Meme coins crash: why are Brett, PNUT, Popcat falling?

PEANUT

PEANUT

SOL

SOL

PNUT

PNUT

NUX

NUX

MOG

MOG

Most meme coins plunged this week as many retail traders continued to sell in panic as the outlook in crypto worsened.

The market cap of all meme coins tracked by CoinGecko was down by 12% to $113 billion on Dec. 13.

While most meme coins plunged, the sell-off was more pronounced among smaller tokens. Brett (BRETT), the biggest meme coin in the Base Blockchain, fell by 11.2% on Thursday and by 23% in the last seven days.

Peanut the Squirrel (PNUT), a Solana meme coin that went viral recently, has plunged by 40% in the last seven days. Similarly, Popcat (POPCAT), Turbo, and Mog Coin were among the worst-performing cryptocurrencies. The market cap of all Solana meme coins dropped by 15% to $15.5 billion.

Meme coins have crashed because of the ongoing performance of Bitcoin. After soaring to a record high of $108,200, Bitcoin fell below $100,000, as we predicted earlier this week.

Bitcoin has dropped because of profit-taking and the jitters surrounding the hawkish Federal Reserve. In its last meeting of the year, the bank warned that it will deliver just two cuts in 2024 as it expressed concerns about inflation.

You might also like: 2 reasons why Bitcoin and other crypto just crashed

Meme coins crashed after Bitcoin fell

Meme coins always drop when Bitcoin slips. Their retreat is usually more severe because most of them are held by retail investors riding the bullish wave. This is unlike Bitcoin, which has huge institutional investors like MicroStrategy, Marathon Digital, and Tesla. Bitcoin ETFs also have over $115 billion in assets. Historically, institutional investors have a longer investment horizon than retail traders.

A good example of this selling is in on-chain metrics. According to Nansen, the number of smart money investors in Peanut the Squirrel has dropped to just 35 from last month’s high of almost 100.

The same trend is happening in Brett, where the number of smart money holders and their balances have dropped in the past few weeks. Brett has about 40 smart money holders, while their balances have fallen to their lowest level in months.

Will meme coins rebound

There is a likelihood that Bitcoins and these meme coins will bounce back for three reasons. First, Bitcoin is still in an uptrend, with this retreat being a breather. Technicals suggest that Bitcoin price will peak at around $122,000 in this bullish cycle.

It is not uncommon for Bitcoin to retreat after hitting a key resistance. For example, it went through a prolonged consolidation when it rose to an all-time high in March.

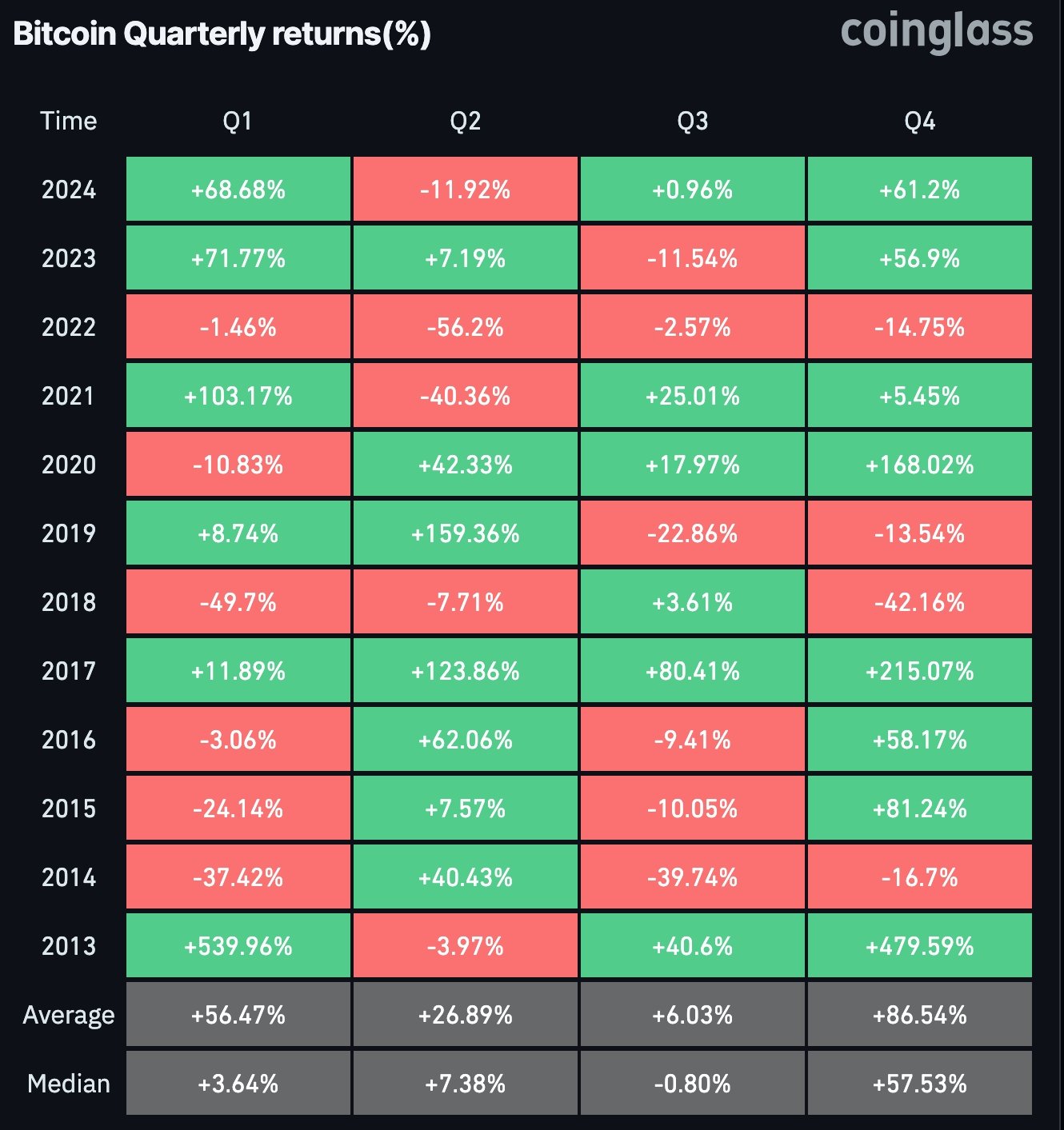

Second, historically Bitcoin – and altcoins – do well during the first quarter of the year. Data by CoinGlass shows that the average Bitcoin return in the first quarter is 56%. This makes it the second-best quarter after the fourth quarter, meaning that there are odds that they will bounce back in Q1.

Third, financial assets often overreact when there is a major event and then moderate as traders adjust to the new normal. A good example of this was in March 2020, when stocks and crypto plunged after COVID was declared an emergency. They then bounced back and reached an all-time high.

You might also like: Ethereum price crashes to key support as ETH ETF inflows surge