Top Crypto Gainers Today Jun 24 – Cream Finance, Artrade, Ontology Gas, LimeWire

CREAM

CREAM

CRM

CRM

LMWR

LMWR

ONT

ONT

ONG

ONG

The crypto market took a significant hit last week, marking its second-largest decline of 2024. Bitcoin dropped to $62,440, hitting a low not seen in over a month, as outflows from US ETFs continued to impact sentiment. Analysts warn that these developments reflect broader risk aversion.

Moreover, low volatility and challenges in maintaining market balance during price movements exacerbate the situation. Despite anticipating upcoming US ETFs for Ether and Solana, both cryptocurrencies also faced prolonged weekly declines. This trend unmistakably signals investor caution amidst the allure of competitive traditional investments such as stocks and bonds.

Biggest Crypto Gainers Today – Top List

Despite the overall market downturn, some cryptocurrencies managed to buck the trend with significant gains today. Cream Finance, a decentralized DeFi lending protocol, surged 9.61% to $77.85, highlighting its resilience in the DeFi sector amid market volatility. Artrade, focused on reshaping the art market with blockchain and NFT technology, saw a 5.04% increase to $0.012853, reflecting the growing interest in digital art transactions.

Ontology Gas, integral to Ontology blockchain for digital identity and data management, rose by 1.98% to $0.363783. LimeWire Token surged by 16.37% to $0.406944, emphasizing its role in transforming the creative industry amidst broader market fluctuations. Let’s dig into the specifics of these top gainers.

1. Cream Finance (CREAM)

C.R.E.A.M. Finance is a decentralized DeFi lending protocol within the yearn.finance ecosystem. It operates on Ethereum, Binance Smart Chain, Polygon, and Fantom, offering various financial services. The platform is open-source, permissionless, and blockchain-agnostic, emphasizing accessibility and inclusivity. C.R.E.A.M. Finance supports crucial DeFi assets, including major stablecoins, governance tokens, and leading cryptocurrencies.

The platform uses automated market making (AMM) to provide liquidity, enabling users to borrow and lend supported assets while earning liquidity mining rewards in CREAM tokens. By supplying collateral, users can participate in yield farming. C.R.E.A.M. Finance collects swap, lending, and borrowing fees, creating a sustainable ecosystem.

Staking CREAM tokens for up to four years allows users to accrue rewards, accessible only at the end of the staking period, ensuring long-term commitment and security. As an ERC20 token on Ethereum, CREAM supports Ethereum Virtual Machines through smart contracts, facilitating decentralized autonomous organizations (DAOs).

C.R.E.A.M. Markets are coming to @Blast_L2 to enable advanced native-yielding DeFi farming strategies on Blast.

Users can supply and borrow assets for their DeFi farming needs while choosing to hold major assets of their choice. pic.twitter.com/P8UlkpbaST

— Cream Finance 🍦 (@CreamdotFinance) June 7, 2024

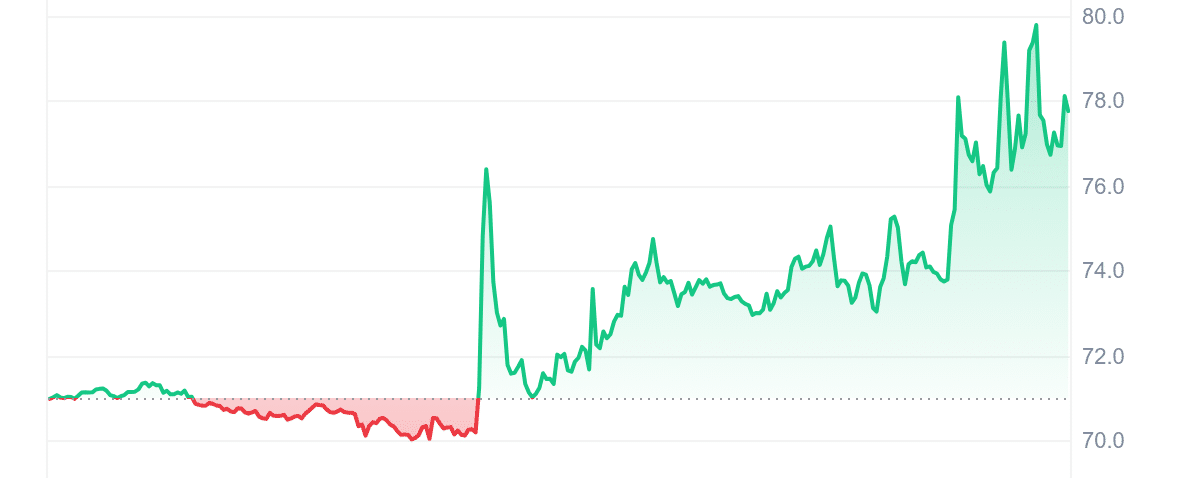

CREAM is making waves with its current price of $77.85, up 9.61% in just 24 hours. The project boasts impressive liquidity, with a market cap of $144.85M and a 24-hour volume of $5.23M. Even more striking, it trades at a remarkable 372.01% above its 200-day SMA of $16.54. Over the past year, the price surged by 120%, outperforming 69% of the top 100 crypto assets. With 14 green days in the last 30 and a low volatility of 5%, its performance is both steady and promising.

