Here’s why WazirX’s WRX token price is pumping

TOKEN

TOKEN

FTT

FTT

TOKEN

TOKEN

WHEN

WHEN

WRX

WRX

WazirX token was one of the best performers on Dec. 3 as it formed a long God candle.

WazirX (WRX) price jumped to a high of $0.3500, its highest level since March 14, and 255% above the lowest point this year.

This rally happened as the developers made an update about the ongoing legal issues following its hack in July.

In a statement, the developer said that they had applied with the Singapore High Court to convene a scheme meeting. This will be a crucial step towards final distributions since it offers the fastest recovery solution, is fair and equitable for all creditors, and is legally binding.

The distributions will be made within ten working days after the scheme is approved by creditors and the court in Singapore.

The WazirX price also jumped after the developers sent an update about asset rebalancing. They noted that they were in the process of rebalancing tokens in its exchange. This will be an important step towards the final allocations to cold wallets.

All these events happened a few months after WazirX, which was then a big crypto exchange, was hacked. Hackers drained over $235 million in what has been viewed as an inside job by some crypto analysts. Police in Delhi arrested a person suspected of carrying out the hack.

Cryptocurrency tokens of troubled companies like Celsius, Safemoon, and FTX Token often jump when there is a major legal progress.

You might also like: Inside job or cover-up? New accusations add fuel to the WazirX controversy

WazirX price analysis

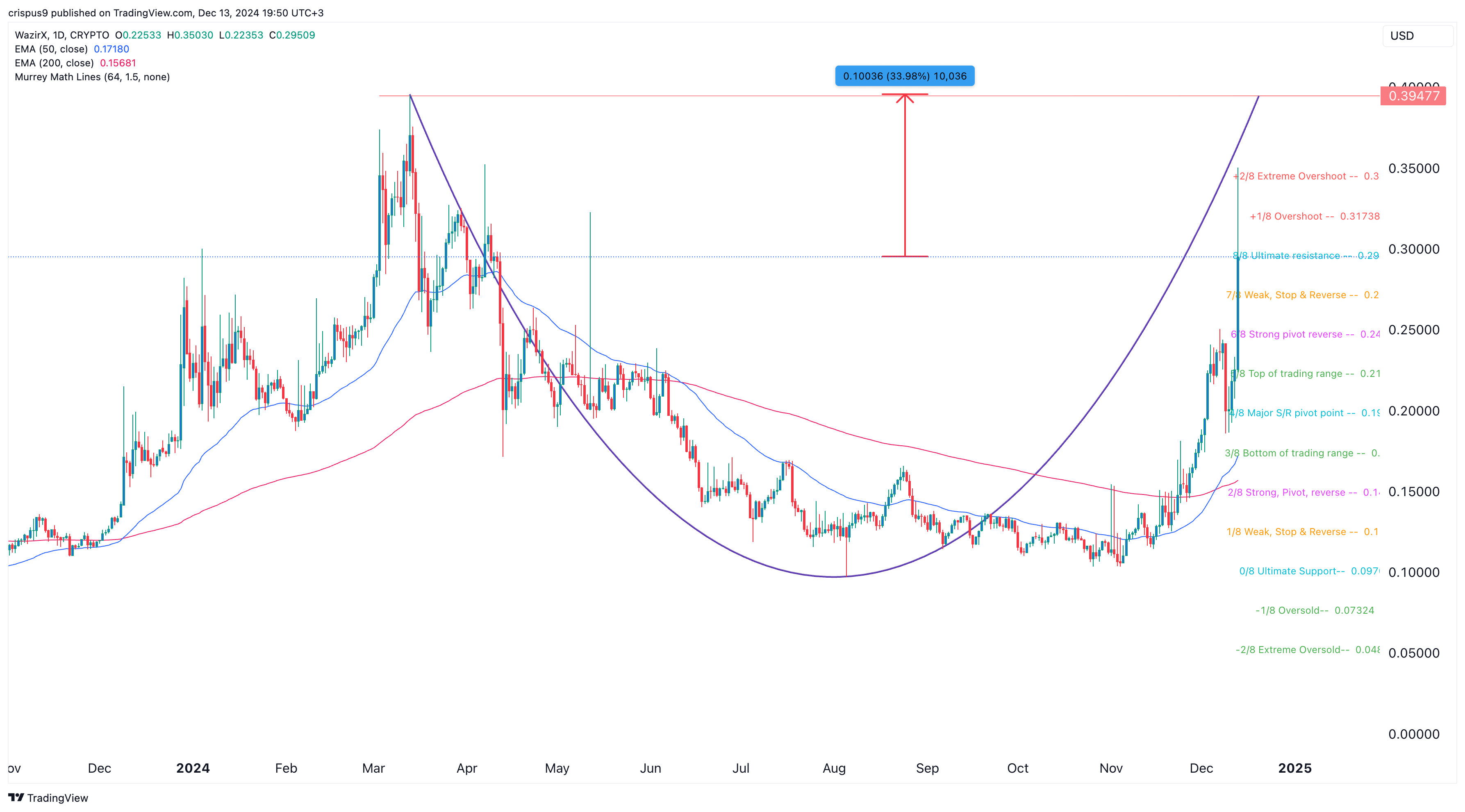

The daily chart shows that the WRX token has staged a strong comeback, rising by over 260% from its lowest point this year. It then pared some of these gains, moving to a low of $0.30. It has formed a golden cross pattern as the 50-day and 200-day Exponential Moving Averages flipped each other.

WazirX token also moved to the extreme overshoot level of the Murrey Math Lines tool. It is also slowly forming a cup and handle pattern whose upper side is at $0.3947, which is about 34% above the current level.

Therefore, the WRX price will likely continue rising if bulls flip the extreme overshoot point at $0.35. A drop below the strong pivot reverse point at $0.20 will invalidate the bullish view.

You might also like: Hedera’s HBAR price may jump 215% to $1, analyst predicts