Major Token Unlocks Scheduled for April, Impacting Market Dynamics

CONX

CONX

ZKJ

ZKJ

APRIL

APRIL

READ

READ

FTN

FTN

- Upcoming token unlocks could influence market supply and dynamics.

- Potential for short-term price corrections.

- Investor focus on volume and sentiment shifts.

Fasttoken, Connex, and other cryptocurrencies will unlock significant token amounts in mid-April 2025, triggering potential market shifts.

These major unlocks are expected to impact market supply and dynamics significantly as trading begins to adjust.

April Unlocks: Fasttoken and Connex Lead Supply Surge

Token Unlock Schedule: Token unlocks highlight several cryptocurrencies like Fasttoken, Connex, and Polyhedra Network expecting large unlock events. These scheduled events, starting April 15, could alter a token's circulating supply substantially. Substantial market movements might ensue as new supply potentially impacts perceived token value.

Market Supply Adjustments: While the planned unlocks could modestly increase liquidity, they might also lower the short-term price via sell-offs. Impacted tokens notably include Connex with a 376% supply increase and QuantixAI, expected to surge by over 3900%. "The upcoming unlocks, particularly for large volumes like 1.14 billion tokens of deBridge, could significantly impact market dynamics, creating potential sell-off pressure." - John Doe, Market Analyst, PAnews. Investor sentiment could influence trading decisions following these shifts.

Market Reactions: Industry participants are monitoring whale activities and trading volumes closely post-unlocks. Insights from projects like Aptos and Solana suggest similar token releases could yield price corrections, albeit varying with market trends. Stakeholders remain attentive to broader implications, including future regulatory shifts.

Crypto Price Analysis and Volatility Post-Unlocks

Did you know? Several cryptocurrencies like Connex have consistently shown price corrections after large token unlocks, highlighting a pattern observed in other major past unlocks.

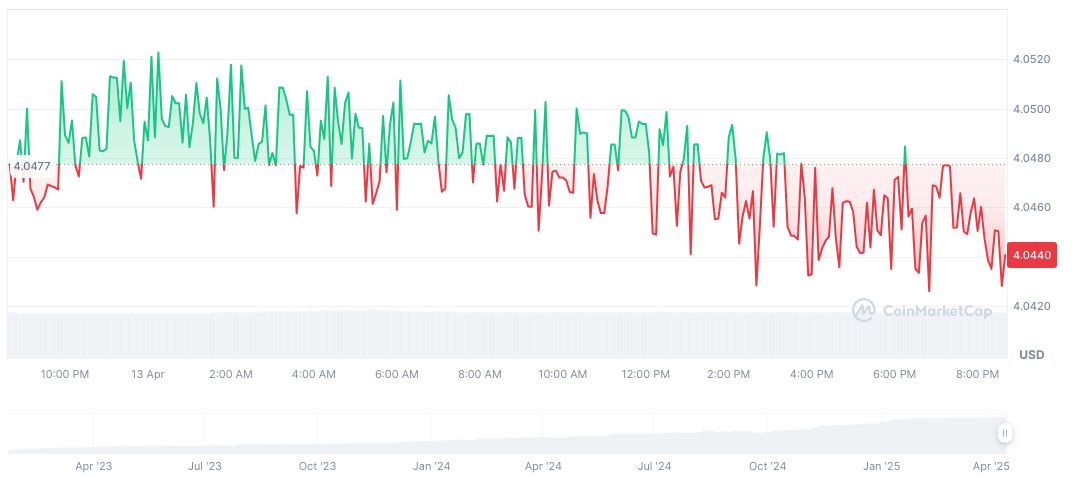

According to CoinMarketCap, Fasttoken trades at $4.04, with a market cap reaching approximately 1.76 billion dollars. Over the past week, the price surged over 23%, countering a recent 4.92% daily drop. Approximately 16.36 million dollars was in 24-hour trading volume, reflecting a decrease of 26.46%.

The Coincu research team states that significant unlocks historically lead to short-term volatility. They underscore the importance of evaluating long-term fundamentals while analyzing immediate market fluctuations. Insights suggest monitoring for potential rebound opportunities.

Read original article on coincu.com