Morpho Blue Vulnerability Results in $2.6 Million Loss

MORPHO

MORPHO

DEFI

DEFI

MM

MM

READ

READ

SECURITY

SECURITY

- Morpho Blue suffers $2.6 million loss from front-end vulnerability.

- Arbitrageur exploits vulnerability; funds transferred to secure address.

- Security measures enhanced; community maintains cautious outlook.

A vulnerability in the Morpho Blue front-end resulted in a $2.6 million loss on April 11, with funds transferred to address 0x1A5B...C742.

The incident underscores significant security challenges in DeFi, prompting rapid response from the Morpho team to secure protocol stability and user confidence.

$2.6 Million Compromised in Morpho Blue Attack

Following a detected vulnerability within the Morpho Blue front-end, an estimated $2.6 million was compromised. The on-chain arbitrageur known as c0ffeebabe.eth preemptively accessed the funds, redirecting them to address 0x1A5B...C742. A resolution was confirmed by Morpho's developers.

Immediate implications of the attack included enhancing the security measures within the protocol, marking an important shift towards fortified DeFi operations. Preemptive actions by Morpho developers aimed at sustaining investor trust.

The cryptocurrency community maintained a cautious stance, acknowledging the expertise of c0ffeebabe.eth but urging for heightened vigilance in detecting vulnerabilities. Morpho Team from the protocol announced, “Steps have been taken to secure the system and protect user funds going forward.” The rapid fix was communicated by Morpho Blue developers, underlining a significant commitment to transparency.

Expert Insights on DeFi Security and Market Stability

Did you know? Elite arbitrageurs can act swiftly to exploit vulnerabilities, emphasizing the need for faster mitigation by DeFi protocols.

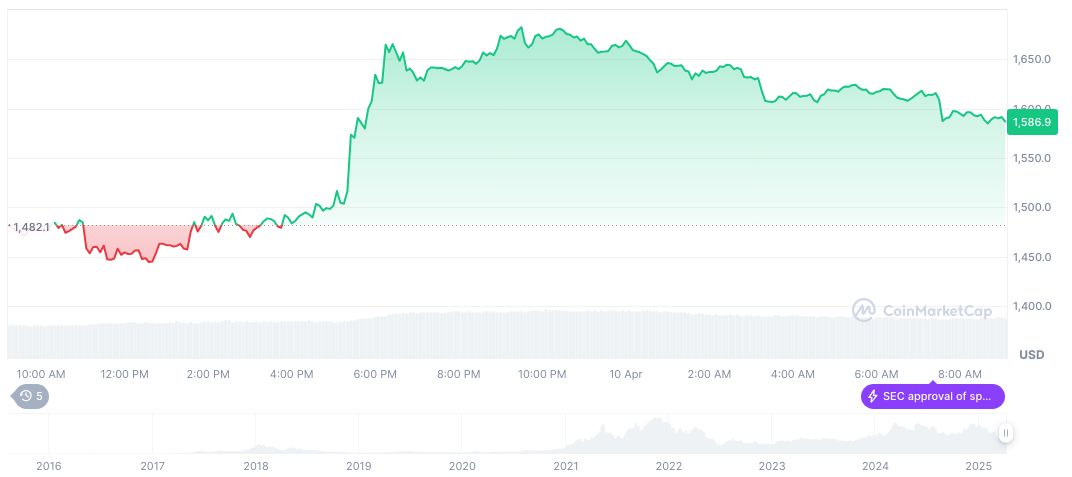

Ethereum (ETH), crucial for DeFi activities, currently trades at $1,548.48 with a market cap of formatNumber(186875002254, 2). Recent statistics indicate a significant decrease in trading volume by 38.04%, highlighting ongoing volatility in the crypto markets, as reported by CoinMarketCap.

Insights from the Coincu research team suggest that such vulnerabilities emphasize the need for robust preventive frameworks in DeFi. Historical data shows that rapid protocol fixes can stabilize markets, albeit temporary increases in volatility remain plausible in the near term.

Read original article on coincu.com