Gaming Tokens Emerge as Dark Horse in Crypto Markets with 22% Weekly Growth

FTR

FTR

SAND

SAND

D4RK

D4RK

CAT

CAT

EGLD

EGLD

Over the past week, the Web3 gaming sector has enjoyed a remarkable upswing, with overall market capitalization climbing by approximately 22%—rising from just under $26 billion to nearly $32 billion. According to DeFiLlama’s Narrative Tracker, the GameFi segment, while ranked eighth among key market narratives, has notably outpaced major assets like Bitcoin, Ethereum, and Solana.

This performance suggests that investors and enthusiasts are increasingly looking beyond traditional crypto markets, seeking higher-risk, higher-reward opportunities in blockchain-based gaming ecosystems.

![]()

Within this upward trend, several GameFi tokens have delivered standout performances. Titles considered "dino" projects - established, well-known gaming platforms - are once again catching the market’s attention. Two such examples are GALA and The Sandbox, both of which have posted impressive seven-day gains, buoyed by strong community support and ongoing ecosystem developments.

Top Performers

GALA

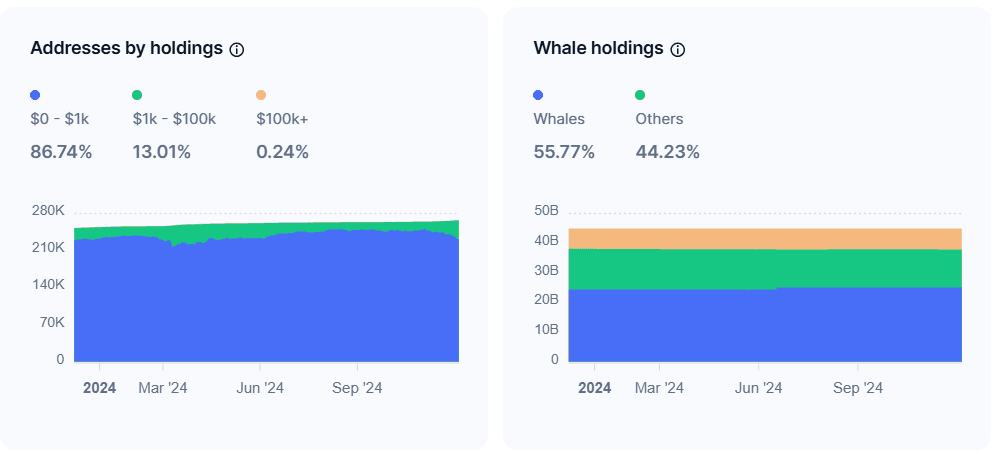

GALA has surged by nearly 50% over the last seven days, reflecting its sustained appeal as one of the most recognizable gaming-focused projects in the Web3 space. With a robust following of nearly 1M users on X, GALA benefits from strong community engagement.

On-chain metrics and holdings data indicate a balanced distribution among both large and small holders, reinforcing market confidence. The combination of a well-established user base, active social channels, and ongoing updates to its gaming ecosystem suggests that GALA’s momentum could extend well beyond short-term gains.