2. Artrade (ATR)

Artrade is revolutionizing the art market with blockchain technology, enhancing security, transparency, and liquidity in art transactions. The platform’s decentralized and immutable ledger eliminates intermediaries, ensuring the authenticity and traceability of each art piece. By incorporating NFT technology, Artrade facilitates direct and secure transactions between art enthusiasts, collectors, and creators, addressing the art market’s historical liquidity challenges. Artrade’s DAO commits 51% of its tokens to supporting emerging artists and advancing blockchain and NFT technology.

ATR tokens form the backbone of Artrade’s community engagement and governance. Token holders benefit from a strategic staking plan that offers APY, initially fueled by a reserve allocation and later by platform fees. A burn program aligns the number of tokens burned with the rewards distributed, enhancing the token’s scarcity and value. Additionally, ATR tokens grant access to exclusive platform features, badges, and benefits, incentivizing active participation.

Difference beteen $ATR and $PABLO?

TL;DR$ATR: Artrade’s Currency $PABLO: Artrade’s Product

Launching $PABLO does not mean liquidating $ATR. Each serves a unique function within Artrade.

Details 👇 pic.twitter.com/hnm8koQnDf

— Artrade (@ArtradeApp) June 10, 2024

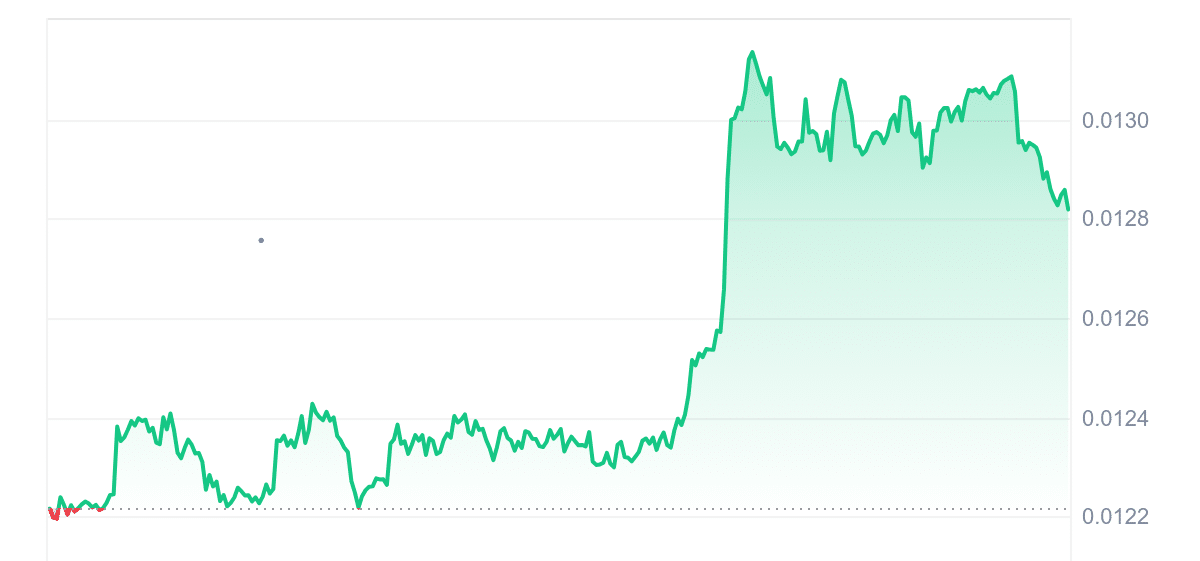

ATR is performing impressively in the cryptocurrency market, with a current price of $0.012853 and a 5.04% increase in the last 24 hours. The high liquidity, indicated by a volume-to-market cap ratio of 0.0984, reflects robust market activity. Despite a neutral 14-day RSI of 64.96 suggesting potential sideways trading, Artrade’s low 30-day volatility of 19% provides a stable investment environment. Significantly, ATR is trading 681.99% above its 200-day SMA of $0.001644, showcasing substantial growth. Over the past year, Artrade’s price surged by 580%, outperforming 96% of the top 100 crypto assets.

