The Massive Shift in Bitcoin ETF Investments Following Trump’s Trade Announcement

SHIFT

SHIFT

ETF

ETF

ETF

ETF

BTC

BTC

ETF

ETF

You can also read this news on COINTURK NEWS: The Massive Shift in Bitcoin ETF Investments Following Trump’s Trade Announcement

On April 3, the last trading day for spot Bitcoin ETFs in the U.S., there was a net outflow of nearly $100 million. This outflow was primarily influenced by President Donald Trump’s announcement of new tariffs on imports. The markets reacted with shock to this decision, resulting in significant declines in both traditional stocks and the cryptocurrency market. The largest cryptocurrency, Bitcoin (BTC) , lost over 6% of its value following the announcement.

Grayscale and Bitwise Lead the Exits

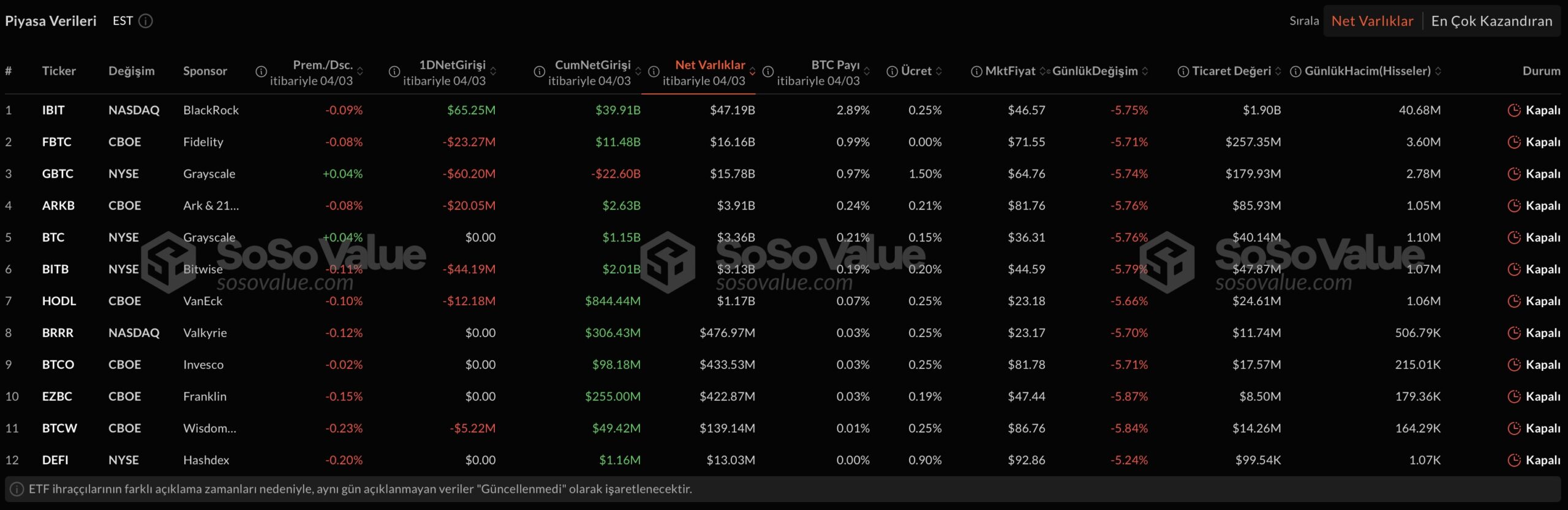

According to SoSoValue data, a total of $99.86 million flowed out of spot Bitcoin ETFs on April 3. Leading this exodus was Grayscale’s GBTC product, which saw an outflow of $60.2 million. Following closely were Bitwise’s BITB with $44.19 million and Fidelity’s FBTC, which recorded $23.27 million in outflows. Notable exits were also seen from Ark and 21Shares’ ARKB fund, VanEck’s HODL ETF, and WisdomTree’s BTCW product.

In contrast, BlackRock’s IBIT fund distinguished itself with a net inflow of $65.25 million. This made IBIT the only spot Bitcoin ETF to record a net inflow during the day. Currently, BlackRock’s IBIT fund stands as the largest spot Bitcoin ETF by net asset size.

Following the over $200 million inflow on April 2, this sharp directional shift in ETFs highlights how sensitive investors are to sudden economic developments. The significant outflows from major players like Grayscale are particularly concerning from the perspective of investor confidence.

Trump’s Tariff Announcement Shakes Markets

Donald Trump’s tariff announcement on April 2 heightened tensions in global trade. The President stated that a base tariff of 10% would be imposed on imported goods, with some countries facing rates exceeding 50%. Following this announcement, panic spread through U.S. stock markets.

The Nasdaq index dropped by 6%, while the S&P 500 fell by 4.8%. The Dow Jones closed the day with a 3.9% loss. This sharp decline in financial markets directly affected the cryptocurrency market. Bitcoin swiftly declined by over 6% and was trading around $83,220 at the time of writing, marking a daily drop of 0.13%.

Ethereum (ETH) also faced losses, with a 1% drop bringing it down to $1,805. Additionally, spot Ethereum ETFs underperformed, recording a $3.59 million outflow on April 3, following a significant outflow of $51.24 million the day before.

While cryptocurrency investors typically seek safe havens against uncertainties in the traditional financial system, such large-scale macroeconomic decisions can have immediate effects. Investments through ETFs are particularly sensitive to shifts in market direction.

The post The Massive Shift in Bitcoin ETF Investments Following Trump’s Trade Announcement appeared first on COINTURK NEWS.