Litecoin ETF Approval Incoming? Will the SEC Deliver the Breakthrough Altcoins Need

CNR

CNR

LTC

LTC

SEC

SEC

ETF

ETF

ETF

ETF

Could Litecoin make history with the first Altcoin spot ETF? The U.S. Securities and Exchange Commission (SEC) is expected to issue a critical decision today, May 5, 2025, regarding a spot Litecoin (LTC) exchange-traded fund (ETF) proposed by Canary Capital. This moment could mark a historic shift in the regulatory landscape for altcoins, with Litecoin potentially becoming the first non-Bitcoin, non-Ethereum cryptocurrency to receive ETF approval in the U.S.

The anticipation is intense, not just for Litecoin investors, but for the broader crypto market—because if approved, this move could open the door for other altcoin-based ETFs such as XRP and Solana.

What Makes This ETF Filing Unique?

Canary Capital submitted its spot Litecoin ETF application back in October 2024, alongside a spot XRP ETF proposal. What sets the Litecoin ETF apart is its clean regulatory record—unlike other filings, the SEC has not issued any delays or extensions on this one.

In fact, Bloomberg ETF analyst James Seyffart noted the anomaly, stating:

“This is the first crypto ETF in recent history that hasn’t been delayed by the SEC. If any asset has a shot at early approval, it’s Litecoin.”

Analysts interpret this silence as either a sign of swift approval or an internal regulatory shift in how altcoin ETF proposals are being evaluated. With Bitcoin ETFs already approved and Ethereum’s under review, Litecoin seems to be next in line for institutional validation.

Why Litecoin? The Case for Approval

Litecoin (LTC) is often dubbed the “digital silver” to Bitcoin’s gold. Launched in 2011, it is one of the oldest and most battle-tested cryptocurrencies in existence. Here’s why many believe the SEC may approve this proposal:

-

Regulatory Clean Sheet: Litecoin has not been labeled a security in any SEC litigation.

-

Decentralization: Like Bitcoin, Litecoin has no central foundation or leadership prone to legal scrutiny.

-

Long History: Over a decade of operation, robust mining activity, and high liquidity.

-

Network Transparency: Transparent development history and steady adoption metrics.

With these factors in play, some market experts give the ETF up to a 90% chance of approval.

