Monday Recap: Coinbase Fee Controversies, Hamster Kombat’s Decline, and a $200K Bitcoin Prediction

HAM

HAM

TOKEN

TOKEN

TOKEN

TOKEN

BRIAN

BRIAN

RISE

RISE

The cryptocurrency industry is abuzz with major stories, from allegations of exorbitant listing fees on Coinbase to Hamster Kombat’s sharp user decline and bold Bitcoin price predictions.

Coinbase’s Alleged Token Listing Fees Stir Controversy

In a surprising twist, Tron founder Justin Sun claimed that Coinbase requested a whopping $330 million to list TRX, sparking debates about fairness in crypto listing practices. Sun alleged that while Binance didn’t charge, Coinbase demanded 500 million TRX tokens and a substantial Bitcoin deposit. Andre Cronje, founder of Fantom, corroborated with his own experience, stating Coinbase sought up to $300 million for listing FTM. Despite these claims, Coinbase CEO Brian Armstrong denied the fees, reiterating that asset listings are free.

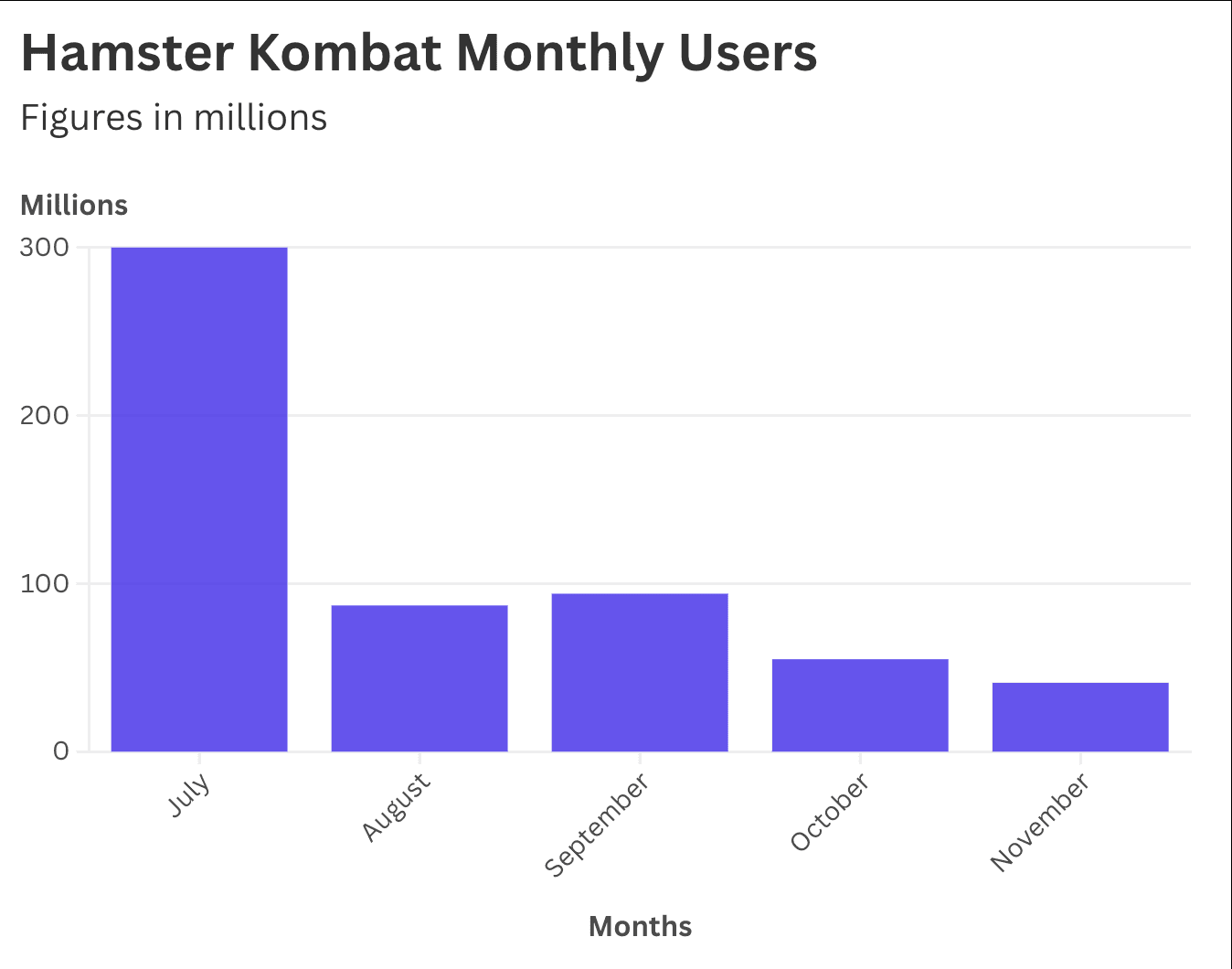

Hamster Kombat’s Meteoric Rise and Fall

Hamster Kombat, once celebrated as the fastest-growing game on Telegram, has reportedly lost nearly 260 million players in just three months. Despite reaching an early peak of 300 million users, the game’s simplistic design and issues with token distribution have alienated players. The token’s value has plummeted by 76%, and controversies around delayed airdrops and an anti-cheat system have damaged its reputation, drawing criticism from governments in Iran and Russia.

Bitcoin’s $200K Forecast by 2025

Analysts at Bernstein predict that Bitcoin’s value could soar to $200,000 by 2025, irrespective of the upcoming U.S. election outcome. They argue that factors like U.S. fiscal irresponsibility and the appeal of hard assets support Bitcoin’s growth. A potential Trump win could push Bitcoin higher, given his perceived crypto-friendly stance, but even a Harris victory is expected to have a favorable long-term impact. Ethereum, too, could see gains with favorable ETF prospects if Harris wins.

These developments underscore the crypto industry’s complex landscape, where regulatory tensions, market speculation, and shifting public sentiment play pivotal roles in shaping the future of digital assets.