Top Crypto Gainers Today Nov 14 – Curve DAO Token, Bitcoin SV, Jito, Fasttoken

CRV

CRV

BSV

BSV

BTC

BTC

TOP

TOP

FTN

FTN

Today’s top crypto gainers showcase an exciting mix of momentum and innovation, led by Curve DAO, Bitcoin SV, Jito, and Fasttoken. From Curve’s scrvUSD launch to Bitcoin SV’s Teranode advancements, these tokens push boundaries and capture market attention. Jito’s pioneering MEV-driven DeFi model and Fasttoken’s unique PoSA mechanism show impressive growth, bringing fresh appeal to DeFi and blockchain enthusiasts alike. Let’s look into each token’s performance and market trends to discover what’s driving these top gainers today.

Biggest Crypto Gainers Today – Top List

Let’s get a little teaser: Curve DAO Token leads today’s gainers with a 13.04% surge, trading at $0.314 after launching its yield-bearing scrvUSD stablecoin. Bitcoin SV follows, rising 8.17% to $64.09 on strong demand and Teranode innovation. Jito holds the third spot, up 4.02%, backed by its MEV-powered model generating $78.92 million in October fees. Lastly, Fasttoken climbed 3.62% to $3.15, gaining traction with its unique PoSA mechanism on the Bahamut blockchain.

1. Curve DAO Token (CRV)

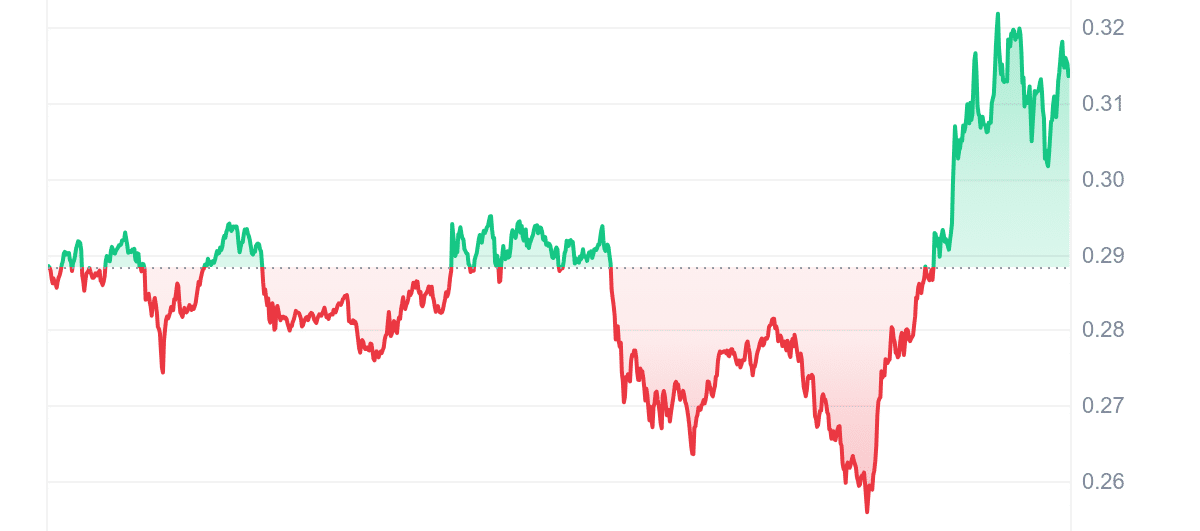

Curve DAO Token tops today’s crypto gainers with a 13.04% surge, now priced at $0.314. This jump follows CurveDAO’s launch of Savings crvUSD (scrvUSD), a new yield-bearing version of its crvUSD stablecoin. Developed in partnership with Yearn Finance, scrvUSD has captured investor interest by offering “low-risk” autocompounding yields, adding an exciting layer to Curve’s ecosystem.

Excitingly, Curve’s crvUSD stablecoin is designed with the LLAMMA algorithm, which cleverly reduces liquidation risk and stabilizes borrowing costs. By dynamically adjusting interest rates to maintain its peg, CurveDAO has successfully attracted users seeking safe, decentralized lending options. With scrvUSD now in the mix, Curve seems poised to keep building this appeal for DeFi investors.

Adding even more value, scrvUSD’s unique autocompounding yields are managed fully on-chain, delivering holders a secure, decentralized interest source. This addition boosts CRV’s utility, and as scrvUSD grows, it could also fuel continued demand for CRV.

The era of scaling crvUSD is here!