3. PlayDoge (PLAY)

Introducing PlayDoge, the latest sensation in play-to-earn (P2E) meme coins already smashing records. In a whirlwind presale, PlayDoge surged past the $5 million mark, kicking off with a lightning-fast $200,000 raised in mere minutes. With its valuation skyrocketing 25x since, PlayDoge is poised to challenge titans in the meme coin arena, if not surpass them altogether.

Built on the Binance Smart Chain (BSC), PlayDoge is strategically positioned for a coveted listing on Binance, the globe’s premier centralized exchange. Additionally, a recent announcement reveals $PLAY’s availability on Ethereum and BNB chains, ensuring seamless transactions. However, BNB Chain remains central to its innovative 8-bit P2E game.

What sets PlayDoge apart is its unique blend of meme coin allure and nostalgic 90s gaming vibes. Players can own and nurture a virtual Shiba Inu, engaging in Tamagotchi-style interactions while earning $PLAY tokens as rewards. As the presale continues, savvy investors still have a chance to grab tokens at a bargain, currently priced at $0.00512, before the next increase.

Investors not only secure tokens at favorable presale rates but also actively engage in PlayDoge’s staking program, offering a robust 134% Annual Percentage Yield (APY). Furthermore, PlayDoge’s smart contract has undergone rigorous auditing by SolidProof, ensuring robust security and reliability for all participants.

4. Ontology Gas (ONG)

Ontology Gas is a crucial utility token within the Ontology blockchain ecosystem designed to excel in digital identity and data management. Ontology facilitates high-performance blockchain solutions focusing on interoperability and Layer 2 scalability, allowing businesses to tailor blockchain applications to their specific requirements.

The platform features ONT ID, a mobile digital identity application, and DDXF, a decentralized data exchange framework to enhance speed, security, and trust in data transactions. Ontology employs a dual-token model comprising ONT and ONG.

ONT serves as a staking tool within the network, supporting the operation and governance of nodes. Conversely, ONG is critical in transaction fees and utility within the ecosystem. It mitigates the volatility risks associated with ONT by serving as a stable unit for gas fees, ensuring consistency and predictability in transaction costs.

🚀 Exciting Collaboration Alert! @GT_Protocol joins forces with #Ontology 🌐💼 Discover a new era of decentralized fund management and investment! 🚀 https://t.co/JjJVgXsMwG pic.twitter.com/1KrA6OVqcF

— Ontology #BUIDL4Web3 (@OntologyNetwork) June 21, 2024

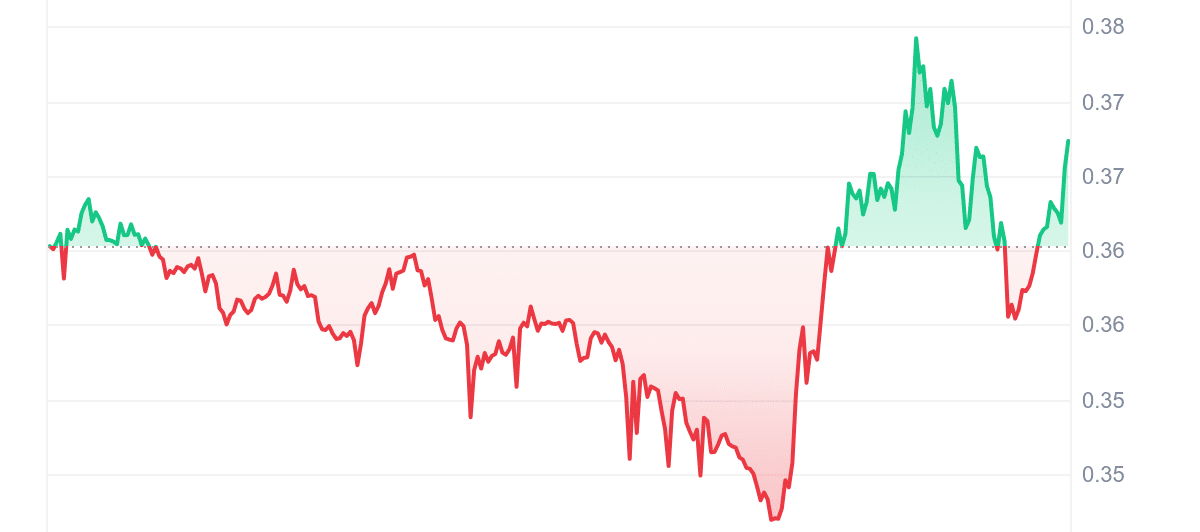

ONG is priced at $0.363783, up 1.98% in the last 24 hours, with high liquidity reflected in a volume-to-market cap ratio of 0.5626. The 14-day RSI is 46.58, indicating neutral market conditions, and ONG experienced 10 green days in the past 30, constituting 33% of the month. With a 30-day volatility of 12%, well below the 30% threshold, ONG trades 8.11% above its 200-day SMA of $0.334937. Over the past year, ONG’s price rose by 57%, yet it outperformed only 49% of the top 100 crypto assets by market cap, reflecting moderate performance compared to peers.

