Top Crypto Gainers Today Jun 13 – Toncoin, Lido DAO, Bittensor, Ontology Gas

TAO

TAO

LDO

LDO

ONT

ONT

GAS

GAS

ONG

ONG

For more than two years, the prospect of higher interest rates has impacted the crypto market. However, in mid-2023, the Federal Reserve’s direction shifted. In eight of its last nine meetings, including one on June 12, the Fed held rates steady after raising them 11 times. Analysts now expect rates to move lower as inflation, which hit 3.3% in May, comes under control.

Higher rates and recession fears are losing their grip on the crypto market. Cryptocurrency prices, which struggled during the rate hikes, have rebounded significantly. The anticipation of lower rates has boosted assets like Bitcoin and Ethereum, with Bitcoin hitting an all-time high in March. This renewed optimism suggests investors are increasingly confident in a soft economic landing.

Biggest Crypto Gainers Today – Top List

Several projects are making significant strides in today’s crypto market, capturing investor attention with innovative solutions and impressive market movements. We will spotlight these top gainers: Toncoin, Lido DAO, Bittensor, and Ontology Gas. Each of these cryptocurrencies demonstrates robust price growth and brings unique features to blockchain.

Toncoin, with its seamless integration into Telegram’s Web3 vision, showcases groundbreaking scalability through multi-level sharding. Lido DAO continues simplifying staking with its liquid solutions, expanding Ethereum’s ecosystem. Bittensor merges blockchain with AI, pioneering a decentralized intelligence network, while Ontology Gas leverages a dual-token model to enhance digital identity and data management. Join us as we dig into what makes these projects stand out.

1. Toncoin (TON)

Toncoin is the native cryptocurrency of The Open Network (TON), a decentralized layer-1 blockchain. Various contributors, including the Switzerland-based TON Foundation, support this open-sourced blockchain. Their vision is to empower 500 million users to own their digital identity, data, and assets by 2028. They aim to build a Web3 ecosystem within Telegram Messenger.

TON is unique due to its multi-level sharding structure, which allows the network to perform numerous simultaneous, ultra-fast transactions. This scalability ensures transactions remain cheap and fast. Telegram has endorsed TON as its official Web3 infrastructure, aiming to integrate and promote the TON-based ecosystem within Telegram.

Toncoin utilizes a proof-of-stake (PoS) consensus mechanism for transaction validation. Validator rewards are paid in Toncoin, and nominators can also provide tokens to validators for rewards. Smart contracts manage validators and nominators, executed using the TON Virtual Machine (TVM), adding extra network protection.

🔈 @travalacom, a leading crypto-native travel booking service with 2.2M+ properties and 400K+ activities worldwide, has integrated with #TON!

You can now book millions of hotels, flights, and fun activities all around the world and pay with $TON and $USDt on TON! ✈️🌴😎

