Reef price rebounds as futures open interest hits 2-year high

REEF

REEF

BULLISH

BULLISH

2024

2024

FLUX

FLUX

FLX

FLX

Reef token rose for five consecutive days as demand in the spot and futures market rose after it was delisted by Binance.

Reef (REEF) rose to a high of $0.0012 on Sept. 3, marking its highest point in a month and 106% above its lowest point last month. This recovery brings its market cap to over $25 million.

Reef’s recovery followed the launch of a new community developer fund by its developers, aimed at supporting projects related to lending protocols, hardware wallets, DAO infrastructure, and bridge integrations.

Reef’s rally led to a sharp increase in investor demand. Data from CoinGecko shows that the 24-hour trading volume jumped to $45 million on Tuesday, up from $23 million on Sept. 1, marking its highest point in nearly a month.

Additionally, Reef’s open interest in the futures market soared to $60 million, its highest level in two years, significantly higher than August’s low of $3 million.

Notably, Reef’s rebound occurred after the token was delisted by Binance, the most popular crypto exchange. Typically, cryptocurrencies tend to retreat after being delisted by tier-1 exchanges.

Data indicates that most of the trading is happening on Gate.io, followed by HTX, KuCoin, and Bitget.

You might also like: Flux token spikes 24% amid debut on Binance futures

Reef price crosses key resistance

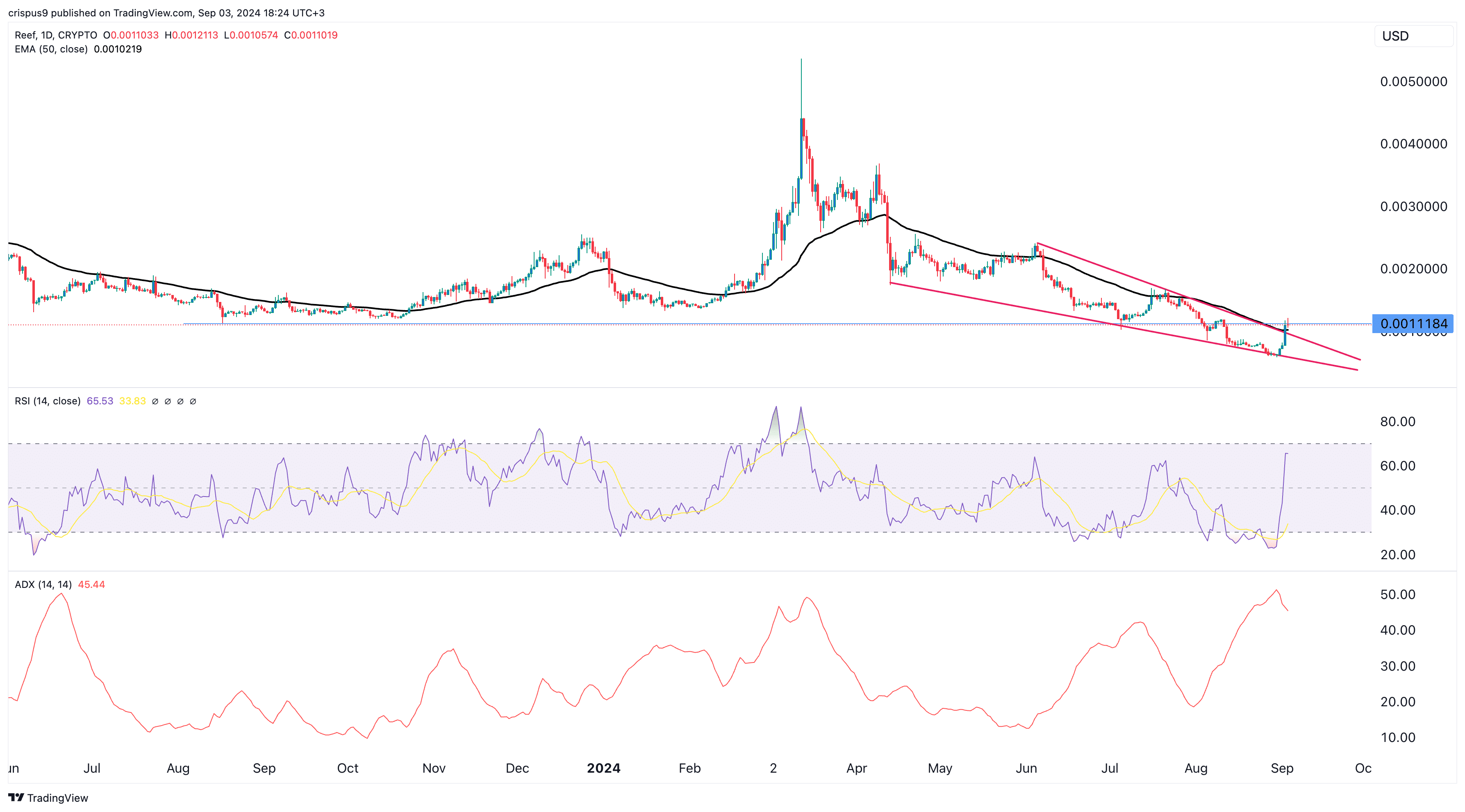

Reef rose to a high of $0.0013, crossing the important resistance point at $0.0011, its lowest swing in August last year.

Before its rebound, Reef formed a falling wedge pattern, a popular bullish reversal indicator. The token has now rallied above the 50-day moving average, while the Relative Strength Index is nearing the overbought level of 70. The RSI is a momentum indicator that measures an asset’s rate of change.

The Average Directional Index, which measures the strength of a trend, was at 50 and pointing downwards. Therefore, the token will likely retreat briefly as traders take profits before potentially resuming the bullish trend.

You might also like: Binance saw $3.7b worth of BTC, ETH leave in 30 days