The SANDBOX

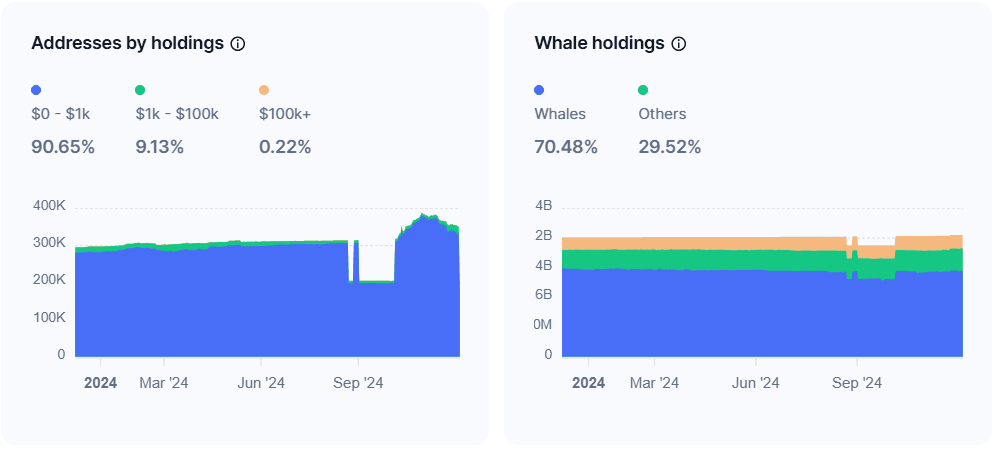

The Sandbox has similarly enjoyed a significant uptick, with a weekly price increase of roughly 40%. Backed by more than 1.1M followers on X, the platform’s vibrant community remains a key driver of its success. The Sandbox’s value proposition lies in its immersive, creator-driven metaverse that rewards players in USD for their in-game activities. This economic model, coupled with consistent ecosystem enhancements and strategic partnerships, has helped The Sandbox maintain market relevance - even amid broader shifts in crypto sentiment.

On-chain holdings also shows regained confidence in the project as the holdings has increased once again after a slight dip in August of this year. Additionally, Coinbase has announced that on 12th December, Sandbox will be added to its Perpetual Future Listing which will definitely add fuel to the fire in the short-term. As user numbers grow and more creators embrace its virtual environment, SAND’s strong fundamentals and community loyalty position it for sustained long-term growth.

MultiversX (EGLD)

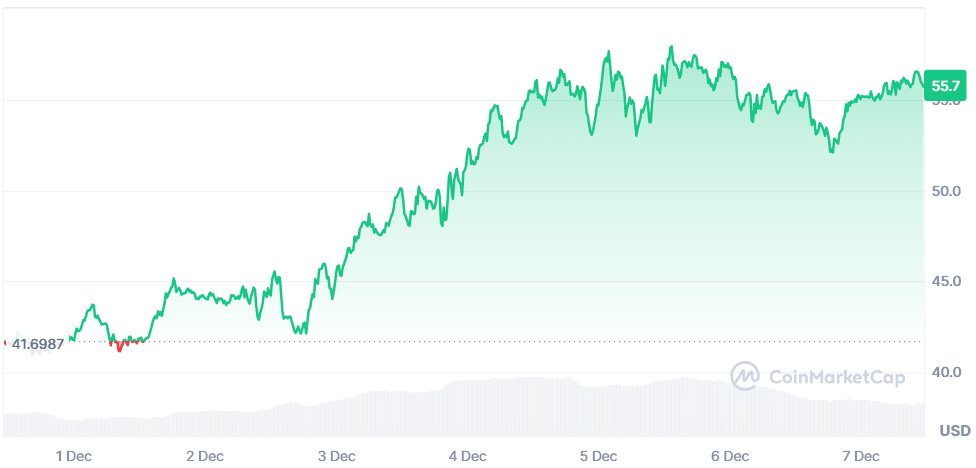

EGLD also recorded strong gains this week, rising by about 30%. With over 1.1M followers on X, it attracts considerable attention despite not being purely GameFi-focused. Its appeal comes from offering robust scalability and accessibility, supported by an active roadmap and integrations with major industry players.

Recent protocol upgrades, like the Spica upgrade, garnered near-unanimous community approval. While daily active addresses and transactions dipped slightly in Q3, staking remained stable, and developer incentives held firm. These fundamentals, combined with horizontal scalability and strong tooling, make MultiversX an appealing environment for teams exploring next-generation Web3 gaming ecosystems.

As more developers seek flexible, performance-driven networks, MultiversX’s infrastructure and community support position it as a key player, complementing the vibrant GameFi landscape.

