Lyra Finance now Allows LRT to Generate Additional Yield through Options Strategies

SWELL

SWELL

YLD

YLD

LYR

LYR

LYRA

LYRA

LYRA

LYRA

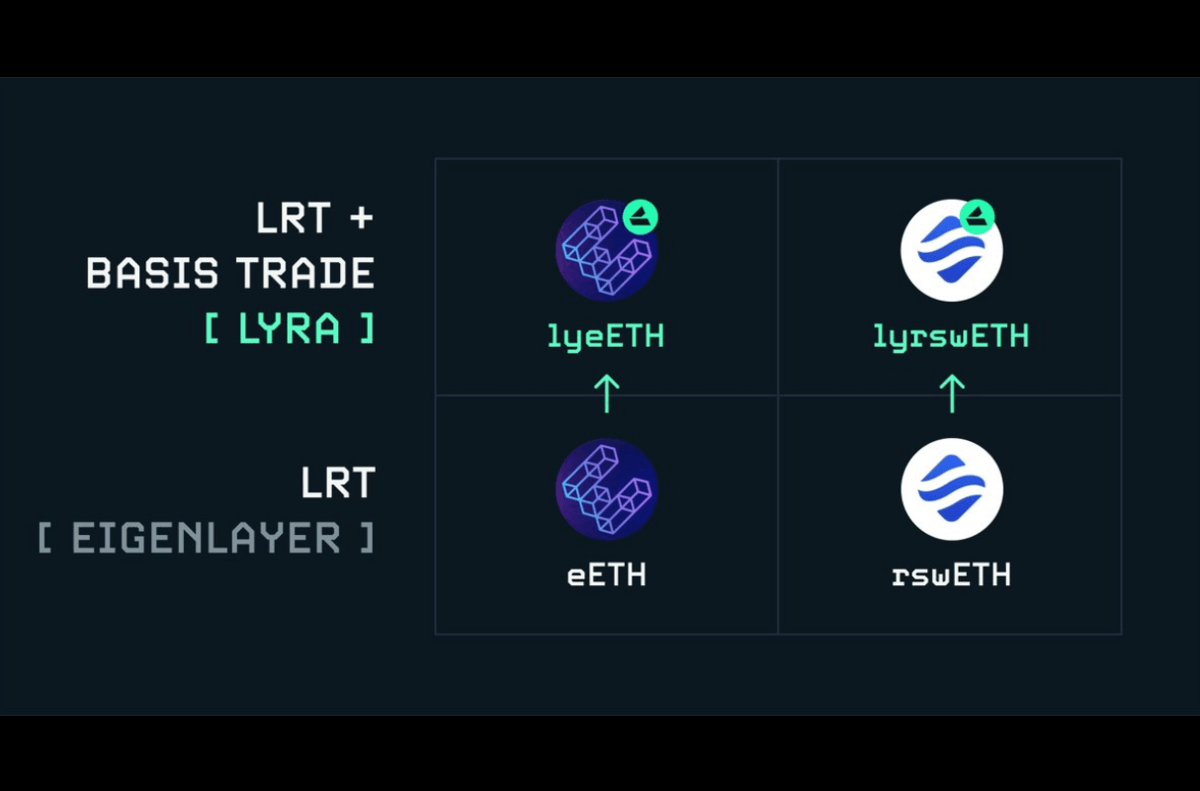

Reported by Coindesk, decentralized options platform Lyra Finance now allows holders of liquid restaking tokens (LRT) to generate an additional yield. The platform will let holders of LTR earn extra income using automated versions of popular strategies like basis trade and covered calls.

The so-called tokenized derivatives yield product has been launched in partnership with liquid restaking protocols Swell NEtwork and Ether.Fi.

It will help holders of rswETH and eETH tokens earn an annualized percentage yield of 10% to 50%. That’s significantly higher than the 10-year yield of 4.47% on U.S. treasuries, traditional finance’s proxy for the risk-free rate.

rswETH and eETH are native liquid staking tokens of Swell Network and Ether.Fi, respectively. Staking refers to the act of locking cryptocurrencies in a blockchain network in return for rewards.

Liquid restaking protocols, such as Ether.Fi and Swell Network allow users to deposit their ether (ETH) or liquid staking tokens like stETH, which are then restaked in EigenLayer. In return, users receive liquid restaking tokens or LRTs, which can be exchanged with ETH at any time.

Users only need to deposit rswETH and eETH in Lyra and mint a yield-bearing derivative token, which then automatically executes a predefined yield-bearing strategy on-chain. In other words, any yield-bearing strategy can be automated and packaged into a composable ERC-20 token, which can be used elsewhere.