Next Cryptocurrency to Explode, November 18 — Ponke, Marlin, Cardano

CRV

CRV

ADA

ADA

PEPE

PEPE

$PEPE

$PEPE

PEPE

PEPE

The overall feeling in the market is surprisingly negative, and cryptocurrency prices have been fluctuating for a while, including Bitcoin (BTC). BTC has returned to $90K+ but still hasn’t surpassed its all-time high of 93,215. Meanwhile, Ethereum (ETH) is currently striving to stabilize above $3,000.

However, identifying the next cryptocurrencies to explode might take some work as most funds are attracted to pumping assets. Today’s article explores the performance of cryptocurrencies that have dominated the gainers list in the last 24 hours. The objective is to identify coins with some potential and inform investors and traders about each token.

Next Cryptocurrency To Explode

Today’s article discusses the performance of potentially explosive cryptos that investors should add to their watchlist. It also includes a special mention of Pepe Unchained, a new Pepe-themed meme coin launched on its Ethereum Layer 2 blockchain. Within minutes, it attracted over $150,000 in investments. The details of its presale and the performance of the top-performing cryptos today are shared below.

1. Ponke (PONKE)

Ponke stands out with its innovative tokenomics, offering a total supply of 555 million tokens tailored for online traders and gaming enthusiasts. Its user-focused design ensures a smooth and enjoyable experience, and its integration into major crypto exchanges has made it accessible to a broader audience.

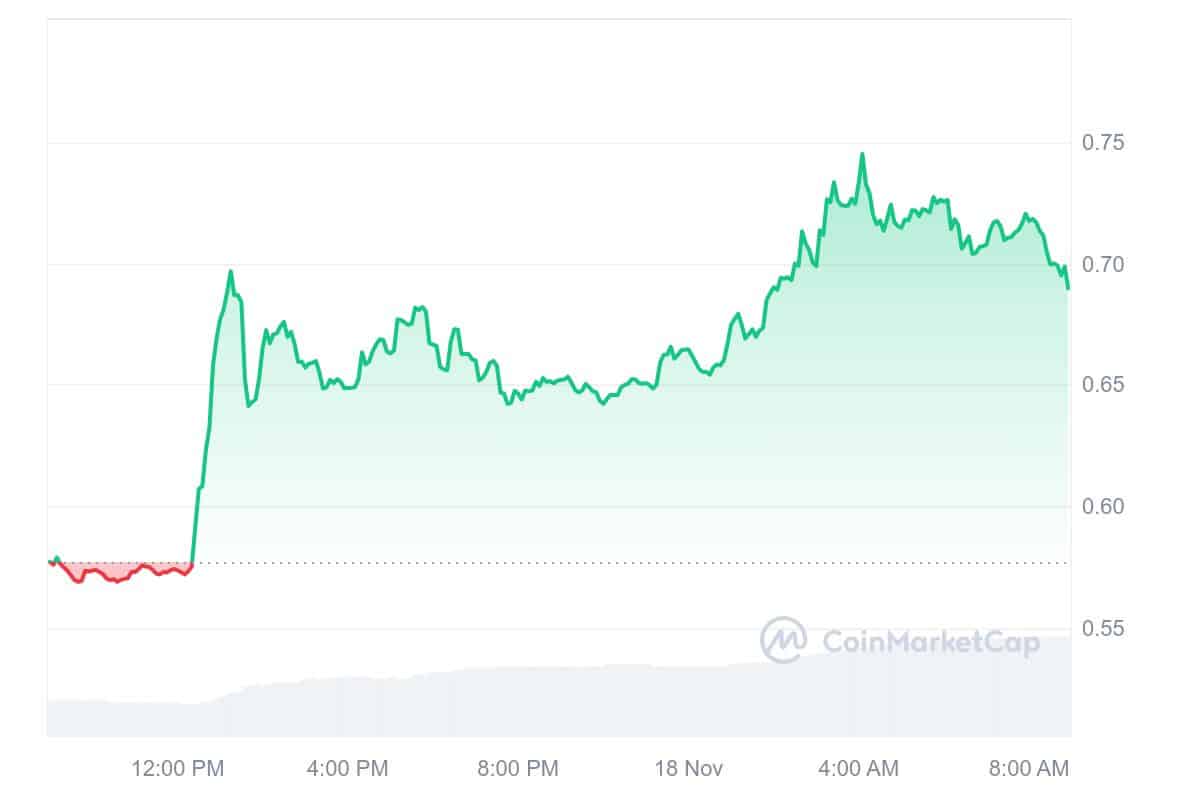

On July 17, 2024, Ponke reached a new all-time high of $0.6591, marking its second major rally. Despite a sluggish market, this achievement highlighted its resilience and growing appeal. Since then, the token has shown steady consolidation, priced at $0.6897. Over the past 24 hours, Ponke surged by 19.39%, with a remarkable 29.69% increase over the week, showcasing strong momentum.

Ponke has hit several milestones in a short time. It is now listed on major exchanges like ByBit, KuCoin, Gate.io, and BitMart and is also capturing the attention of leading crypto influencers and analysts. The upcoming launch of PonkeSwap, its decentralized exchange, promises exciting features, including low fees, efficient trading pairs, staking-based liquidity, and token governance. Additionally, the team is working on cross-chain compatibility, further enhancing Ponke’s utility and value.

Focusing on building a sustainable and innovative DeFi ecosystem on Solana, Ponke aims to go beyond meme culture. The team is dedicated to expanding use cases, integrating cross-chain functionality, and fostering a strong community. Ponke hopes to attract users from other DeFi protocols by leveraging these unique features.