Savings crvUSD (scrvUSD) – Curves’s yield-bearing stablecoin – is officially launched!

It is the safest yield you can get with crvUSD. Depositors get a share of fees earned by the crvUSD system with 0 lockups.

Use it here:… pic.twitter.com/IkluQ8ilew

— Curve Finance (@CurveFinance) November 13, 2024

Moreover, CRV’s high liquidity ratio of 1.5347 signals strong trading support, ensuring traders can access a liquid market. The token’s recent price pattern is also promising, with 17 positive trading days in the past month and an RSI of 56.19, indicating a balanced, stable position.

True, CRV is trading below its 200-day SMA, but this may provide an appealing entry point. Hence, Curve’s thoughtful approach makes it a compelling pick for investors with high growth potential.

2. Bitcoin SV (BSV)

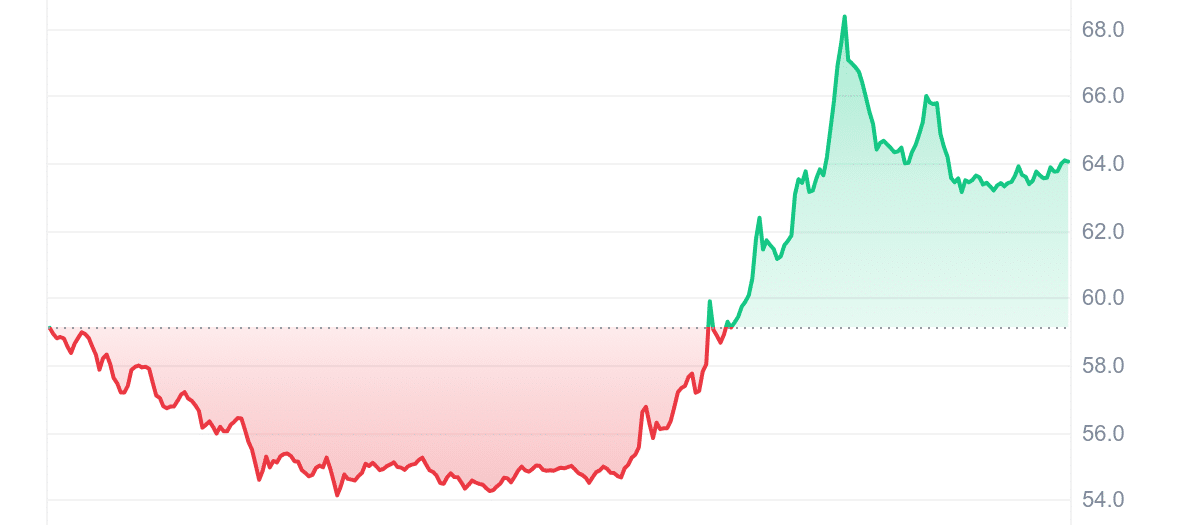

Bitcoin SV ranks as today’s second top gainer, trading at $64.09 with an impressive 8.17% surge in just the last 24 hours. This strong daily performance underscores its position as a high-liquidity asset, reflected in a solid 0.2310 volume-to-market cap ratio. Investors are taking notice, boosting both interest and market activity.

Moreover, BSV’s recent strides in blockchain-based accounting through Teranode technology add further appeal. Martin Coxall, BSV’s Director of Growth, recently highlighted how Teranode helps audit large transaction volumes securely, enabling greater trust in data transparency and security. This innovation bolsters BSV’s application in professional sectors, which, in turn, attracts broader market interest.

The adoption of Teranode can support accountants and auditors by improving the efficiency of auditing transaction volumes and safeguarding privacy.#BSVBlockchain #Teranode #Financehttps://t.co/m1Pp6EoRNE

— BSV Blockchain (@BSVBlockchain) November 12, 2024

Teranode doesn’t just scale BSV’s transaction capacity; it enhances the network’s reliability. In Uganda, companies like KitePesa already use BSV for affordable, real-time money transfers and smart contracts, underscoring the blockchain’s growing influence in global markets.

From a technical standpoint, BSV’s metrics signal strength. It trades 54.41% above its 200-day SMA, has risen 33% over the past year, and outperforms 36% of the top 100 cryptos. Meanwhile, a neutral RSI of 39.21 suggests stability and low volatility at 7% signals a steady price trend. As BSV’s Teranode software drives scalability, its real-world applications, particularly in accounting and finance, strengthen its investment potential.

