Kraken Stablecoin Is Being Promoted In The EU Amid Regulatory Shifts

STABLE

STABLE

DOLLAR

DOLLAR

BANK

BANK

READ

READ

USDG

USDG

Key Points:

- Kraken stablecoin is being developed through the exchange's Irish subsidiary, while Crypto.com aims to launch its stablecoin in Q3 2025.

- The EU’s stricter regulations mandate stablecoin issuers to hold an electronic money license, while Tether itself has yet to secure approval.

As European regulators enforce stricter rules on stablecoins, crypto exchanges Kraken and Crypto.com are preparing to launch their own dollar-pegged digital assets, Bloomberg reported.

Read more: European Central Bank Explores Blockchain for Central Bank Money Transactions

Kraken Stablecoin Is Developed to Comply with EU Regulations

Kraken is in the early stages of developing a stablecoin backed by the U.S. dollar through its Irish subsidiary. Although the exchange has announced that non-compliant stablecoins will be automatically converted to approved alternatives by March 31, Kraken stablecoin is unlikely to be available by that deadline.

The move follows the European Union’s push to remove unauthorized stablecoins, including Tether’s USDT, from trading platforms. The new regulations, which require exchanges to delist unlicensed stablecoins, have prompted major industry players to seek compliant alternatives.

Kraken stablecoin is a product that has been cherished by the trading platform for a long time. Last year, it joined the Global Dollar Network, a consortium that collaborated with Paxos to introduce the USDG stablecoin. Other members of this initiative, including Robinhood and Galaxy Digital, are also pursuing stablecoin projects.

Crypto.com is also entering the stablecoin market, with plans to launch its digital asset in the third quarter of 2025. The company previously informed customers that Tether’s stablecoin would be removed from its European platform by the end of March. The upcoming token aims to replace the liquidity gap left by Tether’s departure.

Tether’s Uncertain Future as Exchanges Adapt to New Rules

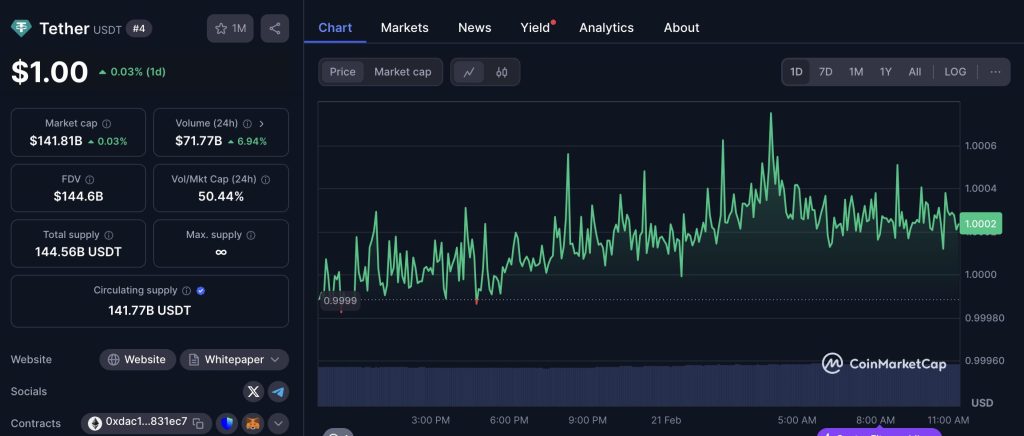

The EU’s regulatory landscape has made launching stablecoins in the region more challenging. Issuers must hold an electronic money license in at least one member state, a step that only a few companies, such as Circle, have taken. Tether, whose USDT remains the world’s largest stablecoin with a $141.8 billion market cap, has yet to secure similar approvals and has criticized the regulatory framework as overly restrictive.

The EU’s Markets in Crypto-Assets (MiCA) regulations have already led to significant shifts in the crypto market. Exchanges have ceased trading support for Tether’s stablecoin in Europe to align with the new compliance framework.

While Tether CEO Paolo Ardoino has indicated the company’s commitment to serving European users, details remain scarce on whether it will secure regulatory approval or exit the region by 2025.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |