Raoul Pal chooses Solana over Bitcoin, portfolio holds 90% SOL

SOL

SOL

VSN

VSN

BTC

BTC

BNB

BNB

CEO

CEO

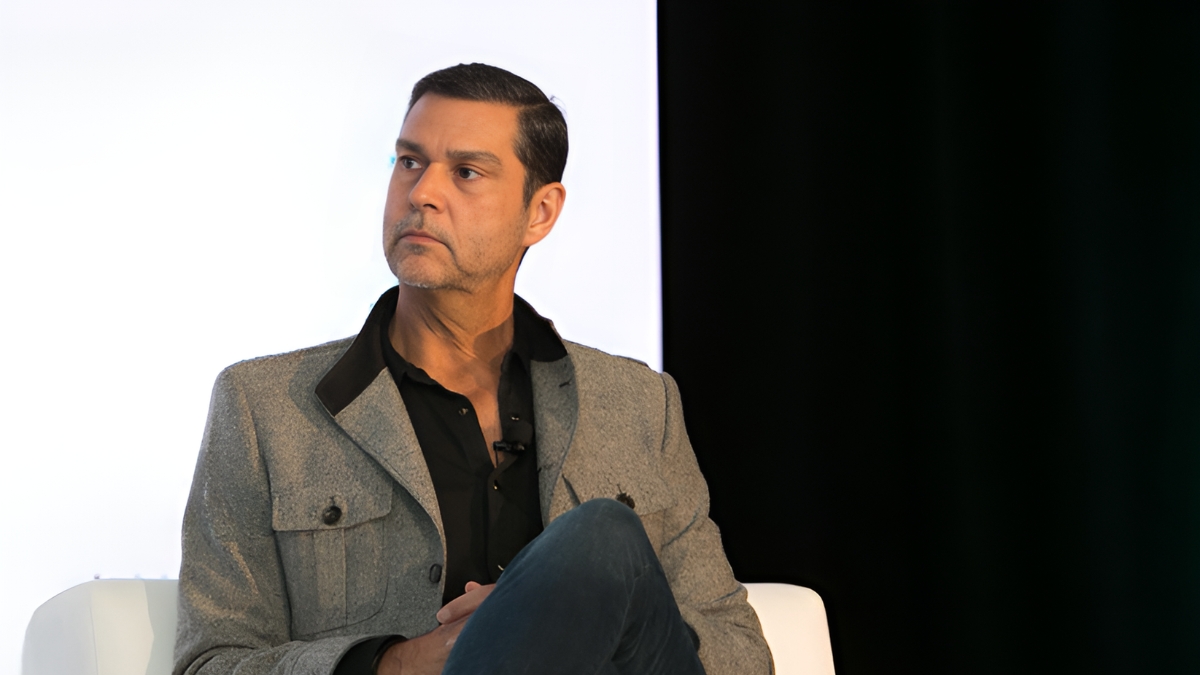

In this bullish market sentiment, a top digital asset Solana (SOL) once again outperforms BNB (BNB) and becomes 4th biggest crypto asset by market capitalization. Following SOL’s impressive performance, a YouTube video of Raoul Pal, CEO of Real Vision and a well-known financial analyst has made an unexpected and bold move in the cryptocurrency market capturing the massive attention of investors and traders

Raoul Pal’s Crypto portfolioIn a recent

podcast, Pal said that he has shifted 90% of his liquid assets into Solana (SOL), departing from his previous focus on Bitcoin (BTC) and other altcoins. However, Pal in his podcast also added, that, “90% of my liquid network is basically allocated right now to Solana. I don’t have much Bitcoin right now. It doesn’t mean that I don’t like Bitcoin; I think the others will go up more, simple as that.”Pal’s confidence in Solana is backed by its strong market performance. Year-to-date, Solana has surged approximately 75%, significantly outpacing Bitcoin and Ethereum, which posted gains of 58% and 42%, respectively. Pal sees Solana’s trajectory as reminiscent of Ethereum’s explosive growth in 2018, suggesting that Solana could experience similar significant increases in value.

A major factor contributing to Pal’s strategic shift is Solana’s user experience, which he compares favorably to Apple’s ecosystem. “The comparison is like Android versus Apple. Solana feels like Apple; it’s a closed system, but it is very slick, very good, and will create great loyalty.

Ethereum is much broader, much more open in terms of other things that can be built on top of it,” Pal explained. This analogy highlights Pal’s belief in Solana’s potential to attract and retain users through its efficient and well-designed platform.

Pal’s move comes at a pivotal moment for the cryptocurrency markets, which are gearing up for a new phase of growth and adoption. He refers to this anticipated surge as the “Banana Zone,” predicting it will trigger widespread excitement and investment mania.

Investors’ interest in SolanaAdding to the excitement around Solana, Franklin Templeton, a global asset management giant with over $1.64 trillion under management, has recently shown interest in Solana. This favor has fueled speculation about a potential Solana exchange-traded fund (ETF), which could provide a regulated pathway for institutional investors to gain exposure to the cryptocurrency.

However, the path to a Solana ETF is not without obstacles. One significant challenge is the absence of a CME futures market for Solana, a factor typically considered by the US Securities and Exchange Commission (SEC) when evaluating ETF applications.

Despite these regulatory challenges, Pal’s strategic shift highlights a broader trend in the crypto market. Investors are increasingly seeking assets with high growth potential and excellent user experiences, positioning Solana as a promising contender alongside established cryptocurrencies like Bitcoin and Ethereum. Pal’s move signals a significant development, highlighting Solana’s growing importance in the evolving cryptocurrency landscape.