Outlook and Considerations for the Future

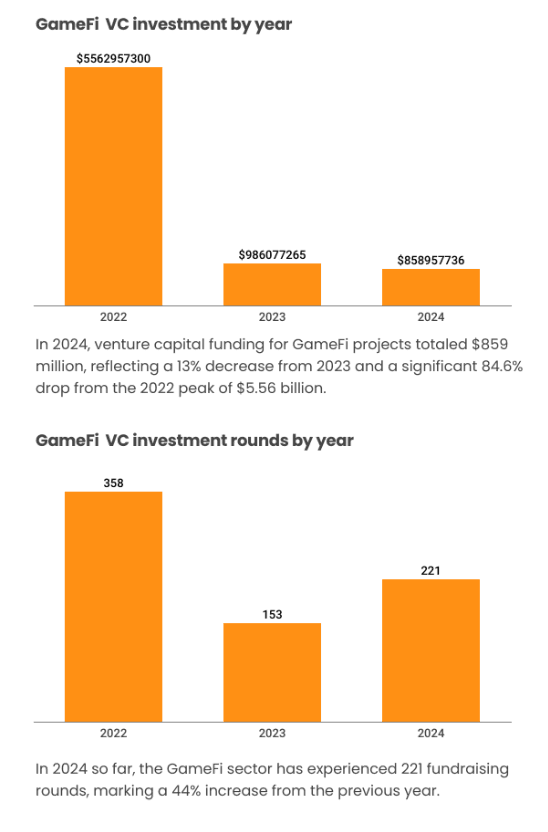

While the GameFi sector’s meteoric rise in 2022 gave way to stark declines and disappointingly short project lifespans, it’s NOT all doom and gloom. The data shows that hype alone no longer guarantees success - projects must now deliver genuine, engaging gameplay, real utility for in-game assets, and sustainable tokenomics. Achieving this balance may help projects avoid the steep 90%+ price drops and the shockingly brief four-month lifespans that have characterized much of the industry.

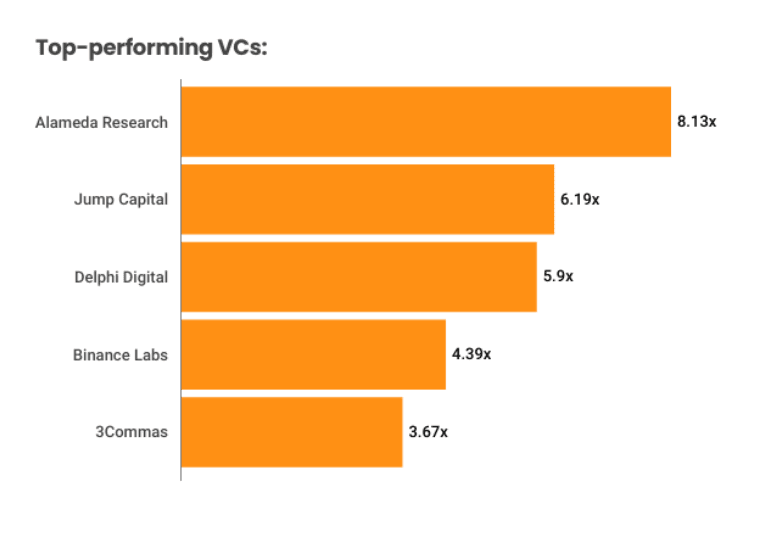

For investors, the key takeaway is the need for meticulous due diligence. Monitoring on-chain activity, assessing strong developer teams, evaluating community health, and gauging a project’s ability to retain users beyond the initial launch rush is critical. As shown, even amid an 84.6% drop in VC funding since 2022, carefully selected opportunities still exist - some investors and top-tier VCs have managed to turn a profit, sometimes significantly.

This period of recalibration could ultimately strengthen GameFi’s foundations. We’re seeing an environment where well-executed projects with meaningful long-term roadmaps can stand out. Studios that prioritize authentic player engagement over speculative hype may emerge as sustainable leaders.

In essence, while the road ahead will remain challenging, the path to meaningful, enduring value in GameFi is becoming clearer. Those willing to look beyond short-term excitement and invest in quality, substance, and community-driven ecosystems may find themselves well-positioned as the sector matures.