3. Flockerz (FLOCK)

Flockerz is making waves in the meme coin market with its innovative Vote-to-Earn (V2E) model, recently raising $1.5 million in presale funds. This surge in interest is unsurprising, as the meme coin market has soared to a $111 billion valuation, driven by gains in assets like Bitcoin. With its unique governance, Flockerz empowers its community, letting holders shape the project and earn rewards.

Shout out to The Flock!!!🔥

We just flocking hit 1.5m! The flock is indeed the best community in crypto right now, we are excited for what's to come!🐦👑 pic.twitter.com/wWHXmTMHET

— Flockerz (@FlockerzToken) November 12, 2024

The V2E model enables $FLOCK holders to participate in critical decisions, from protocol updates to budget allocations. This direct involvement strengthens the community and provides a decentralized alternative to developer-controlled meme coins. Flockerz’s community-driven approach has attracted notable investments, including a $53,000 purchase by a single whale.

Currently priced at $0.0060049, $FLOCK’s presale price is set to increase soon, adding urgency for investors to join before the next phase. With Dogecoin up 35% in one day and meme coins as a whole experiencing a market rally, interest in Flockerz is fueled by a broader bullish sentiment.

Recent news, such as Coinbase’s listing of Pepe, Robinhood’s listing of Pepe, and the relisting of SOL, XRP, and ADA, has added further excitement to the meme coin market. This bullish trend makes it a prime moment for investors to join Flockerz’s momentum.

4. Jito (JTO)

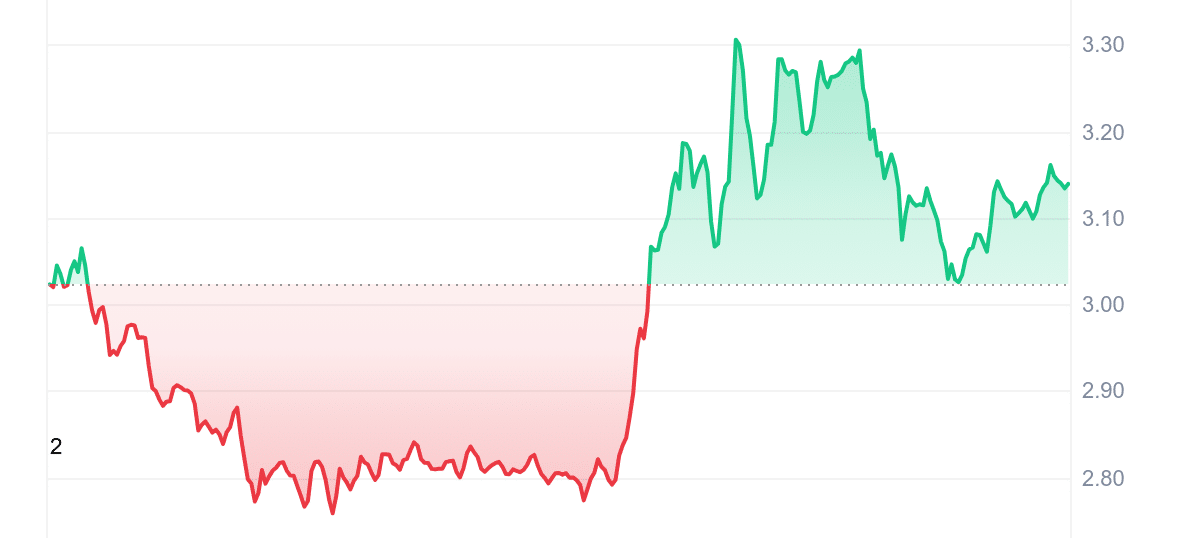

Jito is the third top gainer on today’s list, rising by 4.02% in the last 24 hours. Currently trading at an exciting price, Jito’s growth can be attributed to its impressive performance in the DeFi space. The platform’s success is mainly due to its advanced MEV (maximum extractable value) infrastructure, allowing it to generate a record-breaking $78.92 million in fees for October, doubling its previous high from May.

Jito’s MEV-powered model sets it apart from DeFi giants like Lido and Uniswap by optimizing transaction sequencing on Solana to capture additional value. This innovation has led to significant fee revenue, positioning Jito as a leader in the space. Additionally, Jito’s liquid staking token, JitoSOL, generates income from both staking rewards and MEV extraction, creating a dual-income stream that enhances its profitability.

Jito’s success is also linked to the growing popularity of Solana, especially within emerging sectors like memecoins and AI-related tokens. These niches have fueled higher transaction volumes, giving Jito more opportunities for MEV extraction.

