Sui’s DeFi Total Value Locked Grew 42%, Reaching $1 Billion, Supported By Protocol Enhancements And SUI Price Surge

VALU

VALU

DEFI

DEFI

USDC

USDC

SUI

SUI

CAP

CAP

- Sui Reduced Consensus Latency To 390 Milliseconds With Mysticeti, Handling 100,000 Transactions Per Second, Boosting Network Efficiency.

- Integration With Circle’s USDC And CCTP Contributed To A 139% Increase In Sui’s Market Cap To $4.8 Billion.

Throughout 2024, the Sui blockchain has marked considerable progress with technical enhancements and strategic partnerships that have substantially augmented its standing within the decentralized finance (DeFi) sector.

The adoption of the Mysticeti consensus mechanism notably improved the network’s efficiency, slashing consensus latency to 390 milliseconds at a capacity of 100,000 transactions per second. This upgrade has significantly enhanced Sui’s transaction handling capabilities, positioning it as a competitive entity in the blockchain arena.

Sui’s recent growth can be attributed to its integration with Circle’s USDC and plans to integrate with Circle’s Cross-Chain Transfer Protocol (CCTP).

These integrations have enhanced Sui’s functionality and compatibility with established cryptocurrency frameworks.

The effective implementation of these features led to a 139% increase in Sui’s market value this quarter, raising its market cap to $4.8 billion and placing it 21st globally among cryptocurrencies.