Learn… pic.twitter.com/kVwYbJcsH1

— TON 💎 (@ton_blockchain) June 12, 2024

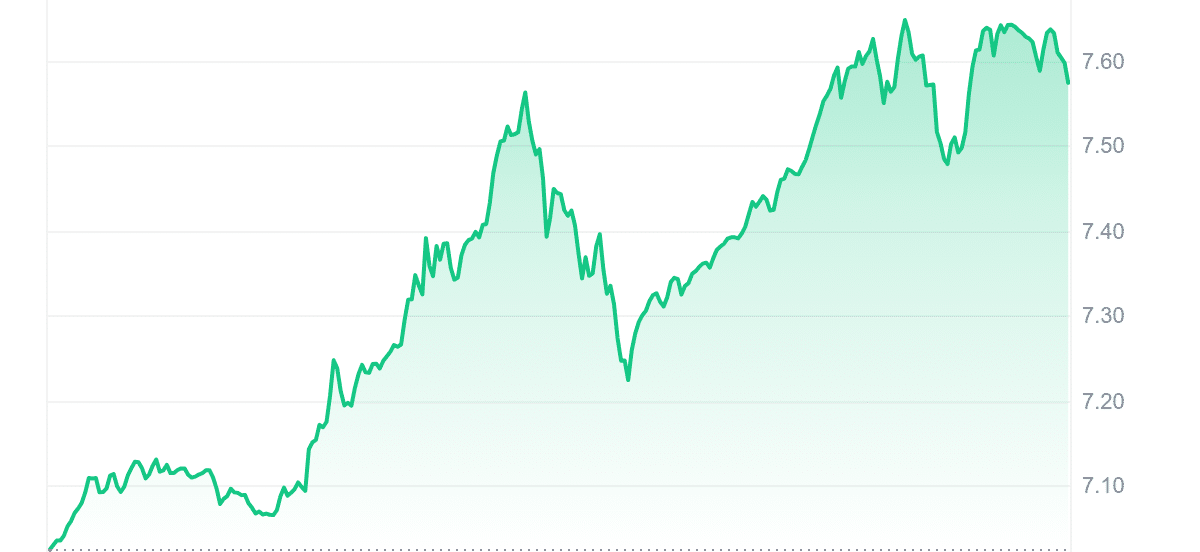

TON is valued at $7.56, up 6.11% in the past 24 hours. Its price has surged by 395% over the last year, outshining 80% of the top 100 crypto assets. Trading 273.12% above its 200-day Simple Moving Average (SMA) of $2.03, the 14-day Relative Strength Index (RSI) is at 47.69, showing a neutral trend. Over the last 30 days, Toncoin had 13 green days, with volatility low at 6%. With a market cap of $26.30 billion and a 24-hour volume of $539.63 million, Toncoin has a medium liquidity ratio of 0.0205.

2. Lido DAO (LDO)

Lido DAO is a decentralized autonomous organization that provides staking infrastructure for various blockchain networks. Its most notable offering is a liquid staking solution for Ethereum, enabling users to stake their ETH and receive stETH tokens in return. These stETH tokens represent the user’s staked ETH and accrue staking rewards.

LDO holders participate in governance proposals and vote on critical decisions such as board adjustments, new integrations, and platform updates. Lido’s liquid staking model negates the need for users to have technical expertise or a minimum amount of 32 ETH to run their validator, making staking accessible to a broader audience.

Lido’s platform uses smart contracts on Ethereum to manage deposits and distribute rewards. It supports staking for Ethereum and Polygon, enhancing network security and offering users flexible, liquid staking options.

Introducing advanced DeFi strategies for stETH with Mellow & Symbiotic ✨ https://t.co/dzmYEFY8dM

A new initiative to provide stETH holders with access to new DeFi opportunities, including restaking. pic.twitter.com/KRIqIPzvAa

— Lido (@LidoFinance) June 11, 2024

Also, the Lido protocol ensures security through decentralized governance, audited code, and robust smart contracts. Several third-party security firms have audited Lido’s contracts to identify and address vulnerabilities, reinforcing the platform’s reliability.

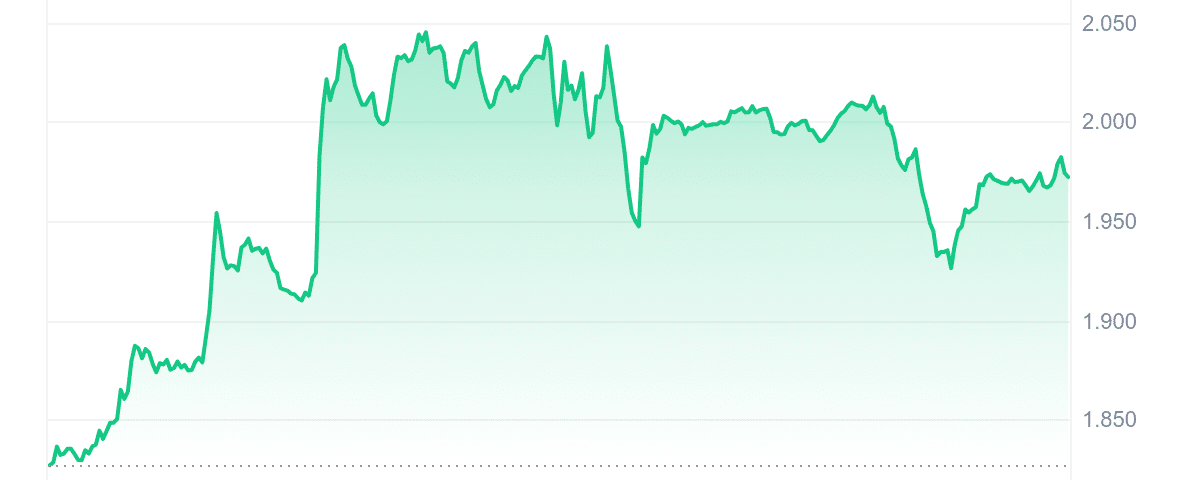

LDO is making waves at $1.97, jumping 6.60% in the past 24 hours. However, it climbed 10% over the past year, surpassing only 16% of the top 100 crypto assets. Trading slightly above its 200-day SMA at 0.25%, its 14-day RSI of 51.64 signals neutral momentum. In the last 30 days, LDO saw 12 green days and maintained a stable 14% volatility. Its high liquidity ratio of 0.1573 underscores robust market activity.