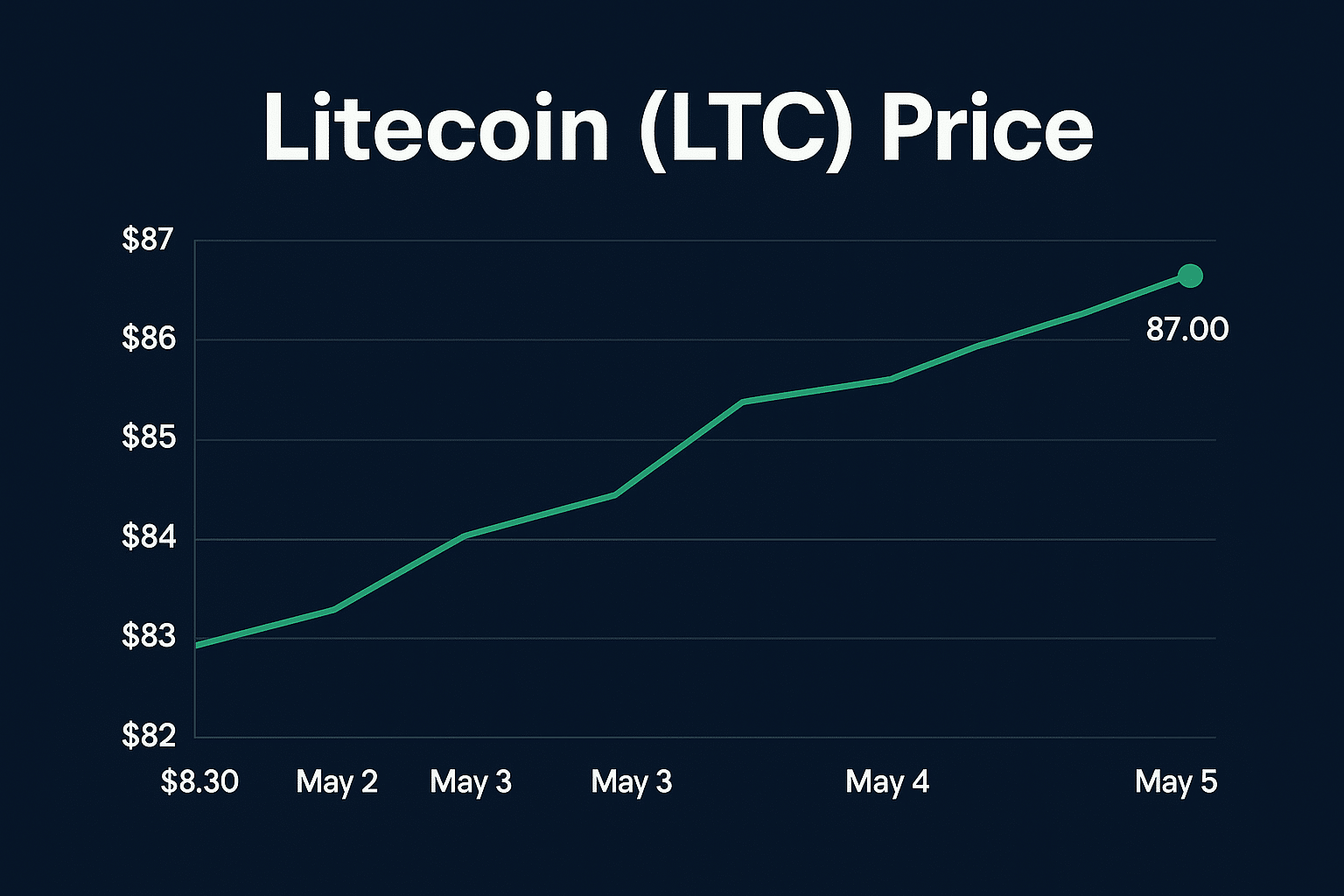

Market Reaction and Litecoin Price Movement

As of May, Litecoin (LTC) is trading around $87, up nearly 10% in the past two weeks. The token has held firm above its 50-day moving average, suggesting building momentum ahead of the SEC’s decision.

Litecoin Price Table

| Date | Price (USD) | Daily Change |

|---|---|---|

| May 1 | $82.30 | — |

| May 2 | $83.90 | +1.9% |

| May 3 | $85.50 | +1.9% |

| May 4 | $86.60 | +1.3% |

| May 5 | $87.00 | +0.5% |

Analysts suggest that a positive ETF decision could propel Litecoin to $100 or more, while a delay or rejection might trigger a short-term pullback to the $78–$80 support range.

Why This Matters Beyond Litecoin

If the SEC greenlights the Litecoin ETF, the implications are massive:

-

First Altcoin ETF Approval: Breaks the Bitcoin/Ethereum dominance in institutional investment products.

-

Gateway for XRP, Solana, and Others: Could lead to a domino effect in ETF approvals.

-

Institutional Onboarding: Easier access for retirement funds, family offices, and large investors to gain Litecoin exposure.

-

Mainstream Legitimacy: Positions Litecoin as a compliant, institution-grade digital asset.

Moreover, this would signal a regulatory shift—one where digital asset diversification is officially welcomed into traditional finance.

Caution Still Looms: Regulatory Uncertainty Remains

Despite the optimism, not all industry voices are convinced. Some caution that the SEC may still delay or reject the proposal, citing broader concerns over market manipulation, custody, and pricing mechanisms for altcoins.

“The lack of prior delay might be strategic,” said Todd Carey, a crypto regulation expert. “It’s possible the SEC wanted to avoid prematurely raising hopes.”

Others believe the SEC could approve a futures-based Litecoin ETF first, a route already seen in Ethereum’s case.

Conclusion: All Eyes on the SEC

The crypto market is watching closely as the SEC prepares to rule on what could become a landmark altcoin ETF. A favorable decision for the Canary Capital Litecoin ETF would make Litecoin the first regulated altcoin ETF in the United States, potentially reshaping how institutional investors interact with the crypto sector.

Whether the decision arrives as an approval, delay, or denial—it will undoubtedly set the tone for upcoming altcoin ETF proposals. One thing is clear: Litecoin is on the cusp of rewriting its legacy not just as digital silver, but as a pioneer in regulatory legitimacy.

FAQs

What is a Litecoin ETF?

A Litecoin ETF would allow investors to gain exposure to LTC price movements via traditional stock exchanges, without holding the crypto directly.

Why is this decision significant?

If approved, it would be the first-ever spot ETF for an altcoin (non-Bitcoin), signaling major regulatory progress.

Who filed the ETF proposal?

Canary Capital filed the proposal in October 2024. The SEC officially acknowledged it in January 2025.

Could XRP or other coins follow?

Yes. Approval of the Litecoin ETF could set a regulatory precedent for XRP, Solana, and other altcoins.

Glossary of Key Terms

ETF (Exchange-Traded Fund)

A type of investment fund traded on stock exchanges, much like stocks. In crypto, a spot ETF allows investors to gain exposure to the actual asset (e.g., Litecoin) without directly holding it.

Spot ETF

An ETF backed by the actual underlying asset, rather than futures contracts. A spot Litecoin ETF would require holding real LTC tokens, offering true price exposure.

Litecoin (LTC)

A decentralized cryptocurrency created in 2011 as a “lighter” version of Bitcoin. Known for fast transaction speeds and low fees, it’s often referred to as “digital silver.”

Canary Capital

The investment firm that filed for the proposed spot Litecoin ETF with the U.S. SEC. The firm also submitted a similar filing for a spot XRP ETF.

SEC (Securities and Exchange Commission)

The U.S. federal agency responsible for enforcing laws against market manipulation and fraud. The SEC plays a key role in approving or rejecting crypto ETF applications.

Altcoin

Any cryptocurrency that is not Bitcoin. Litecoin is one of the earliest and most prominent altcoins in the market.

50-Day Moving Average

A commonly used technical indicator in financial analysis that tracks the average price of an asset over the past 50 days. It helps identify trends and support/resistance levels.