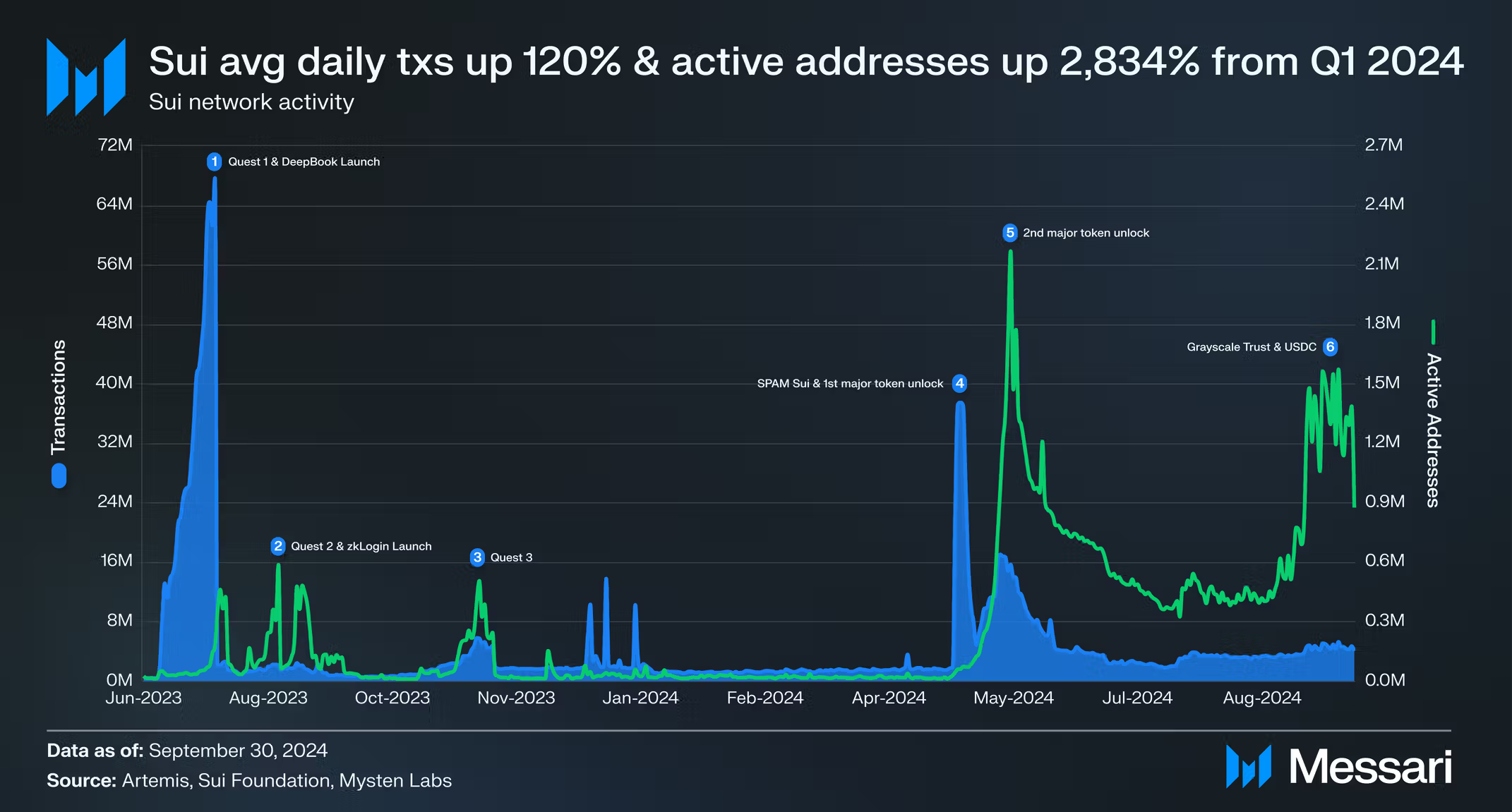

The platform witnessed a significant uptick in activity, with active addresses reaching a peak of 2.2 million on May 30, 2024, coinciding with a token unlock that released 9.3% of total tokens. This event significantly spurred trading and transfer activities, underlining a dynamic user engagement within the Sui ecosystem.

Moreover, Sui’s DeFi total value locked (TVL) saw an impressive 42% growth, amounting to $1 billion over the last two quarters. This rise was fueled by enhancements and funds introduced by DeFi protocols such as NAVI, Scallop, and Cetus, as well as a significant appreciation in SUI’s token value, which surged by 117.1% from the second to the third quarter of 2024.

The period also observed robust venture capital activity, with projects on Sui raising $16.3 million in the second and third quarters of 2024, marking a 41.7% increase from previous periods. This investment influx highlights growing investor confidence and the platform’s potential for long-term growth.

Despite a general market downturn in the second quarter, where the total cryptocurrency market dipped by 16.4%, Sui distinguished itself by rebounding robustly in September.

Its market cap witnessed an approximate 133.3% increase throughout the month, facilitated by strategic integrations and new product launches such as the Grayscale Sui Trust.