3. PlayDoge (PLAY)

PlayDoge is a new multichain Play-to-Earn (P2E) meme coin that raised over $4 million two weeks into its presale. The project recently added Ethereum staking to its original option on the BNB Chain, which remains its primary base. The presale offers tokens for a fraction over half a cent, potentially securing the lowest price for the year.

The PlayDoge game provides a nostalgic experience where players earn XP by caring for their virtual Shiba Inu and participating in mini-games. The most attentive players receive bonus $PLAY tokens and exclusive rewards. Unlike the original Tamagotchi, PlayDoge is easier to manage. Players can also earn $PLAY through staking, with early participants enjoying an APY of 242% on Ethereum and 88% on BNB Chain, enhancing the game’s appeal.

PlayDoge’s presale allocates 50% of its 9.4 billion token supply to early investors and 12% to staking. With its smart contract fully audited by SolidProof and a potential Binance listing, $PLAY is positioned for significant growth. Joining the presale is simple, with buying options using BNB, ETH, USDT, or credit cards. Combining elements of meme coins, P2E gaming, and nostalgic game remakes, PlayDoge stands out in the market.

4. Bittensor (TAO)

Bittensor is an innovative platform combining blockchain technology with machine learning. It creates a decentralized network for developing, sharing, and monetizing AI. Bittensor utilizes a peer-to-peer intelligence market, which enables collaborative training of machine learning models.

Contributors are rewarded with TAO tokens based on their informational value. The native cryptocurrency, TAO, not only incentivizes participation but also grants users access to the network’s collective intelligence, enabling tailored use of AI resources.

Bittensor’s security framework includes token-based incentives, anti-cheating protocols, hotkey security features, privacy protections, and open-source collaboration, all bolstered by decentralized governance. This ensures a fair, secure, and resilient environment for AI development. Ultimately, Bittensor aims to create an incentivized and trustless marketplace for AI, fostering open and permissionless innovation on a global scale.

Compute is expensive, but one of Bittensor's subnets is making it cheap.

Subnet 12 "Compute Horde" is competing with the biggest compute providers using the Bittensor network.

Watch this weeks Novelty Search podcast here: https://t.co/GFvGhw7O4i pic.twitter.com/cZDYb3N0oL

— Openτensor Foundaτion (@opentensor) June 9, 2024

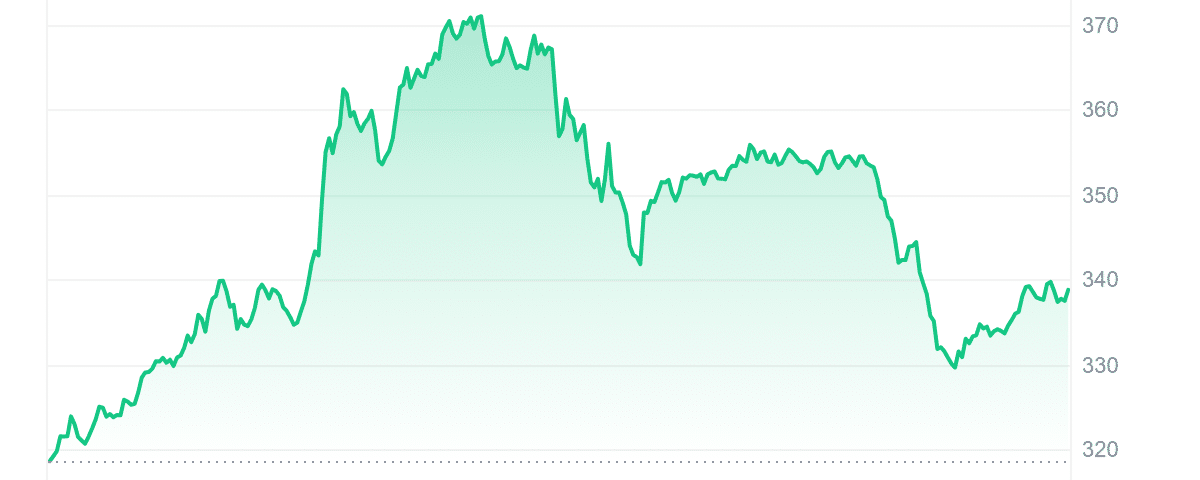

The price of its native token, TAO, has reached $338.33, marking a 5.68% increase in the last 24 hours. Over the past year, TAO’s price has surged by 511%, beating 83% of the top 100 crypto assets by market cap. Additionally, TAO is trading 177.04% above its 200-day SMA, which is $122.07.