5. LimeWire (LMWR)

LimeWire is back with a bold vision to transform the creative industry. It offers a leading AI studio for generating image, music, and video content, complementing a vibrant social platform. The platform has amassed a massive community, boasting over 2 million Discord members. Additionally, LimeWire has facilitated the creation of 500+ million pieces of content through its advanced AI models.

Leveraging blockchain technology, LimeWire empowers creators to tokenize AI-generated content as NFTs. Furthermore, LimeWire rewards participants with LimeWire Token (LMWR) through its ad-revenue sharing program.

LimeWire’s strategic advantages are rooted in its globally recognized brand. This brand resonates deeply with users who recall its impact from the early 2000s. Additionally, LimeWire innovates with a multi-chain NFT strategy, enabling creators to choose their preferred blockchain for content ownership.

A second new listing in just one week 🚀$LMWR is now available on @bitvavocom, a leading European exchange with more than 1.5 million users and a monthly volume of over €10B 📈

Come and check it out here 👇 https://t.co/g45CkVYBQ0

— LimeWire (@limewire) June 20, 2024

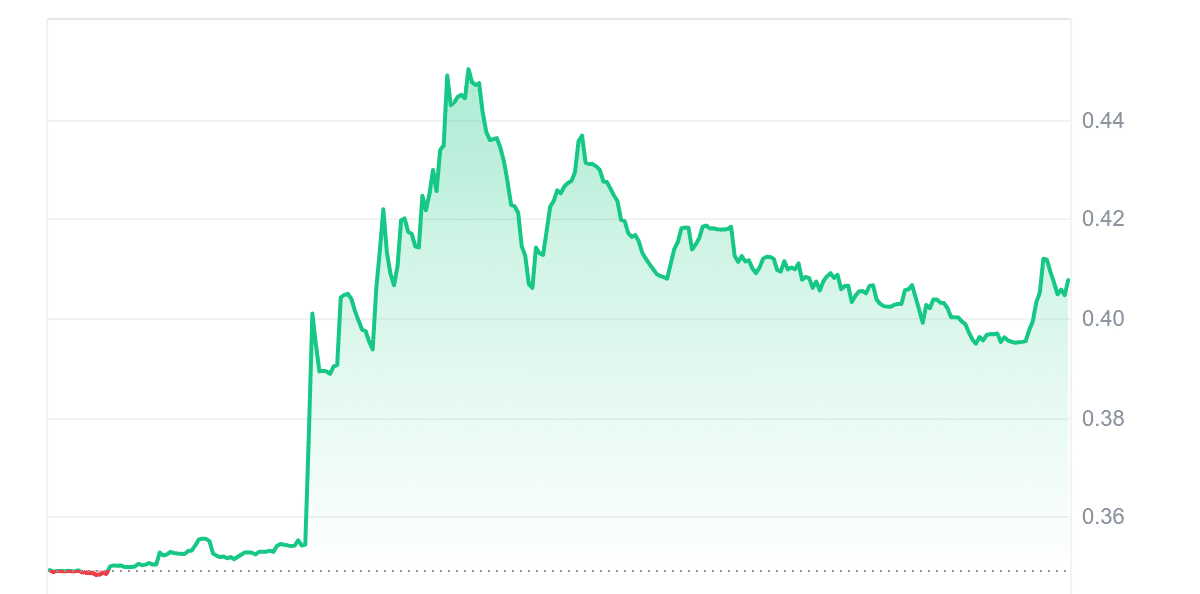

LMWR is priced at $0.406944, reflecting a 16.37% increase over the past 24 hours. With a 14-day RSI of 55.76, indicating neutrality, the cryptocurrency may experience sideways trading in the near term. Over the last 30 days, LMWR has seen 7 green days while maintaining a moderate 30-day volatility of 21%. Notably, it is trading well above its 200-day SMA, currently at 181.00%, with the price surging by 423% over the past year. This performance places LimeWire Token among the top-performing crypto assets, outperforming 90% of the top 100 by market cap in the same period.