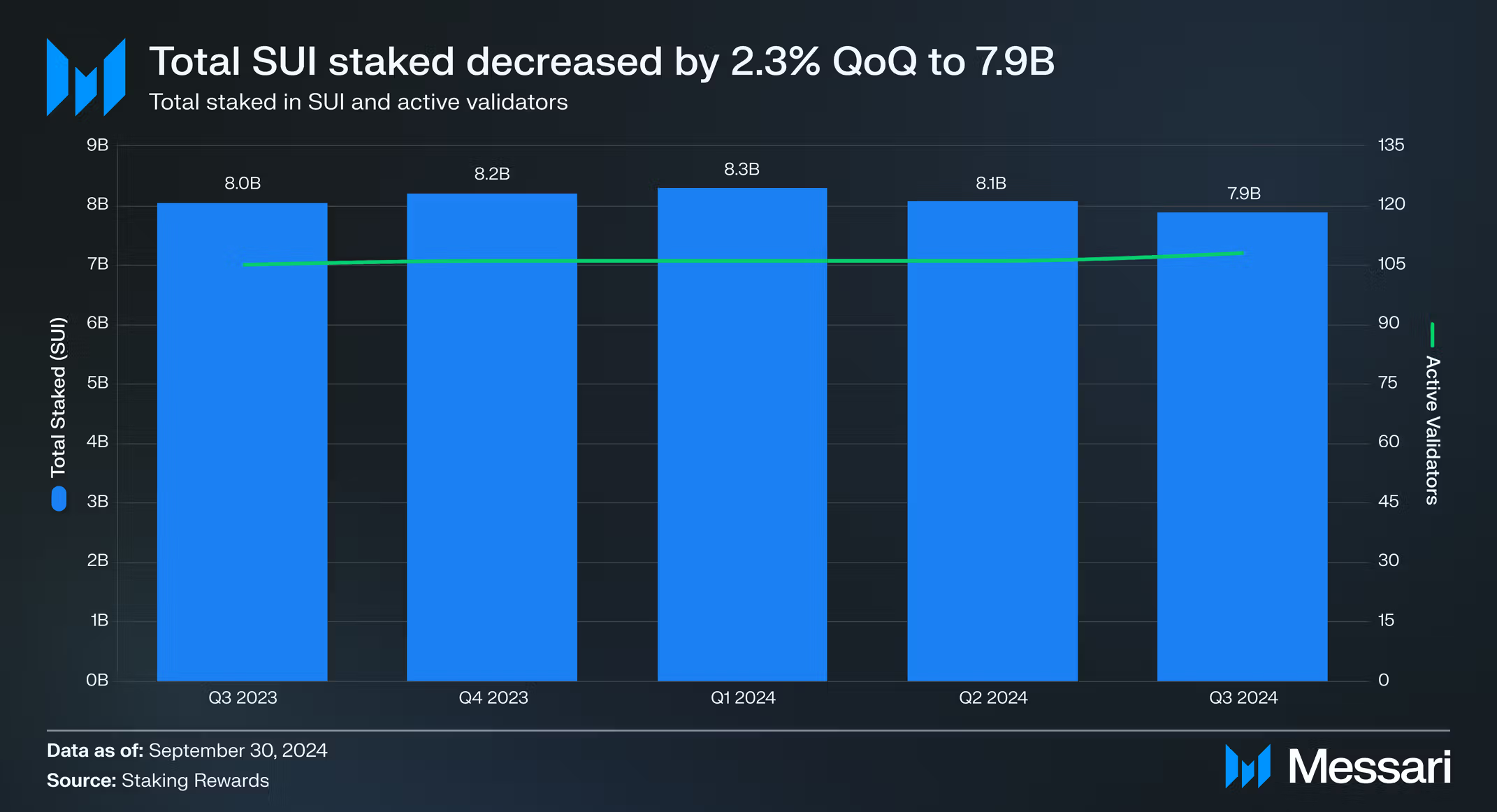

In terms of network economics, Sui’s model of transaction fees, which includes computation and storage costs, saw its quarterly fees hit a peak of $1.1 million in Q2 2024 due to a surge in transaction activity following the token unlocks. However, as activities normalized, the fees saw a quarter-on-quarter reduction of 31.8%.

SUI (Sui) is currently trading at $3.20 USD, showing a daily increase of 0.38%. Over the past month, it has surged by 78.70%, and in the last six months, its price has risen by 215.51%, indicating a strong recovery and momentum in its market performance.

Year-to-date, SUI has gained an impressive 313.53%, and it has seen a 404.47% increase over the last year, solidifying its position as one of the top-performing tokens in the crypto market.

Key Metrics:

- Market Cap: $9.11 billion USD

- 24-hour Trading Volume: $1.68 billion USD

- All-Time High: $3.94 USD

- Circulating Supply: 2.85 billion SUI

- Max Supply: 10 billion SUI

Technical Overview:

SUI recently faced a two-hour network outage but managed to maintain price stability above the $3 mark. Its price is approaching resistance near the $3.50 – $4.00 USD level, which has been a significant barrier historically.

Breaking through this resistance could see the token test higher levels, while immediate support lies around $3.00 USD, which needs to hold for the bullish momentum to continue.

SUI’s integration into DeFi and its partnerships, like the recent collaboration with Franklin Templeton, are contributing to its growing adoption and increasing trading activity. Traders should watch for confirmation of a breakout above $3.50 or signs of consolidation near $3.00 for clearer market direction.

Potential Trades:

Long Opportunities:

- Entry near $3.00 USD: If the price holds the equilibrium, enter long positions targeting $3.50 USD or higher. Stop-loss: Below $2.90 USD.

- Breakout above $3.80 USD: Enter on confirmation of a breakout, targeting $4.00 – $4.50 USD. Ensure volume supports the move.

Short Opportunities: - Rejection at $3.50 USD: If the price continues to face resistance, short positions targeting $3.00 USD could be viable.

- Stop-loss: Above $3.60 USD.

- Breakdown below $3.00 USD: Short positions targeting $2.60 USD. Monitor for demand in the discount zone.

The post Sui’s DeFi Total Value Locked Grew 42%, Reaching $1 Billion, Supported By Protocol Enhancements And SUI Price Surge appeared first on ETHNews.