Justin Sun Accuses First Digital Trust of Financial Misconduct

APRIL

APRIL

MM

MM

READ

READ

CEO

CEO

TUSD

TUSD

- Justin Sun accuses First Digital Trust of multiple financial violations.

- $456 million TUSD was allegedly misused by FDT.

- Regulatory scrutiny on trust operations in Hong Kong increases.

Justin Sun, founder of TRON, accused First Digital Trust (FDT) of financial misconduct on April 8, 2025, in Hong Kong. This situation exposes vulnerabilities in financial regulations, potentially impacting market stability and investor confidence.

Justin Sun accused First Digital Trust of misappropriating $456 million from TUSD reserves and violating multiple Hong Kong laws, naming it the "Seven Sins." "This is not about money—it’s about justice," Sun stated, urging swift regulatory action and greater transparency in trust operations. Vincent Chok, CEO of FDT, denied these allegations, labeling the claims as a smear campaign.

Allegations of $456 Million Misappropriation Stir Market

The revealed misconduct has shaken investor confidence, leading to potential regulatory changes. Justin Sun announced a $50 million bounty for evidence gathering, promoting accountability and highlighting the need for regulatory oversight in Hong Kong.

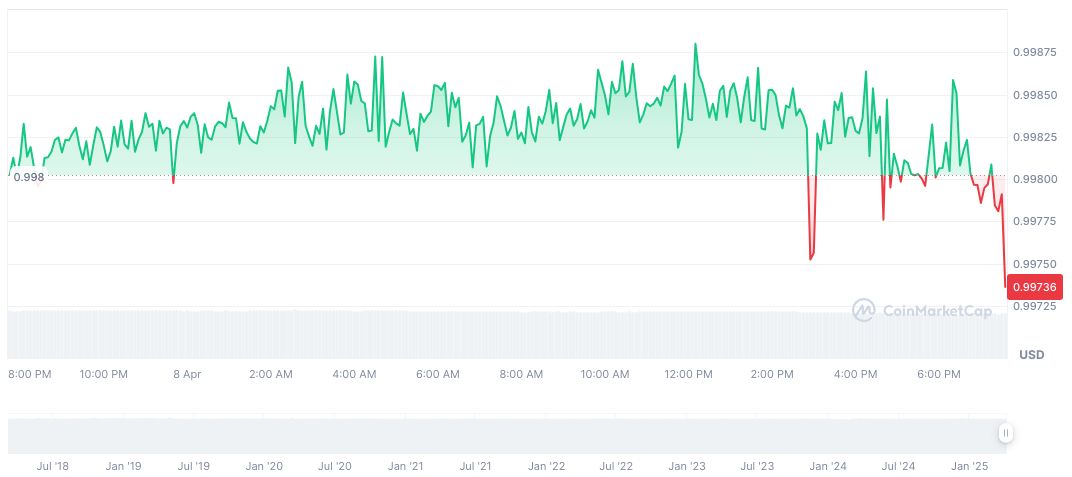

Market reactions included the depegging of several stablecoins, such as TUSD and FDUSD, although they later stabilized. Hong Kong legislator, Johnny Wu, called for reforms to close regulatory loopholes, while FDT pledged legal action against Sun.

TUSD Trading Resilience Amid Controversial Accusations

Did you know? Sun's allegations echo past financial controversies, amplifying calls for enhanced trust entity scrutiny, reminiscent of regulatory changes post-FTX collapse.

TrueUSD (TUSD) currently trades at $1.00 with a market cap of $494.27 million, holding a 0.02% market dominance. According to CoinMarketCap, the 24-hour trading volume decreased by 6.39% to $51.69 million. Despite recent allegations, TUSD shows a stable 0.08% decrease in 24 hours.

Insights from the Coincu research team indicate that potential outcomes include increased scrutiny on financial entities in Hong Kong. Historical trends suggest heightened regulatory measures could arise, ensuring better compliance and protection for investors in the Web3 space.

Read original article on coincu.com