Hashdex Pushing for a Crypto ETF: A Step Forward

TRUMP

TRUMP

DJT

DJT

SEC

SEC

ETF

ETF

TRUMP2024

TRUMP2024

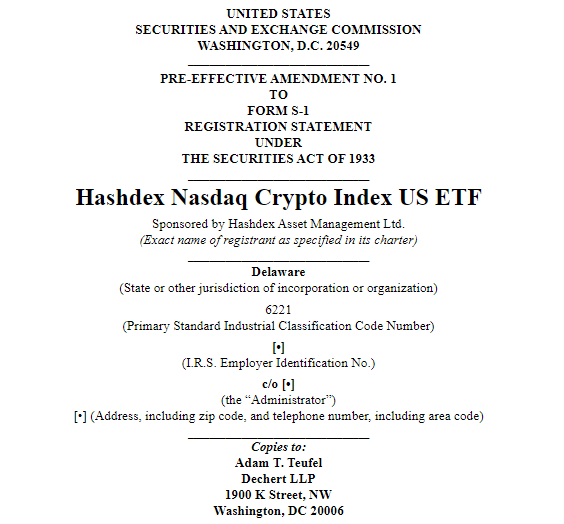

Crypto ETFs have been a hot topic for years, with some already available, but the question remains: will the SEC approve Hashdex’s crypto ETF, and what sets it apart from the rest? On November 25, 2024, Hashdex, the asset management firm, took another step forward by submitting its second amended S-1 filing for a cryptocurrency-focused ETF. But will the SEC give it the green light? That’s the big question.

Will Bitcoin and Ether Be Enough?

So, what’s the deal with Hashdex’s proposal? Well, it’s all about offering investors exposure to a diversified portfolio of cryptocurrencies—starting with Bitcoin (BTC) and Ether (ETH). These two coins are currently the only ones in the Nasdaq Crypto US Index, so they’ll be the focus of the ETF for now. It makes sense, right? Bitcoin and Ether are the big players, and they have the track record to back it up. But Hashdex isn’t stopping here; they’re planning to expand the ETF to include more digital currencies in the future.

SEC’s Slow-Motion Approval Process

Here’s the thing: the SEC has been super cautious about approving crypto-related financial products. Remember when Hashdex first filed for the ETF? They had to modify their proposal after the SEC asked for more time to review it. It’s not surprising. The SEC has a history of being very, very careful with crypto. But the thing is, Hashdex is sticking with it, continuing to tweak their filing to meet the SEC’s standards. This back-and-forth is pretty typical in the world of crypto ETFs, but it does raise the question—how long will this take?

[post_titles_links postid="385344"]Crypto ETFs Are Gaining Traction

If you’re wondering why anyone would be interested in a crypto ETF, here’s why: they’re becoming incredibly popular. Just like traditional index funds (think S&P 500), crypto ETFs give investors a way to access the broad market without having to buy individual coins. It’s an easy way to get involved without too much risk. Katalin Tischhauser from Sygnum even pointed out that crypto index ETFs are especially appealing to those who prefer a more traditional investment route. Who doesn’t want a simple, diversified way to dip into crypto, right?

Who Else Is Eyeing Crypto ETFs?

But here’s the kicker—Hashdex isn’t the only player in the crypto ETF game. Other firms, like Franklin Templeton and Grayscale, are also working on their own crypto-focused ETFs. Franklin Templeton’s version will track the CF Institutional Digital Asset Index, similar to Hashdex’s plan for Bitcoin and Ethereum. Meanwhile, Grayscale is looking to turn its Digital Large Cap Fund, which includes coins like Solana (SOL) and XRP, into an ETF. With so many firms in the mix, it’ll be interesting to see who gets approval first.

What Happens Next?

The crypto ETF saga isn’t over yet, and a lot could change in the near future. One major factor? The SEC’s leadership. Gary Gensler, the current SEC chair, is set to retire in January 2025, just as Donald Trump begins his second presidential term. Trump has been outspoken in his support for cryptocurrency, and analysts think that with new leadership at the SEC, there could be a shift in how crypto ETFs are viewed. If the SEC lightens up, Hashdex’s ETF—and others like it—could soon be approved. It’s definitely something to watch.