Bittensor’s market cap is $2.31 billion, and its 24-hour trading volume is $63.72 million, indicating medium liquidity and a volume-to-market cap ratio of 0.0276. It has remained stable despite market volatility, with a 30-day volatility rate of 8% and 11 positive trading days out of the last 30.

5. Ontology Gas (ONG)

Ontology is a high-performance, open-source blockchain specializing in digital identity and data management. Its robust infrastructure supports cross-chain collaboration and Layer 2 scalability, allowing businesses to create customized blockchain solutions that meet their needs.

It includes vital components like ONT ID, a mobile digital ID application, and a decentralized identity (DID) framework. It features DDXF, a decentralized data exchange framework, and ONTO, a self-sovereign data wallet. SAGA, a decentralized data marketplace, and Wing, a DeFi platform for borrowers and creditors, are also part of the ecosystem.

Ontology employs a dual-token model with ONT and ONG to mitigate volatility risks. ONT is used for staking, while ONG anchors the value of on-chain applications and facilitates transactions. This separation ensures that fluctuations in the native asset value do not impact the gas fees required for network operations.

Did you know running a Candidate Node for @OntologyNetwork does not require any server running 24/7? 🤯

Find out here how you can run your own Node for Ontology!

⚡️How to Sign Up to Run an Ontology Node⚡️https://t.co/hsteaET8YL#ONT #Ontology #DID #Web3 #ONTID @ONTOWallet

— Ontology Node Australia – ONT Australia (@OntologyAU) June 11, 2024

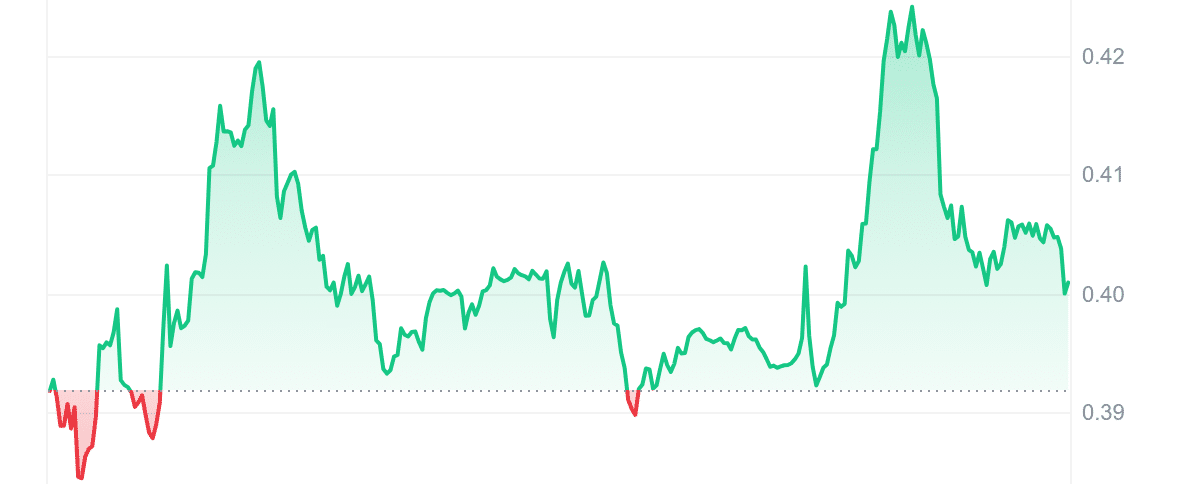

ONG is priced at $0.402902, up 2.78% in the last 24 hours. Its price surged 99% over the past year, outdoing 49% of the top 100 crypto assets. ONG trades 20.16% above its 200-day SMA of $0.334937, indicating an upward trend.

The 14-day RSI is 46.58, suggesting a neutral market stance. In the last 30 days, ONG had ten green days, with volatility of 9%, indicating stability. With a market cap of $152.79 million and a 24-hour volume of $143.74 million, ONG has a high liquidity ratio of 0.9408.