Here is what you can do with your JitoSOL 🔖

• 🍻💧 provide liquidity

• 💸📥 lend & borrow

• 💚🥩 restake

• 💎🔄 lever up

• 🔄🪙 swap to/from any SPL token, OR

• 🤝🛡️ hold & contribute to Solana's decentralization🧵 more on JitoSOL below ⬇️ pic.twitter.com/qpc4baUKKM

— Jito (@jito_sol) November 8, 2024

Jito’s future revenue depends on sustained trading volume, particularly in volatile sectors like memecoins. While demand in these areas could impact earnings, Jito’s high liquidity, robust revenue model, and 1.0350 volume-to-market-cap ratio indicate stability. With low 13% 30-day volatility and recent price gains, Jito remains a strong contender for long-term growth in the DeFi space.

5. Fasttoken (FTN)

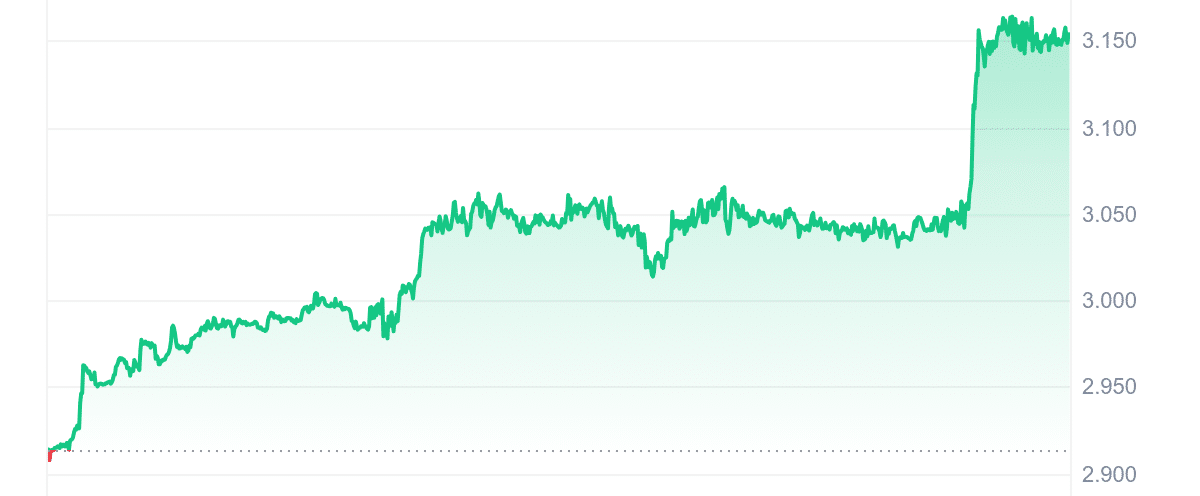

Closing out the list of today’s top crypto gainers, Fasttoken surged by 3.62%, reaching a new price point of $3.15. This surge brings attention to Fasttoken’s dynamic role in the Bahamut blockchain, an EVM-based layer-1 network with an innovative twist: Proof of Stake and Activity (PoSA). As the backbone of Bahamut, FTN is essential for staking, gas fees, and cross-chain transactions, making it a versatile player in the SoftConstruct ecosystem.

Bahamut’s PoSA consensus sets FTN apart. It rewards validators based on stake size and contract activity. The more actively a smart contract is used, the higher a validator’s reward potential. This pushes developers to create high-quality, widely used contracts that benefit the whole network. This setup amplifies engagement and strengthens security, a smart move for long-term growth.

Here is what you can do with your JitoSOL 🔖

• 🍻💧 provide liquidity

• 💸📥 lend & borrow

• 💚🥩 restake

• 💎🔄 lever up

• 🔄🪙 swap to/from any SPL token, OR

• 🤝🛡️ hold & contribute to Solana's decentralization🧵 more on JitoSOL below ⬇️ pic.twitter.com/qpc4baUKKM

— Jito (@jito_sol) November 8, 2024

FTN’s long-term potential is equally compelling. Its 159% price increase over the past year shows robust investor confidence. With a market cap-to-volume ratio of 0.2575, FTN also has high liquidity, which supports its trading resilience.

Though the 14-day RSI shows FTN as overbought, suggesting a cooldown could follow, its performance has outpaced 66% of top crypto assets. Fasttoken’s rising popularity within Bahamut’s active, scalable blockchain keeps it a compelling option for DeFi enthusiasts looking for an innovative edge.