2. Marlin (POND)

Marlin is an innovative open protocol designed to enhance network infrastructure for DeFi and Web 3.0 applications. Its network operates through Metanodes, which run MarlinVM, providing developers with a virtual router interface to create custom overlays and perform edge computations.

The project aims to bring the speed and performance of Web 2.0 to decentralized Web 3.0 applications. With this vision, Marlin ensures blockchain-secured apps function seamlessly. Its utility token, POND, plays a vital role within the ecosystem, supporting functions like staking to operate validator nodes.

POND also powers governance, allowing token holders to propose and vote on resource allocation. Additionally, it facilitates network performance auditing and compensates users from an insurance fund in cases of Service Level Agreement (SLA) breaches.

Currently, POND is priced at $0.01874, marking an impressive 55.45% increase in the past seven days. Over this period, its market cap has surged by over 50%, reaching $151.55 million. Meanwhile, the trading volume grew by 399.15% in the last 24 hours, hitting $176.52 million. With a bullish price prediction sentiment, POND is trading 106.65% above its 200-day SMA of $0.009848.

Moreover, the Fear & Greed Index stands at 83 (Extreme Greed), signalling growing optimism and increased token transactions. These developments indicate strong momentum and a positive outlook for Marlin’s continued growth in the DeFi and Web 3.0 space.

3. Pepe Unchained (PEPU)

Pepe Unchained is making waves in the meme coin world, quickly becoming the most successful presale of the year. The project, as its name suggests, aims to liberate Pepe from the limitations of traditional Layer 1 servers. It will operate on its own Ethereum Layer 2 blockchain, offering faster transactions and lower costs.

By positioning itself as a competitor to its predecessor, Pepe, which soared an impressive 763x, Pepe Unchained aims to dominate the frog-themed meme coin market. The development team has ambitious plans, including the recent launch of Pepe’s Pump Pad. This meme coin launchpad is set to rival Solana’s Pump.fun. Additionally, token holders can enjoy passive earnings through the platform’s staking system, offering a generous annual yield (APY) of 77%.

Pepe is celebrating 35M today!

With just under 26 days left in the presale don't miss out on your chance to get in on the ground floor! 🐸💚🔥 pic.twitter.com/6eTaUVUZSs

— Pepe Unchained (@pepe_unchained) November 17, 2024

With only 25 days left before its presale ends, excitement is building for Pepe Unchained’s debut on tier 1 exchanges. Many speculate whether PEPU could be the next meme coin to explode, especially after potential listings on platforms like Coinbase or Binance. The original Pepe saw massive gains following its Coinbase and Robinhood listings last week, hinting at a similar trajectory for PEPU.

You can purchase $PEPU tokens for $0.012891 directly from the official website using ETH, USDT, or a bank card. With its innovative approach and growing momentum, Pepe Unchained could be a game-changer in the meme coin market.

4. Curve DAO Token (CRV)

Curve DAO (CRV) is regaining attention with a recent price uptick, presenting a potential entry point for investors. Despite facing market challenges, the altcoin’s current position in a demand zone suggests growing buying interest, making it an appealing option for those who missed earlier dips.

In the last 24 hours, CRV’s price surged by 8.31%, driven by a drop in its inflation rate to 6.35% in mid-August. This decrease in token supply has reignited investor interest, signalling the possibility of future growth. With fewer new CRV tokens entering circulation, reduced supply could positively impact prices.

Though CRV’s price has fallen over 30% since its launch, the supply reduction may trigger a rebound. On August 13, rumours about the inflation drop led to a 71.90% surge in trading volume, hitting $244 million—a two-month high. This activity reflects increased market interest and supports CRV’s recent price rise. If bullish momentum continues, CRV could climb to $0.44 or even $0.54. However, a bearish market turn might push the price below $0.18.

Additionally, Curve Finance has partnered with the TON Foundation to launch a hackathon focused on stablecoin trading solutions. This event aims to integrate Curve’s CFMM into the TON blockchain, reducing price volatility and slippage in stablecoin swaps. By enhancing user experiences in DeFi, this collaboration could attract more developers and investors, further strengthening CRV’s position in the market.

5. Cardano (ADA)

Cardano (ADA) has shown significant volatility, with analysts predicting a potential short-term dip followed by long-term growth. Crypto analyst Kenshiyesreel has taken a short position, targeting a price pullback to the $0.45-$0.50 range for accumulation. However, the Golden Cross indicates a continued bullish trend if ADA holds above key support levels.

A short-term price drop could offer an ideal entry point for investors, with analysts expecting increased selling pressure in the $0.45-$0.50 zone. However, if ADA sustains its upward momentum, analysts suggest a potential rise to $1.20 after a pullback.

Recently, ADA’s price climbed to $0.63 before retracing to $0.5947, staying above the 9-day and 21-day moving averages. Should the price turn bearish, current support levels are around $0.5464 and $0.4663. The Money Flow Index (MFI) is at 69.66, indicating bullish market conditions but nearing an overbought state. A bearish reversal may follow if the MFI hits 70 and the buying pressure decreases. This balance of buying strength and overbought risks suggests short-term fluctuations. At the same time, long-term indicators point to a positive outlook.

Meanwhile, Cardano continues to scale its network activities by maintaining a balanced mix of legacy and blockchain-native use cases. By the end of 2023, the Cardano Foundation managed $478.24 million in assets, with 82.5% held in ADA, 10.1% in Bitcoin, and the remainder in USD liquidity.