Justin Sun Accuses First Digital Trust of Misappropriation

STABLE

STABLE

TOKEN

TOKEN

FTT

FTT

TOKEN

TOKEN

MM

MM

- Justin Sun accuses FDT of misappropriating user funds.

- Allegations over ten times worse than FTX's scandal.

- Sun criticizes FDT's diversion of funds to private ventures.

Justin Sun, Tron founder, accused First Digital Trust (FDT) of severe misconduct, claiming misuse of nearly $500 million in Hong Kong. Allegations emphasize heightened severity compared to FTX.

FDT’s actions represent a blatant and malicious misuse of user assets, far worse than even FTX’s mismanagement. This is a mockery of the law in Hong Kong.

FDT Misappropriation Sparks $500 Million Controversy

Justin Sun's accusations against First Digital Trust (FDT) have stirred the crypto community. He claims FDT's misappropriation of user funds exceeds that of the FTX scandal. Sun pointed out FDT's lack of collateralization and direct asset theft as key factors.

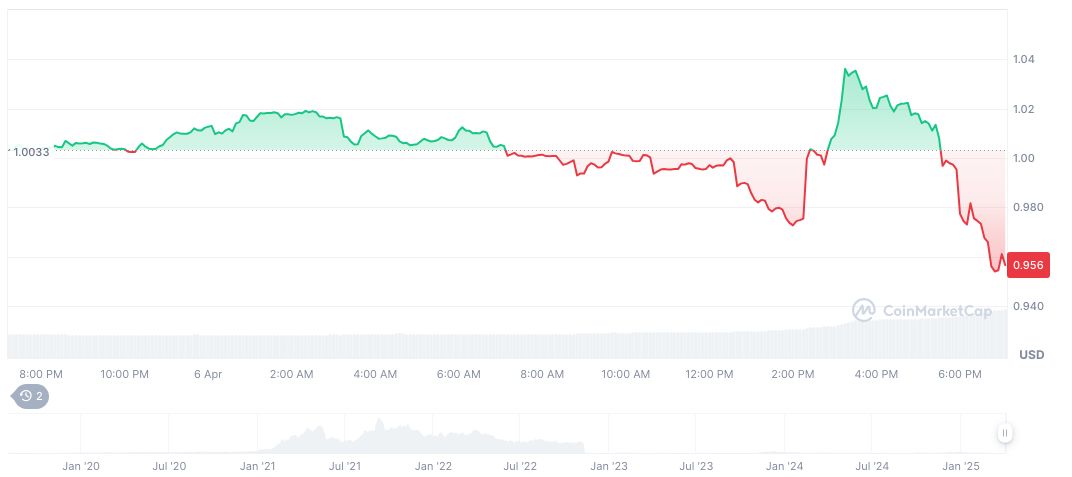

The gravity of the allegations has caused a notable decline in the value of FDUSD. Stablecoin depreciation reached $0.76 against USDC, reflecting market unease. Critics question Vincent Chok's leadership, particularly his dismissive stance on the accusations.

Sun's insistence on transparency highlights broader implications for the crypto market. He has called for regulatory interventions and raised concerns about Hong Kong's regulatory gaps. The community awaits further developments and potential responses from FDT and authorities.

FTX Down 70% as Industry Faces Regulatory Scrutiny

Did you know? The FDT misappropriation case reflects intensified scrutiny in regions like Hong Kong, emphasizing regulatory challenges and their impact on stablecoin markets.

FTX Token (FTT) fell by 70.29% over the past 90 days to a price of $0.96, with a market cap of $314,817,789. CoinMarketCap data indicates substantial declines in recent months, affecting the FTX ecosystem severely.

Insights from Coincu's research suggest potential regulatory updates in response to such cases. Analysts emphasize strengthening user protections and blockchain transparency. Historical trends underline the ongoing need for accountability and resilience within the cryptocurrency sector.

Read original article on coincu.com