Top Crypto Gainers Today May 13 – OctaSpace, Powerledger, Zeebu, Artrade

AI

AI

ATR

ATR

OCTA

OCTA

ZBU

ZBU

POWR

POWR

In the rapidly evolving global crypto market, advancements in blockchain technology continue to push boundaries. Lightning Labs, the developer behind Bitcoin’s Lightning Network, recently conducted successful tests. These tests are aimed at enabling stablecoin issuance on the Bitcoin blockchain.

During the Financial Times Crypto and Digital Assets Summit, Lightning Labs CEO Elizabeth Stark made a significant announcement. She highlighted the breakthrough in protocol, emphasizing its potential to address real-world problems. Moreover, she noted its capacity to attract more users to digital assets. This is good news for the crypto community as it broadens investment opportunities and expands cryptocurrency utility.

Biggest Crypto Gainers Today – Top List

Today’s crypto market is exciting as OctaSpace, Powerledger, Zeebu, and Artrade emerge as the top gainers. OctaSpace, transforming cloud computing and distributed services, surged 25.50% in the last 24 hours. Powerledger, leading the charge in sustainable energy markets, saw a surge of 11.97%, reflecting its growing influence. Meanwhile, Zeebu, disrupting telecom with a decentralized voice traffic exchange, reached a 2.79% surge during the same period. Lastly, Artrade democratizes the art market through blockchain and NFTs, showing a 1.56% increase in the same timeframe. Now, let’s take a closer look at the specifics of these gainers.

1. OctaSpace (OCTA)

OctaSpace is a cloud platform revolutionizing distributed computing, data storage, and VPN services. It offers easy accessibility and allows users to tap into global CPU and GPU resources. With OctaSpace, individuals and organizations can securely store data, process heavy tasks, and even earn by renting out spare hardware. Its decentralized infrastructure ensures enhanced security and privacy. This makes it an attractive option for industries prioritizing data protection.

OctaSpace’s versatile use cases span cloud computing, gaming, IoT, and AI sectors. Users can seamlessly integrate AI applications, securely manage IoT data, and offer decentralized server hosting solutions for gaming. This multifaceted platform caters to diverse industry needs, providing a cost-efficient and secure alternative to traditional cloud providers.

An Abstract Sphere Animation created by @motiongrapharsh and brought to life using OctaRender.#DePIN #Rendering https://t.co/TubykutiUh

— OctaSpace (@octa_space) May 12, 2024

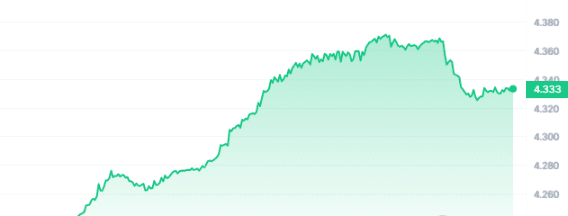

The performance metrics of OctaSpace are captivating, given its enticing figures. In the last 24 hours, OCTA has experienced a surge of 25.50%, reaching a current price of $2.03, and over the past year, it has seen a remarkable increase of 1,168%. It’s trading significantly above the 200-day SMA at $0.513699, indicating bullish solid sentiment. With a 14-day RSI of 31.99, OCTA demonstrates promising investment potential. Furthermore, its 50% positive trends in the last 30 days indicate favourable market sentiment. This is further supported by its relatively low volatility at 18%.

2. Powerledger (POWR)

Powerledger is a technology company pioneering distributed energy markets for a sustainable future. It facilitates energy tracking and trading through its blockchain-based platform, offering cheaper alternatives. With operations in over 10 countries, the POWR token is a license for various businesses. This includes utilities, renewable energy operators, microgrids, and property developers.

The Powerledger network empowers asset owners, ensuring secure transactions across monitored distribution networks. Supported by Ethereum wallets, POWR tokens secure transactions on Powerledger’s scalable blockchain, which is built on Solana software. Additionally, POWR tokens can be secured through hardware wallets, ensuring user control.

We are delighted to announce our collaboration with Greece's one of the largest energy companies @MytilineosSA, to introduce first of its kind clean energy PPA tracking and smart energy sourcing solutions in #Greece.

Learn more here: ⬇️https://t.co/tns6sfYFZS#NewPartnerships pic.twitter.com/vkL7VijuJh— Powerledger (@PowerLedger_io) April 17, 2024

POWR is priced at $0.340128, reflecting an 11.97% surge in the last 24 hours. Over the past year, the price has increased by 116%, outperforming market expectations. It is trading 9.16% above the 200-day SMA at $0.313693, thus exhibiting bullish momentum. The 14-day Relative Strength Index (RSI) stands at 43.16, suggesting a neutral market sentiment. Also, with 60% of the last 30 trading days yielding positive results, POWR demonstrates stability amidst volatility. Additionally, it boasts high liquidity, with a volume-to-market cap ratio of 1.2218, signalling robust market activity.

