Polymarket Users Predict a 31% Chance of Bitcoin Surpassing $105K in November

BULLISH

BULLISH

2024

2024

2024

2024

BTC

BTC

Polymarket Users Predict a 31% Chance of Bitcoin Surpassing $105K in November

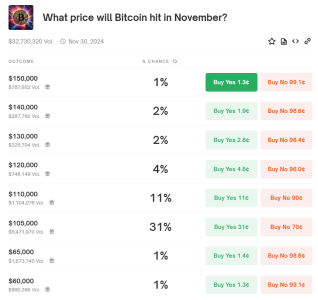

On the decentralized prediction platform Polymarket, users are betting on the possibility of Bitcoin (BTC) breaking the $105,000 mark in November. According to the platform, there’s a 31% probability of BTC surpassing this milestone by month’s end. The betting pool for this prediction has already reached $32.7 million, showcasing the market’s active interest in Bitcoin’s potential for another major rally.

Bitcoin’s $105K Target: Polymarket’s Insights

Polymarket, known for hosting prediction markets on various topics, provides valuable insights into user sentiment on Bitcoin’s price movements:

Key Predictions for November:

- 31% Chance: Bitcoin exceeds $105,000.

- 11% Chance: Bitcoin hits $110,000.

The predictions reflect optimism tempered by caution, as the cryptocurrency market continues to experience high volatility.

Why $105K Is a Significant Milestone

Bitcoin breaking past $105K would mark a new all-time high, signaling renewed bullish momentum in the cryptocurrency market.

Key Implications of Reaching $105K:

- Psychological Resistance: $100K has long been a psychological target for Bitcoin, and exceeding $105K would solidify confidence in a sustained bull market.

- Institutional Interest: Such a rally could attract further institutional investment, cementing Bitcoin’s position as a store of value.

- Altcoin Boost: A Bitcoin rally often spills over into altcoins, potentially leading to a broader market upswing.

The Role of Polymarket in Bitcoin Price Sentiment

Polymarket leverages decentralized prediction markets to gauge public sentiment on various topics, including cryptocurrency prices:

How It Works:

- Users place bets on outcomes, creating a real-time sentiment indicator for market expectations.

- Outcomes are assigned probabilities based on the total wagers in the pool.

Betting Pool:

The Bitcoin $105K prediction pool has attracted $32.7 million, reflecting significant interest in the asset’s near-term prospects.

Factors Driving Bitcoin’s Price Predictions

Several factors are contributing to optimism around Bitcoin’s potential to reach $105K:

1. Institutional Adoption:

Growing institutional interest, including Bitcoin ETFs and corporate treasury holdings, continues to drive demand.

2. Macro Trends:

Global economic uncertainties and inflation concerns have positioned Bitcoin as a hedge against traditional financial risks.

3. Halving Anticipation:

The upcoming Bitcoin halving in 2024 is expected to reduce supply, potentially driving prices higher.

4. Recent Market Momentum:

Bitcoin’s strong performance in 2024, nearing $100K, has boosted confidence among traders and investors.

Challenges to Bitcoin Reaching $105K

Despite the optimism, several challenges could prevent Bitcoin from reaching this milestone:

1. Regulatory Uncertainty:

Ongoing scrutiny from governments and regulators could impact market sentiment.

2. Market Volatility:

Bitcoin’s notorious price swings pose a significant risk, even during bullish trends.

3. Profit-Taking:

As BTC approaches key psychological levels, some investors may sell off holdings, creating resistance.

What Does This Mean for Investors?

For Bitcoin investors, the predictions on Polymarket highlight potential opportunities and risks:

Opportunities:

- A breakout above $105K could trigger a broader rally, benefiting both Bitcoin and altcoins.

- Increased adoption and institutional interest could lead to sustained growth beyond November.

Risks:

- The market may fail to breach $105K due to resistance or external factors, leading to short-term corrections.

- Over-reliance on prediction markets may not account for sudden macroeconomic or geopolitical changes.

Conclusion

Polymarket’s users estimate a 31% chance that Bitcoin will surpass $105,000 in November, reflecting cautious optimism amid a volatile market. While the predictions are encouraging, external factors such as regulatory developments and market dynamics could significantly impact BTC’s trajectory.

For investors, monitoring sentiment indicators like Polymarket alongside fundamental and technical analysis can provide a more comprehensive view of Bitcoin’s potential in the coming weeks.

To stay updated on Bitcoin price predictions and market trends, check out our article on crypto market analysis for 2024.