outlook, Ali charts also indicate that BTC buying pressure has increased across major platforms in the last few hours. More investors are buying Bitcoin from platforms like Binance, OKX, HTX, and Bybit.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

The post Expert Describes “Worse-Case Scenario” for Bitcoin (BTC) as Price Struggles to Break Past $100k appeared first on CaptainAltcoin.