3. WienerAI (WAI)

WienerAI, the quirky yet innovative project, merges humour with cutting-edge AI trading technology. It aims to be every trader’s perfect companion with predictive features and an AI interface. At the same time, it will provide instant, user-friendly trading experiences. It charges zero fees and provides MEV protection against front-running bots as well. With these aspirations and over $1.6M raised, WienerAI is set to shake up the trading market.

Investors eyeing WienerAI’s potential will find its tokenomics and master plan particularly intriguing. The tokenomics allocates 30% to presale, allowing early investors to secure tokens at a discounted rate. Additionally, its master plan outlines strategic steps. These include a thorough marketing campaign, KOL blasts, and a planned token listing on global exchange platforms, marking the public launch of $WAI.

Thousands of people are bringing WIENER into their lives.

Will you join them?

🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖 pic.twitter.com/xmm2XFP3dQ

— WienerAI (@WienerDogAI) May 12, 2024

With 1 $WAI valued at $0.000706, swapping for WienerAI tokens is a breeze by connecting wallets. Investors can fund their purchases with ETH, BNB, MATIC, USDT, or bank cards. Furthermore, WienerAI incentivizes early investors through staking, offering high APY rewards. As WienerAI prepares for its worldwide launch, investors can engage with a unique project at the forefront of AI trading technology.

4. Zeebu (ZBU)

Zeebu aims to transform the telecom wholesale voice industry through decentralized voice traffic exchange. It leverages blockchain to introduce transparency and efficiency to voice traffic exchange. This reduces costs and enhances trust between buyers and sellers. With smart contracts and DeFi protocols, Zeebu ensures fast and secure transactions. Hence, this benefits both parties in the telecom wholesale ecosystem by eliminating intermediaries.

In recent news, Zeebu has celebrated a significant milestone, surpassing 1.5 billion blockchain transactions. This achievement underscores Zeebu’s resilience and adaptability in the Web3 space. Additionally, Zeebu introduces the Zeebu Governance Programme, emphasizing community inclusivity in decision-making processes. These initiatives reflect Zeebu’s commitment to scalability, efficiency, and community-driven governance.

🔬 At Zeebu, we're distilling the complexities of telecom billing into simple, efficient solutions.

Join us as we brew the perfect formula to keep your costs down and efficiency up! 🌐 pic.twitter.com/OXGVWQWPod

— Zeebu (@zeebuofficial) May 13, 2024

Considering recent developments, Zeebu’s price metrics demonstrate its growing influence. With a 2.79% increase in the last 24 hours, ZBU continues its upward trajectory. The 14-day RSI of 51.97 indicates neutral market sentiment, suggesting potential for sideways movement. Over the past 30 days, 50% were positive, suggesting moderate market sentiment. Additionally, with 30-day volatility below 30% (currently at 6%), Zeebu demonstrates stable price movements. Moreover, it boasts high liquidity, with a volume-to-market cap ratio of 0.0301. Zeebu’s achievements and proactive approach position it as a critical player in Web3.

5. Artrade (ATR)

Our last gainer, Artrade, offers an inclusive platform aiming to democratize the art market, hence making it accessible to both artists and collectors. It enhances transparency, security, and liquidity by leveraging blockchain technology and NFTs. The platform serves as a marketplace connecting artists, galleries, and collectors worldwide.

Artists gain global visibility and control over their earnings, while galleries discover new talent based on quality and potential. Collectors benefit from managing both physical and digital collections within a supportive community.

Artrade introduces a revolutionary app that addresses the flaws of the current NFT market. It eliminates high fees, commissions, and environmental impact while offering a user-friendly experience. It is the first eco-responsible NFT platform, providing exclusive features like NFT Live and NFT Real. Additionally, its utility token ATR offers users cost reduction and decision-making participation.

Imagine, acquiring a fraction of Andy Warhol’s piece as a part of your investment portfolio.

At Artrade, we enable anyone to become a true fine art collector with just a fraction of the cost of a million-dollar piece.

Artrade, trade art.

🫰 pic.twitter.com/00ijLA6XCs— Artrade (@ArtradeApp) May 12, 2024

ATR is priced at $ 0.024971, showing a 1.56% increase in the last 24 hours and a remarkable 826% surge over the past year. It trades at 1,418.41% above the 200-day SMA, indicating strong market performance. Despite a neutral RSI of 64.96, suggesting potential sideways movement, the last 30 trading days saw 8 positive days, accounting for 27%. Additionally, with a 30-day volatility of 21% and a high liquidity ratio of 0.0655, Artrade presents stable conditions for investors.